The on-chain data indicates that the Bitcoin realized cap currently held by long-term owners has increased to almost 80%.

Bitcoin holders who hold long-term Bitcoins have almost 80% of realized Cap

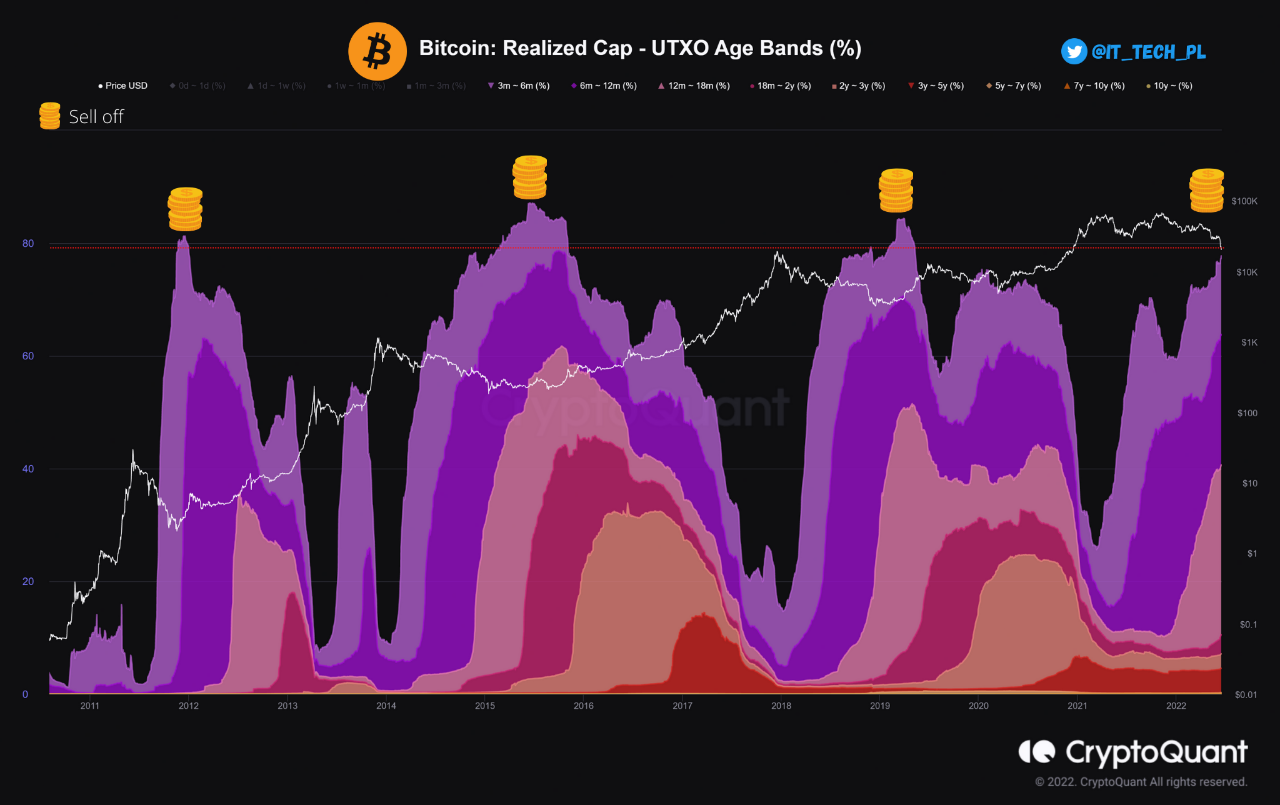

According to a CryptoQuant analyst, historically the bottoms of crypto have been formed when the realized cap long-term holder has exceeded 80%.

The “long-term holders” (LTHs) are all those Bitcoin investors who have been holding onto their coins without selling or moving since at least 155 days ago.

The realized cap is a way of assessing the capitalization of the crypto where each circulating coin’s value is taken as the price it was last moved or sold at, rather than the current BTC price.

Now, the relevant on-chain indicator here is the “realized cap – UTXO age bands (%),” which tells us what part are the various groups in the Bitcoin market contributing to the total realized cap of the coin.

Related Reading: Bitcoin Exchange Reserve Rises, Selloff not Over Yet| Bitcoin Exchange Reserve Spikes Up, Selloff Not Over Yet?

Investors belonging to different age groups are represented by the time they have held their coins.

LTHs, as mentioned previously, include all holders who have held Bitcoin for at least 155 calendar days. Below is a chart showing how these investors contributed to Bitcoin’s realized cap.

The value of the Metric has been on the rise lately, Source: CryptoQuant| Source: CryptoQuant

The graph above shows that the quant marked the most relevant trends related to Bitcoin’s realized cap percent of LTHs.

It seems like whenever the indicator’s value has crossed the 80% mark, a bottom in the price of the crypto has taken place.

Related Reading| Bitcoin Funding Rates Remain Negative But Open Interest Tells Another Story

Currently, the metric’s value has been rising up in recent weeks, however, it has still not gone above the threshold just yet.

The indicator is close to being there, however. Bitcoin might see a bottom soon if it continues rising in value and the historical trend holds.

BTC Prices

At the time of writing, Bitcoin’s price floats around $21k, down 30% in the last seven days. In the past month, crypto lost 30%.

Below chart displays the trends in the value of the coin during the last five working days.

Source: BTCUSD on TradingView| Source: BTCUSD on TradingView

Bitcoin’s price has mostly stabilized around $21k since the crash of a few days back. Currently, it’s unclear whether the decline is over, or if more is coming.

If LTH shares of the realized caps are any indication, BTC could see a little more fall before it finally hits bottom.

Featured image by Kanchanara at Unsplash.com. Charts from TradingView.com and CryptoQuant.com.