Investors are worried that Bitcoin’s value has dropped by 70% from its peak of November 2021. In the meantime, market sentiment is at an all-time low due to analysts’ expectations of a major recession. This is especially clear from the decline in the equity markets as measured by the S&P 500 and Nasdaq 100 indices, which has a big impact on how people invest in BTC on regulated markets.

Bitcoin Investment Vehicles Are Under Attack

Grayscale Bitcoin Trust’s share price dropped significantly from $56 at its peak to $11.94. The share prices of the Grayscale Bitcoin Trust and the Purpose Bitcoin Canadian ETF also fell dramatically.

Grayscale Bitcoin Trust (GBTC), has seen a sharp decline to $11.94 from its peak. TradingView

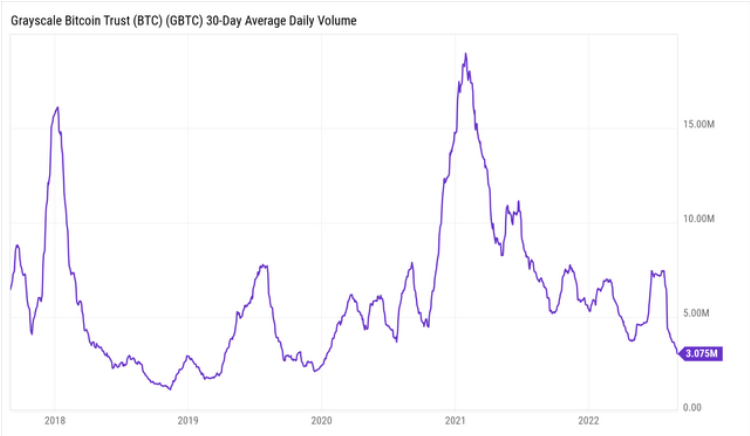

Despite the shares’ significant discount, GBTC’s daily trading volume has drastically decreased to 3.075M. This suggests institutional investors may be skeptical of Bitcoin-related financial instruments on the regulated markets. Or they could simply believe the bear market has not ended.

Despite the large discount on the shares, the daily trading volume for GBTC dropped sharply to 3.075M. Source: YCharts

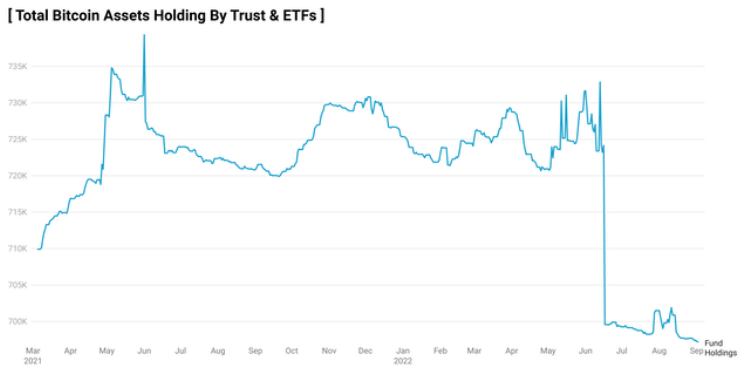

A number of trusts or ETFs are selling off their stock due to the market environment. Since February 2022 when the Grayscale Bitcoin Trust reached its peak, the amount of BTC it holds has fallen. Additionally, ETFs and trusts are gradually selling off their Bitcoin holdings since May 2021 when the market peaked.

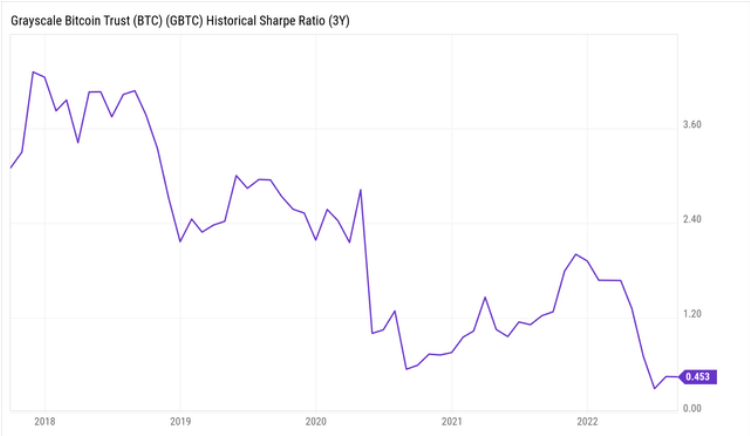

The Sharpe ratio shows that GBTC has a poor asset and a low return-on-investment risk. The Sharpe ratio is now at 0.453, after decreasing over the years. It implies that while GBTC’s volatility is fairly high, the projected return on investment is rather modest.

Loss After Loss

Some of the most prominent crypto investments vehicles on regulated markets (trusts and ETFs) have displayed the pessimistic sign. Despite the substantial discount that GBTC was sold at, daily trading volume has steadily declined and many trusts and ETFs (such as Grayscale Bitcoin Trust) have been urged sell their BTC holdings.

The total number of BTC held by trusts & ETFs has plummeted since May 2021. Source: CryptoQuant

To a degree, the current Bitcoin investment instruments in regulated markets like trusts and ETFS have turned out to be bearish. GBTC traded at a large loss but the daily trading volume is decreasing. Trusts, ETFs, and Grayscale Bitcoin Trust are encouraged to liquidate their Bitcoin holdings.

The Sharpe ratio shows that GBTC has a low-risk performance and is a bad asset. Source: YCharts

Many trades that were made recently may not have been reported because the quarterly reports on GBTC shares sold and bought by institutional investors report them all. These figures may give some insight into what might be happening behind-the scenes with Bitcoin.

A local bottom can be only recognized by retailers when it is already achieved, such as the institutional investors that purchased GBTC late June before July’s rise.

Most notably, the Sharpe ratio shows that GBTC’s return on investment is rather low and that this asset appears to be quite risky. Investors would therefore be willing to start hedging against bitcoin’s rising downside risk.

Featured Image from Unsplash. Charts from TradingView.com and Ycharts.