Decentralized finance (defi), which has enabled a multitude of protocols to allow crypto assets to generate a yield over time, was not the case ten-and-a-half years ago when Bitcoinica launched an interest accruing system that allowed bitcoin deposits. Bitcoinica was the original to try the system, but it eventually failed after several hacks saw approximately 62,101 Bitcoin stolen. Interest-bearing crypto accounts didn’t return for eight years.

Bitcoinica introduced interest-bearing accounts in 2012

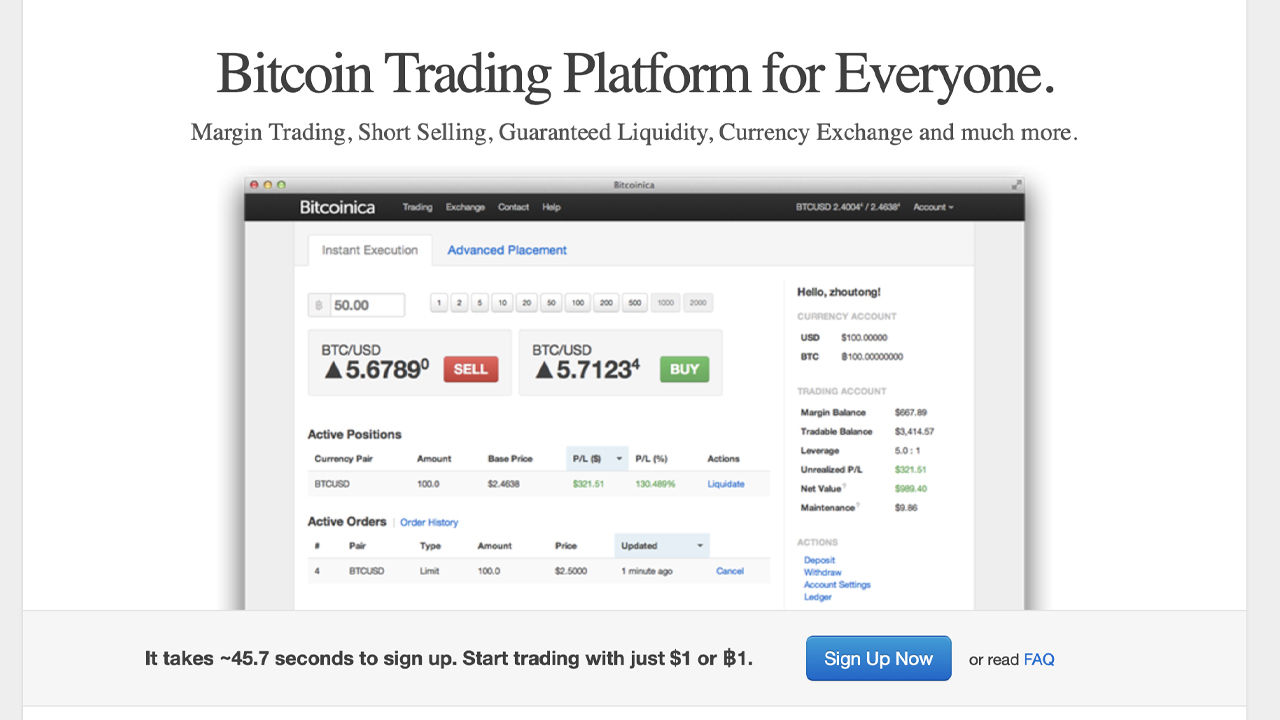

These days, interest-bearing accounts and yield-gathering defi protocols are all the rage in the world of cryptocurrency, but most people don’t know that the idea was introduced more than a decade ago. Bitcoinica (now defunct) came up with an innovative idea in February 2012 that enabled bitcoin deposits to gain interest. Zhou Tong (18 years old), a passionate bitcoin enthusiast, announced the idea. Bitcoinica saw 3,724.12 BTC, worth $71.56 million today, traded during the trading platform’s first 24 hours of operation.

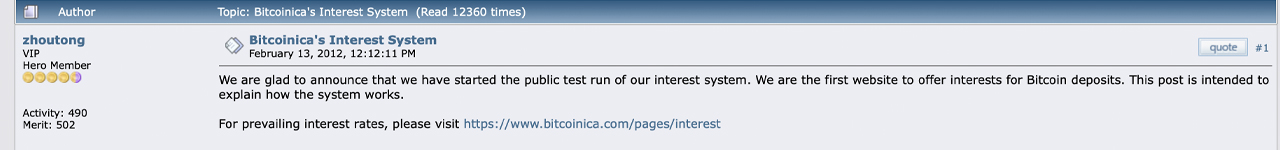

Bitcoinica, which was second in volume after Mt Gox’s bitcoin trading platform, had been the largest Bitcoinica by September 2011. “We are glad to announce that we have started the public test run of our interest system,” the Bitcoinica founder wrote on February 13, 2012. “We are the first website to offer interest for Bitcoin deposits. This post is intended to explain how the system works — Assuming you deposit $10,000 with us and the interest rate is always 4.17, you will get $4.17 every day or $1,644 every year (with compound interest).”

A great deal of today’s interest-bearing protocols stems from the world of decentralized finance (defi), which is a whole lot different than Bitcoinica’s interest-bearing account offering. Bitcoinica’s concept is similar to what centralized crypto exchanges like Coinbase, Crypto.com, and many others offer today, as Bitcoinica was a centralized bitcoin trading platform.

Bitcoinica looked a lot like Celsius in that it paid interest and eventually fell on hard times. Bitcoinica’s interest accounts were calculated every hour, and payouts were distributed after each day ended. “Bitcoinica has been running great for the last [five] months, and we’re the fastest growing bitcoin business ever,” Zhou Tong wrote at the time.

After the Bitcoinica interest-bearing accounts were introduced, the very next month Bitcoinica was hacked and lost 43,554 bitcoins worth $837.17 million using today’s exchange rates. Bitcoinica, which was established in April 2012 with interest-bearing accounts, suffered another hacking attack on May 11, 2012. This time, the attackers stole 18,547 bitcoins worth approximately $356.50 million.

Crypto Yields took 8 years to Mature After Bitcoinica’s Collapse

After the scandal surrounding Zhou Tong, the founder of Bitcoinica and his mysterious hacks, interest-bearing Bitcoinica accounts never gained traction. Bitcoinica eventually went out of business and was liquidated in August 2012. It is interesting that Zhou Tong, who announced the BTC-interest bearing account, was asked by one of his first commenters to ensure the safety and security of their money.

“Soothe our fears and tell us why Bitcoinica will not be hacked, and tell us about how our money will not be stolen out of thin air?” the individual asked the Bitcoinica founder. While Zhou Tong pledged to keep the exchange safe, the trading platform’s two breaches were considered some of the most controversial hacks in crypto history, besides the scandals surrounding Mt Gox.

Crypto interest bearing accounts took eight years for crypto currency to finally become mainstream. Defi protocols make it possible to earn yields in a private, non-custodial manner without having crypto assets at a central exchange.

But, just like Bitcoinica and Celsius, interest-bearing cryptocurrency platforms can go under, as Celsius, one lender, went bankrupt recently. Although Celsius and Bitcoinica are centralized platforms, it is possible for defi platform to go bankrupt, as was the case with Terra’s blockchain ecosystem.

Defi users that leveraged Anchor Protocol’s lending program had to face the consequences of UST’s de-peg from $1. Others defi apps have been compromised or seen rug pulls. Defi users who were looking for interest have now lost their entire money.

Do you have any thoughts about Bitcoinica’s original bitcoin interest-bearing account, which was launched more than a decade ago. We’d love to hear your opinions on the subject below.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThis article serves informational purposes. This is not an invitation to purchase or sell directly, nor a suggestion or endorsement of products, services or companies. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused or alleged caused by the content or use of any goods, services, or information mentioned in the article.