The trend in Bitcoin inflows is up according to on-chain data, which could indicate that whales may be increasing their dumping. This could be a bearish sign for Bitcoin.

The Inflows of Bitcoin Continue to Rise as the Whales Keep Selling

CryptoQuant’s post points out that BTC inflows into exchanges are increasing, as shown by on-chain information.

The “all exchanges inflow” is an indicator that shows the amount of Bitcoin that holders are depositing to exchanges on a given day.

Investors send more coins to exchanges if the metric’s value rises. Holders deposit BTC in order to purchase altcoins or withdraw their fiat. This could indicate dumping and be bearish on the market.

However, if the value of Bitcoin inflows drops, this could mean that fewer investors are depositing Bitcoins to exchanges. Such a trend may mean that holders aren’t interested in selling at the moment.

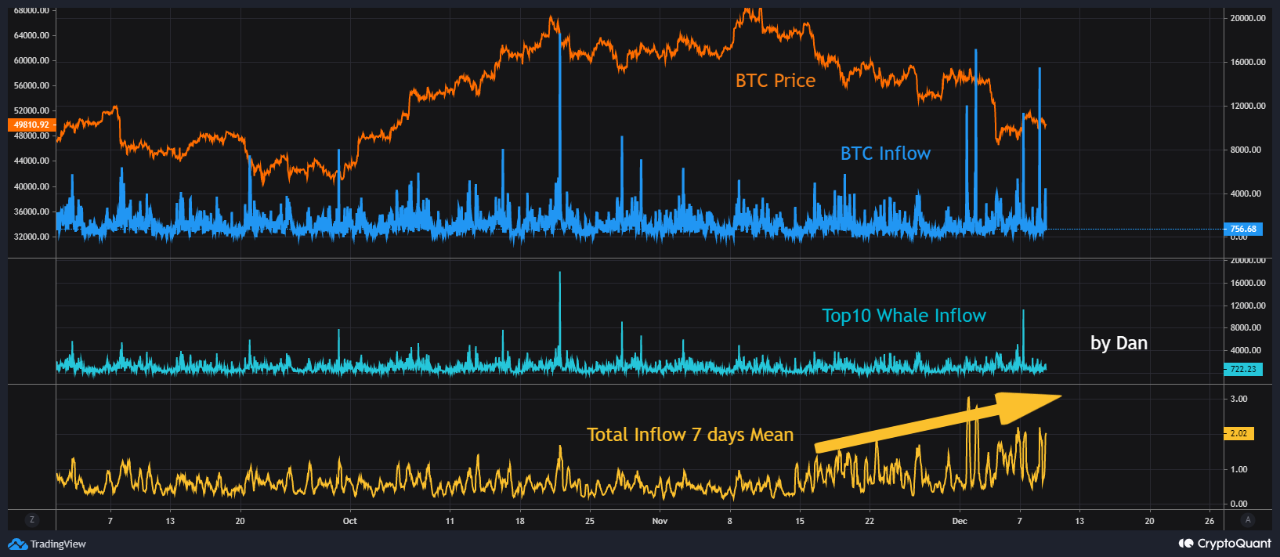

Below is a chart depicting the recent trend in BTC inflows.

Source: CryptoQuant| Source: CryptoQuant

BTC inflows seem to be on the rise, as the graph shows. The total inflows were at a record high before the December crash.

Related Reading | Weekend Volatility Awakens Bitcoin Buyers, Active Addresses

The indictor noticed big spikes after the crash. This could indicate that there may be some selling going on in the market.

You can also see curves for the top 10 whale inflows as well as the seven-day average total inflow. As its name suggests, the latter is the average seven-day value of the normal indicator.

This metric shows how top ten inflows of whales are related to the total inflows. The graph shows that this indicator has seen a recent spike, which could indicate that whales are increasing their dumping.

Bitcoin Hovers Below $50k After Weekend Wipeout – Crypto Roundup, Dec 6, 2021| Bitcoin Hovers Below $50k After Weekend Wipeout – Crypto Roundup, Dec 6, 2021

This has been a bearish trend for the cryptocurrency’s price. However, it hasn’t always been the case. But given the recent market environment, signs may not be in BTC’s favor.

BTC Prices

At the time of writing, Bitcoin’s price floats around $49.1k, down 13% in the last seven days. In the past month, crypto lost 27% in gains.

Below is a chart showing the change in BTC’s price over the past five days.

BTC looks like it is moving in the opposite direction again. Source: BTCUSD on TradingView| Source: BTCUSD on TradingView

Bitcoin is mostly in consolidation since its crash. Currently, it’s unclear when the coin might show some recovery.

Unsplash.com's featured image. Charts by TradingView.com. CryptoQuant.com chart.