The Bitcoin funding rate is at a high level of positive data, which could cause a market squeeze.

Bitcoin Funding Rate Increases as Open Interest Goes up

A CryptoQuant analyst has pointed out that at this moment, the BTC financing rate is positive.

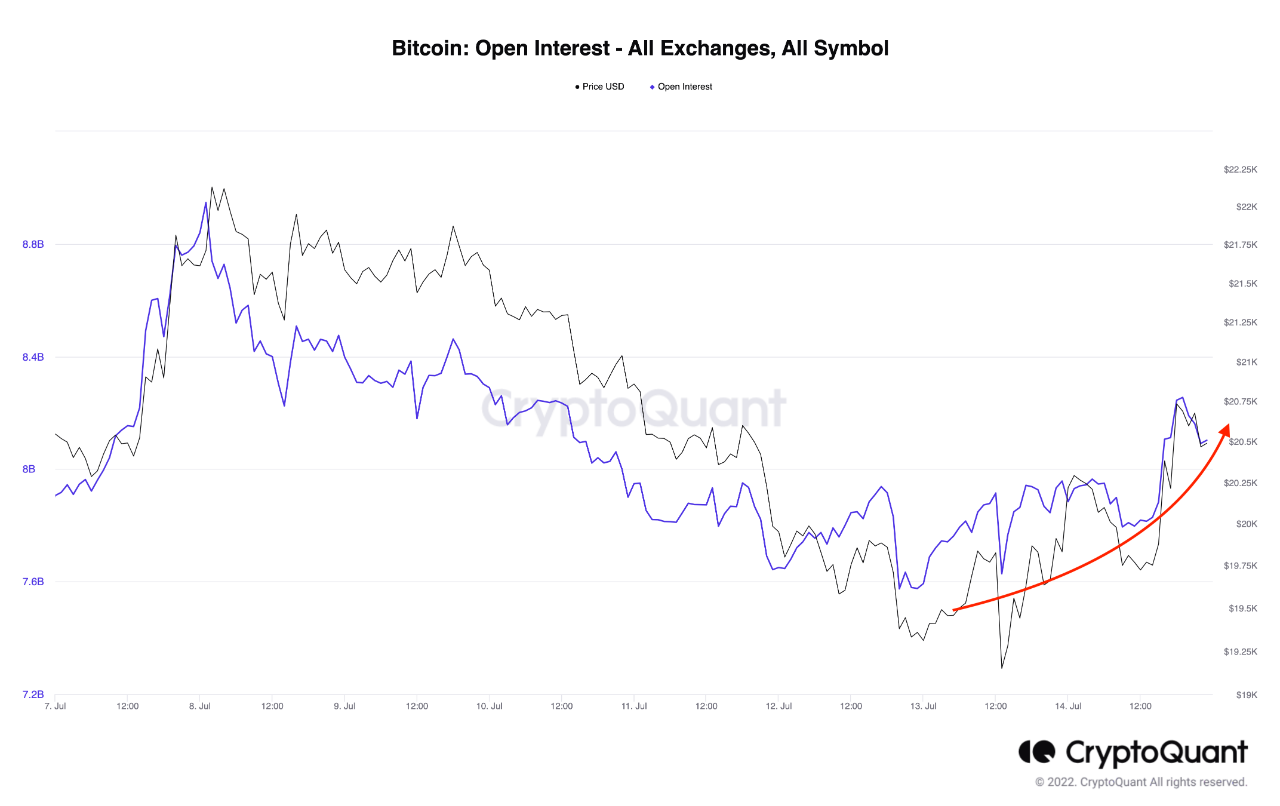

The “open interest” is an indicator that measures the total amount of positions currently open in the Bitcoin futures market.

This metric indicates that there is significant leverage in the current market. Excess leverage usually leads to the crypto’s price turning more volatile.

When Will The Extended Stretch Of Extreme Fear In Crypto End?| When Will The Extended Stretch Of Extreme Fear In Crypto End?

On the other hand, low values of the open interest can result in lesser volatility in the BTC market as there isn’t much leverage involved in the futures market.

Here’s a chart showing the trends in open interest for the week.

The metric seems to have increased in value recently. Source: CryptoQuant| Source: CryptoQuant

The graph above shows that the Bitcoin open rate has been increasing in recent days. The crypto could face greater volatility over the next few days.

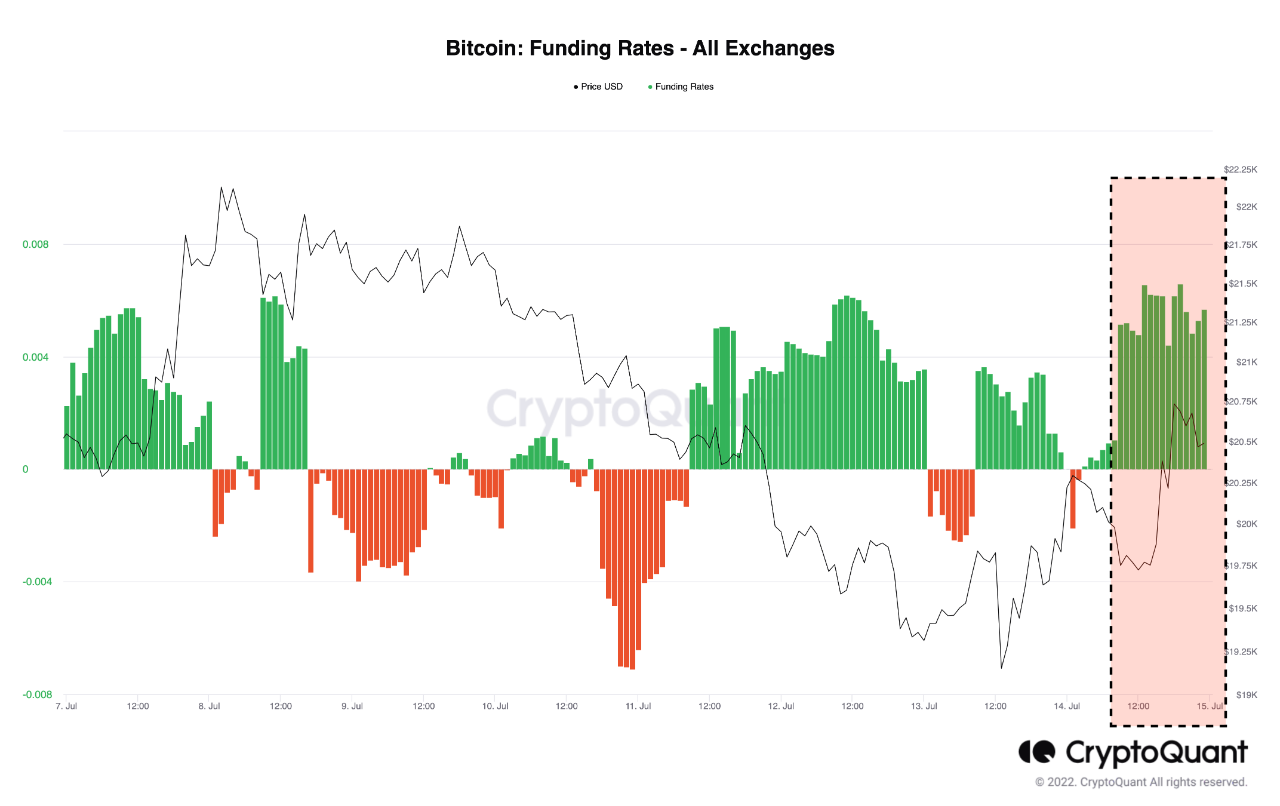

Another indicator, the “funding rate,” measures the periodic fee that traders on derivatives exchanges pay each other to hold onto their positions. This indicator shows us the current split of open interest between short and long traders.

Bitcoin Manage To Hold Its Own As Wall Street Open With Losses, Analysts Weigh In On Bottom| Bitcoin Manage To Hold Its Own As Wall Street Open With Losses, Analysts Weigh In On Bottom

The below chart shows how this indicator’s value has changed during the past seven days.

CryptoQuant reports that the indicator has a green value recently. Source: CryptoQuant| Source: CryptoQuant

From the graph, it’s apparent that the Bitcoin funding rate has a relatively high positive value currently. The market is currently home to a greater number of longs.

Long traders paying premiums to maintain their positions, which is why the rate has turned positive, the market sentiment tends towards bullish.

However, with the high open interest values, it’s possible that any large swing in the price can cause what’s called a “long squeeze,” which is an event where mass liquidations of long positions cascade together and push the price further down.

BTC Prices

At the time of writing, Bitcoin’s price floats around $20.9k, down 2% in the last week. In the past month, crypto lost 5%.

BTC prices have risen over the last couple of days. Source: BTCUSD tradingview| Source: BTCUSD on TradingView

Featured image from Aleksi Räisä on Unsplash.com, charts from TradingView.com, CryptoQuant.com