The value of Bitcoin exchange reserves has risen sharply in the data chain, which may indicate that this selloff is not over.

Bitcoin Exchange Reserve Notices Rapid Rise

A CryptoQuant analyst noted that many coins had entered exchanges in the last 24 hours.

The “exchange reserve” is an indicator that measures the total amount of Bitcoin currently present in wallets of all centralized exchanges.

If this metric increases in value it indicates that there is more supply of the currency on the exchanges as investors have been depositing more coins.

This could have a negative effect on the cryptocurrency’s price, as holders often transfer their crypto to other exchanges.

Related reading: Panic Vs Pandemic. The Crypto Market Is Worse Than on Black Thursday| Panic Vs Pandemic: Crypto Market Is More Fearful Than On Black Thursday

A declining reserve value could indicate that investors are withdrawing coins. This kind of trend, when prolonged, can be a sign that holders are accumulating, which could prove to be bullish for the coin’s price.

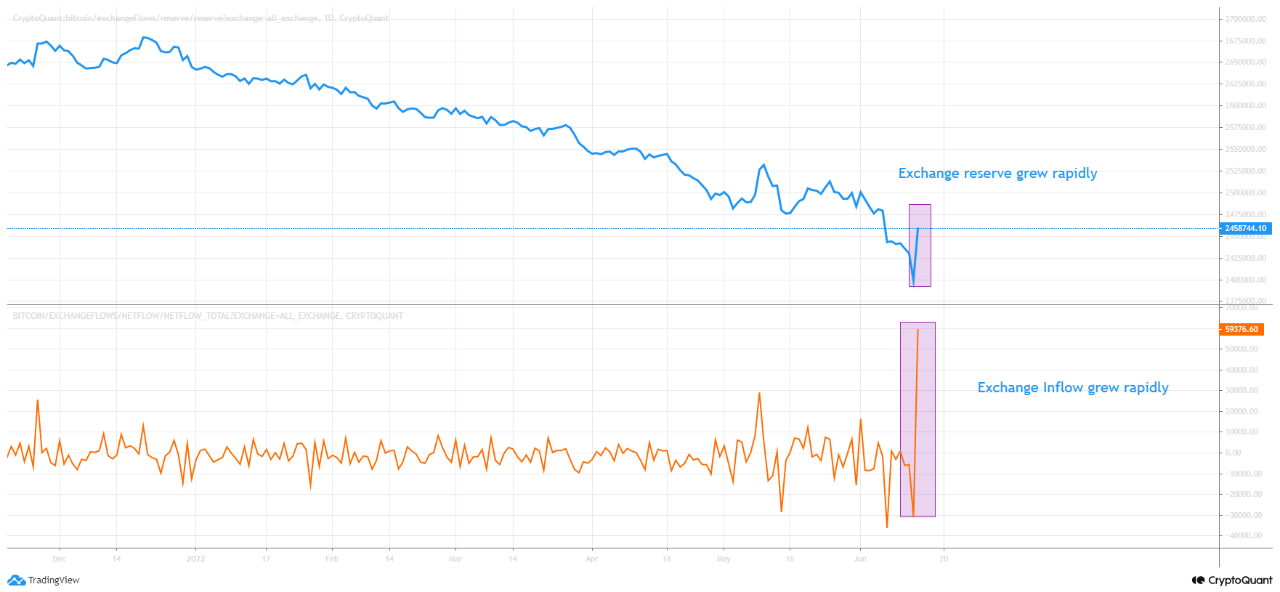

Below is a chart that illustrates the recent trend in Bitcoin’s exchange reserve.

It looks like the value has increased recently. Source: CryptoQuant| Source: CryptoQuant

The above graph shows that the Bitcoin exchange reserves has seen a dramatic increase in value in recent months.

The chart also shows the curve for the “all exchanges netflow,” another metric which measures the net amount of coins entering or exiting exchanges.

Bitcoin Faces a New Downtrend Of 28.82%, Why Someone Still Makes More Than 1000% ROI| Bitcoin Faces a New Downtrend Of 28.82%, Why Someone Still Makes More Than 1000% ROI

This metric basically tells us how the reserve is changing or increasing right now. Its value has risen over the past few days, as expected.

The fact that the Bitcoin exchange reserve doesn’t seem to have changed trend and is still rapidly rising after the crash may mean that the crypto’s price could see further decrease in its value in the near future.

BTC Prices

At the time of writing, Bitcoin’s price floats around $21.1k, down 30% in the last seven days. In the last month, crypto lost 32%.

Below is a chart showing the change in coin price over the past five days.

Source: BTCUSD on TradingView| Source: BTCUSD on TradingView

Bitcoin fell to $20k after the crash. It then rebounded a bit to its current level. Currently, it’s unclear whether the carnage has ended, or if further decline is coming.

But if the exchange reserve is anything to go by, then signs aren’t looking in the crypto’s favor.

Unsplash.com's featured image. Charts by TradingView.com. CryptoQuant.com chart.