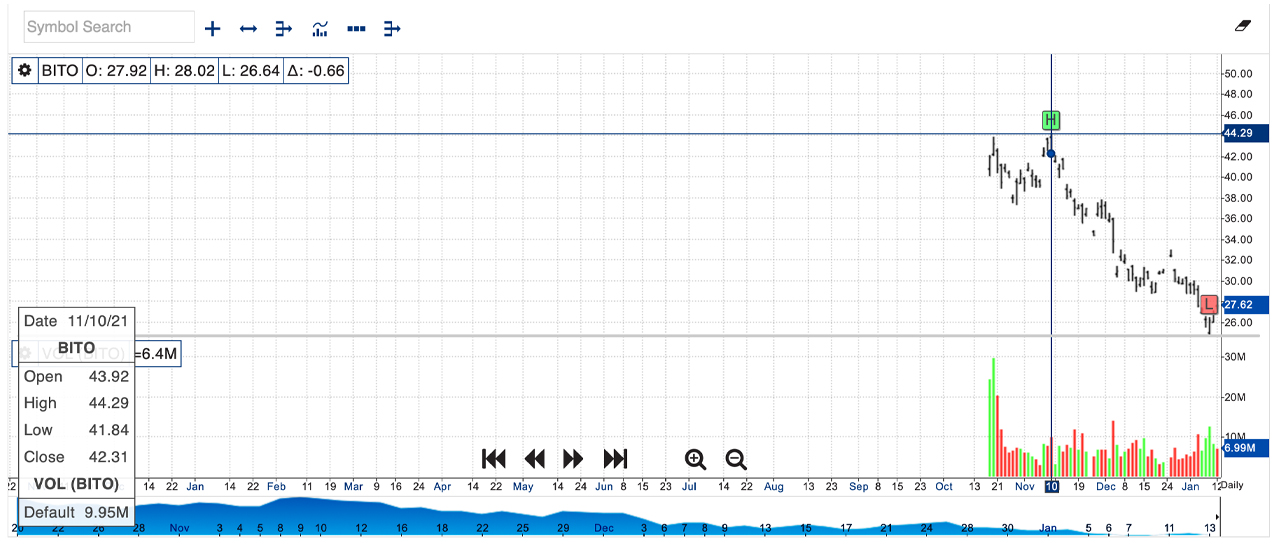

Following the charged-up debut of the Proshares bitcoin exchange-traded fund (ETF), Valkyrie’s bitcoin futures ETF and the Vaneck bitcoin strategy ETF, interest in these types of funds seems to have faded a great deal. The ETF has fallen 39% in 64 days since the Proshares Bitcoin ETF BITO hit an all-time peak on November 10. Valkyrie’s bitcoin ETF has also shed 37% in value over the last two months.

Bitcoin Futures ETF Lull Continues

The launch of the first Bitcoin exchange-traded funds (ETF) was a huge event for a large part of cryptocurrency’s community. Many bitcoin ETF application were rejected prior to 2021.

Finally, when the first U.S. bitcoin futures ETF was approved, the debut of Proshare’s bitcoin futures ETF smashed records, capturing close to $1 billion in total volume during the first 24 hours. Proshares Bitcoin Strategy ETF BITO (BITO) traded for $26.96 January 13, 2022. This price is 39% lower than November 10, 2021’s 44.29 high.

Bloomberg author Katherine Greifeld explained in mid-November that the “bitcoin futures ETF frenzy is fading.” “While the Proshares fund absorbed $1.1 billion in just two days — the quickest an ETF has ever done so — that pace of growth has cooled considerably,” Greifeld said at the time.

She also discussed Vaneck ETF with the financial writer, noting that it could be distinguished from others by lower management fees. Greifeld quoted Eric Balchunas (an ETF analyst at Bloomberg Intelligence), who stated:

There’s definitely a lull going on right now relative to the launch mania and so Vaneck has their work cut out for them in trying to get people excited again.

Valkyrie’s BTF Down 37%, Vaneck’s XBTF Is Down 27%, Aggregate Bitcoin Futures Open Interest Across Cryptocurrency Exchanges Slid by More Than 38%

The same can be said for the Valkyrie Bitcoin Strategy ETF (BTF) when it reached an all-time high (ATH) of $26.67 per share on November 9, 2021, and today it’s changing hands for $16.70 per unit or 37.38% down from the ATH.

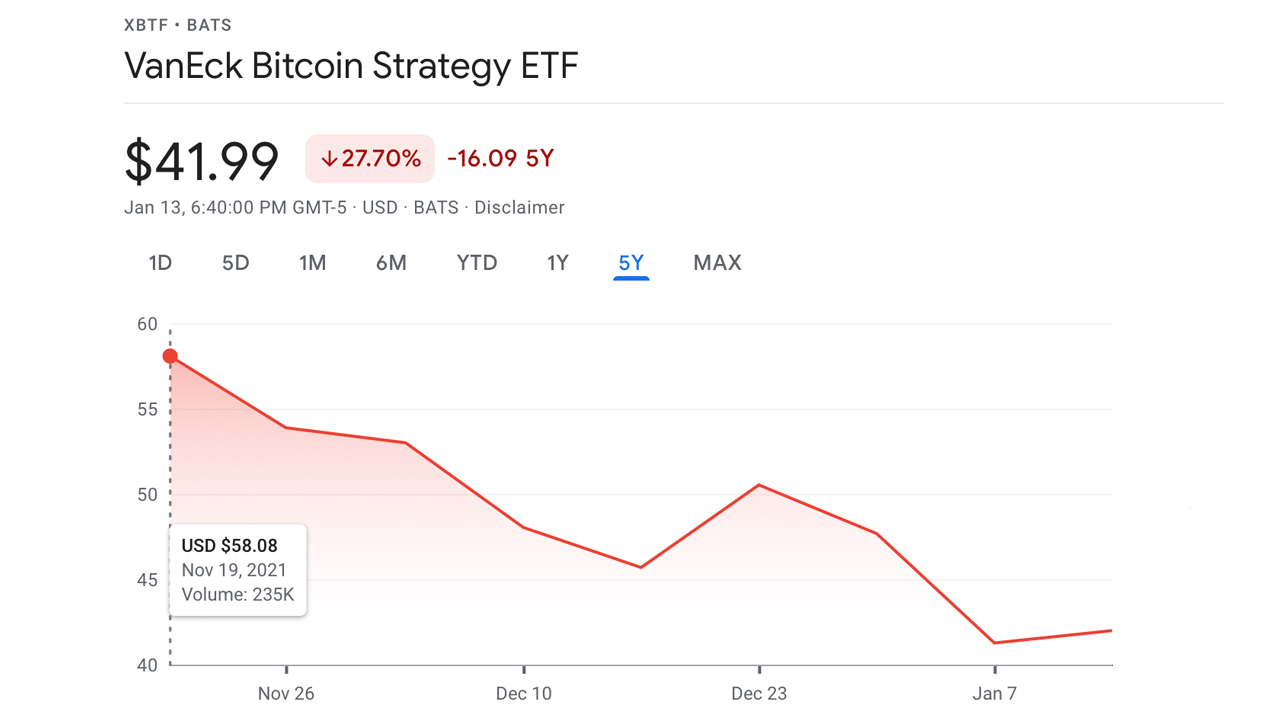

The Vaneck Bitcoin Strategy ETF (XBTF) is only down 27.70%, as the ETF exchanged hands for $58.08 per unit on November 19, 2021, and today it’s trading for 41.99 per unit. While Proshares and the Valkyrie ETFs debuted well before Vaneck’s offering, all of the funds have a strong relationship with spot price of bitcoin and the crypto asset’s futures markets.

Open interest has been declining in the futures market. The total open interest in bitcoin futures on all crypto exchanges since mid-November also declined. On November 11, 2021 with more than $28 billion, bitcoin futures opened interest reached its highest level.

Today’s aggregate open interest for the largest derivatives exchanges amounts to $17.22 trillion. That equates to a loss of 38.50% over the last two months and the pattern is quite similar to bitcoin’s (BTC) spot market price action.

How do you feel about three Bitcoin futures ETFs? What is your overall opinion on their performance over the past few months. Please comment below to let us know your thoughts on this topic.

Images Credits: Shutterstock. Pixabay. Wiki commons. Google. NYSE. Nasdaq.

DisclaimerThis information is provided for educational purposes only. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused or alleged caused by the content or use of any goods, services, or information mentioned in the article.