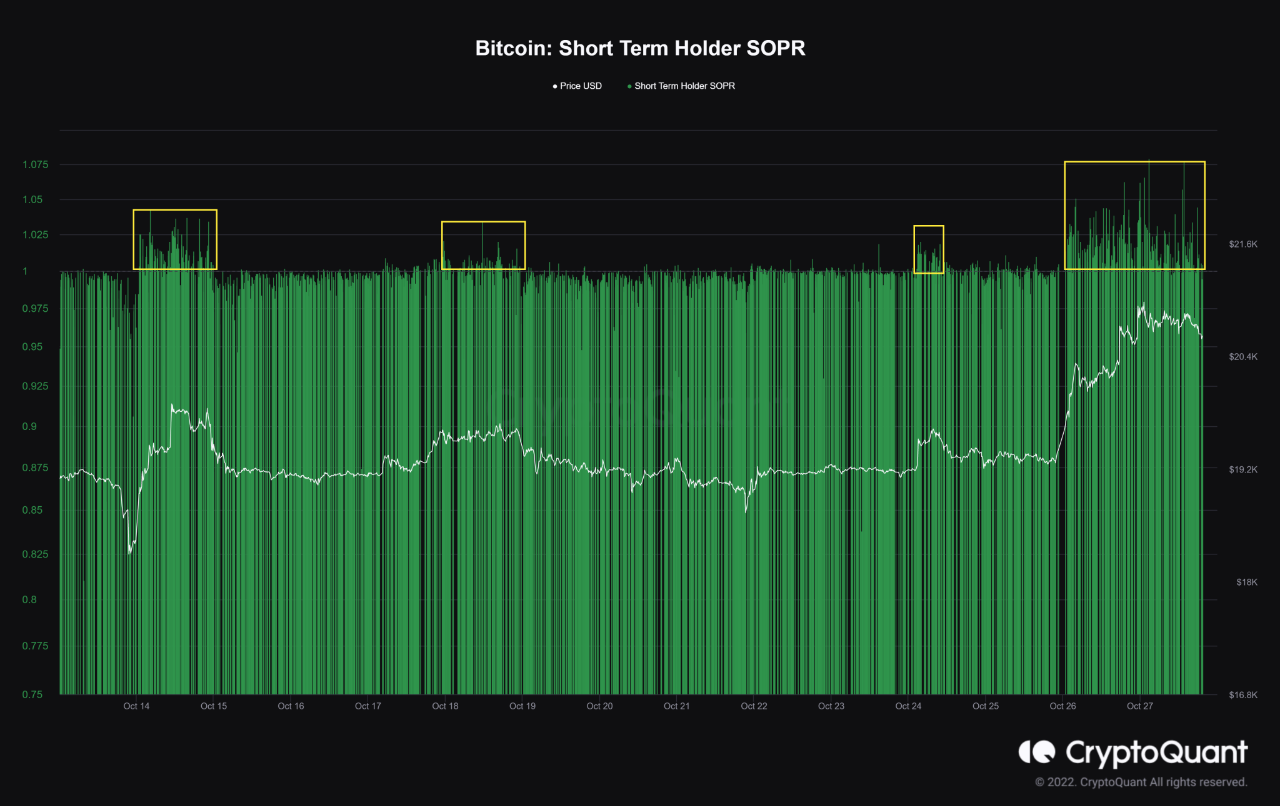

Bitcoin’s price has fallen to $20k after a surge of $20.9k. This is due to profit-taking by short-term investors.

SoPR, a Bitcoin short-term holder SOPR has been elevated over the past two days

An analyst pointed out in CryptoQuant that short-term investors seem to use the most recent price increase for profit taking.

The relevant indicator here is the “Spent Output Profit Ratio” (SOPR), which tells us whether the average investor is selling Bitcoin at a profit or at a loss right now.

If this value is higher than 1, then the market as a whole is making some profit. Values below this threshold indicate that all holders are losing money.

Naturally, the values of the SOPR are equal. This suggests that investors just make a loss on selling.

Now, there is a cohort in the Bitcoin market called the “short-term holders” (STHs), which includes all investors who have been holding their coins since less than 155 days ago.

This chart shows how the BTC SOPR has changed over the last few weeks.

Source: CryptoQuant| Source: CryptoQuant

You can see that Bitcoin STH SOPR was above the 1. level in the graph.

After a slow rise to $19k, the BTC price has risen. These investors may be taking advantage of this chance to make some profit.

This type of profit-taking can be bearish for crypto’s price. The chart shows that there have been three cases of it in the last two weeks. The price went back down following a quick rise from all those STH profit realizations.

The BTC price dropped from $20.9k, its peak of $29.9k, to below $20.1k. before it retraced some of its upward movement to current levels.

BTC Prices

At the time of writing, Bitcoin’s price floats around $20.5k, up 8% in the last seven days. The crypto gained 7% over the last month.

Here is a chart showing the trends in coin price over the last 5 days.

Source: BTCUSD on TradingView| Source: BTCUSD on TradingView

Unsplash.com's featured image. Charts by TradingView.com. CryptoQuant.com chart.