Data shows the Bitcoin correlation with S&P 500, and hence the stock market, has now set a new all-time high (ATH).

Bitcoin Correlation With S&P 500 Reaches New High

As pointed out by an analyst in a CryptoQuant post, the BTC correlation with the stock market is currently at an all-time high, further damaging the “safe haven” narrative.

The “Bitcoin correlation with S&P 500” is an indicator that measures how strongly the price of BTC reacts to volatility in S&P 500, as well as the direction of the response.

If the indicator’s value is greater than 0, it indicates that there is a positive correlation between crypto price and stock market. “Positive” here means that BTC moves in the same direction as S&P 500.

On the other hand, correlation values less than zero imply that BTC reacts to S&P 500’s price changes by moving in the opposite direction.

Bitcoin Plunges Below $40 As Russia Has Reportedly Given Its Forces Order To Attack Ukraine| Bitcoin Plunges Below $40 As Russia Has Reportedly Given Its Forces Order To Attack Ukraine

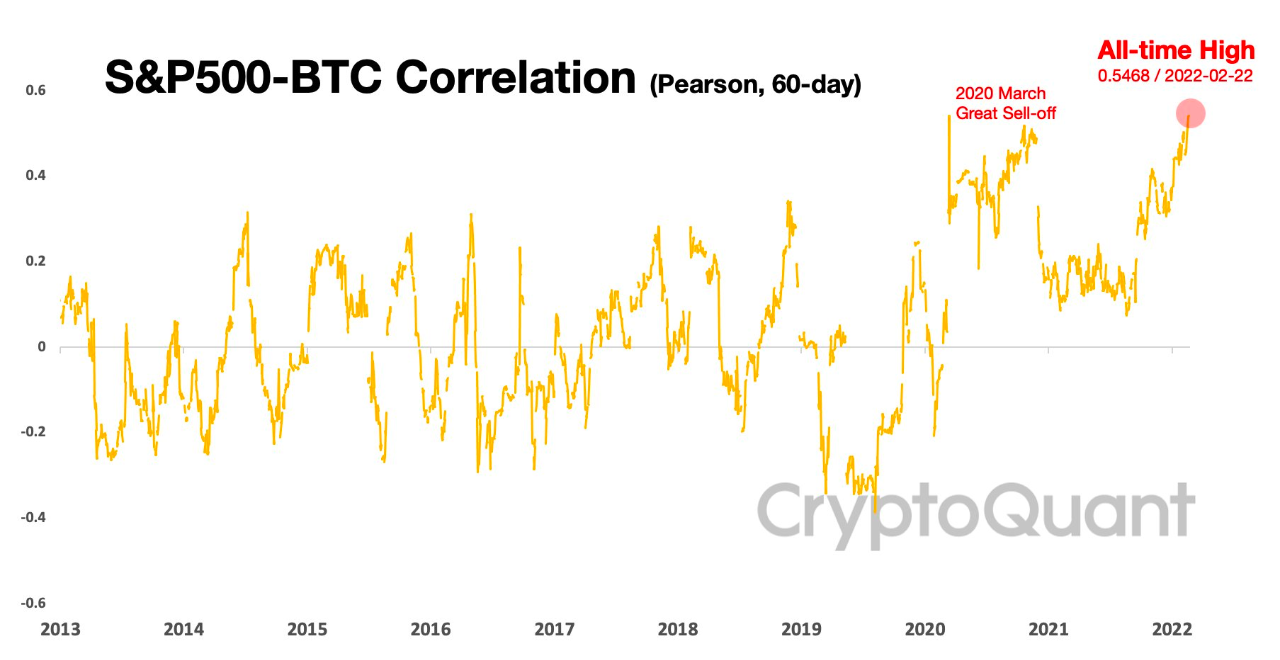

The indicator’s values being exactly the same as zero automatically indicate that there is no correlation. Now, here is a chart that shows the trend in the S&P 500 and Bitcoin correlation since the year 2013:

The history of crypto has affected the value of the indicator. Source: CryptoQuant| Source: CryptoQuant

As you can see in the above graph, the correlation between Bitcoin and S&P 500 swung between positive and negative while remaining low for the most part of BTC’s history.

Read Related Articles: Bitcoin won’t crack over fresh bear assault, next potential target for BTC| Why Bitcoin Won’t Crack Over Fresh Bear Assault, Next Potential Target For BTC

The two assets are now strongly and positively related since the end of 2019 to early 2020. Although the 2020 COVID sell-off caused the indicator to crash, it has been steadily rising in the second half of 2021-2022.

This month, the correlation between Bitcoin and stock markets has reached a new record (ATH), of +0.5468.

Such high correlation between the assets has further put a dent on the narrative of “digital gold” as the crypto is no longer the safe haven it once was.

BTC Prices

At the time of writing, Bitcoin’s price floats around $39k, down 12% in the last seven days. In the last month, crypto’s value has risen 10%.

Below is a chart showing the change in BTC’s price over the past five days.

Source: BTCUSD on TradingView| Source: BTCUSD on TradingView

Bitcoin prices plunged recently, reaching as low as $36.4k just a few days earlier. The value of Bitcoin has seen some improvement since then and is now above $39k. At the moment, it’s unclear whether this fresh uptrend will last.

Unsplash.com featured image, Charts from TradingView.com and CryptoQuant.com charts