Bitcoin could see its price drop to below $21,000 as the bear hug becomes tighter. The price of Bitcoin has fluctuated between a high point of $25,135 (high) and low points of $23,243 (low). The short-term aim for the declining price trend is a drop to $21,000–$20,000.

Bitcoin Bulls Loses Steam

Bitcoin, the digital currency that is the largest, challenged to retain $23,500, August 18 as it attempts to sustain an upward trend of growth for the last two months.

The bulls’ dominance is clearly dwindling on the daily bar chart, and they will soon need to show greater tenacity to continue a price climb.

BitcoinBTC/USD Trades on $23k TradingView

The Crypto Market Fear and Greed Index fell from 47 to 30 in a week. It also dropped to 41 from 31 within one day.

This week’s additional selling pressure could either reverse the upward price trend or put it in an even more vulnerable situation.

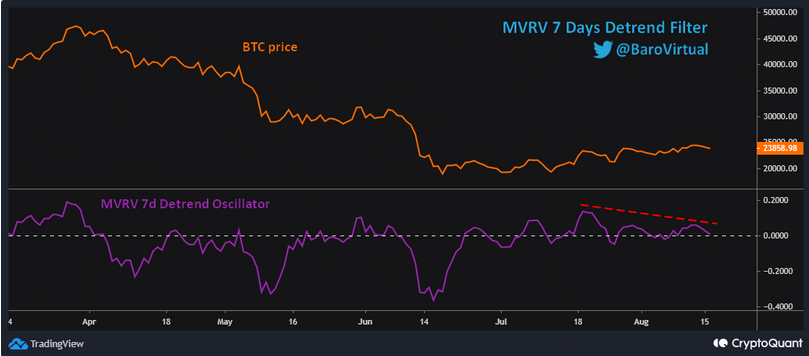

A negative divergence pattern has been observed in the MVRV 7 day Detrend Oscillator as a result of the Bitcoin price trend. The result is that BTC prices can plummet below $21,000. Applying a detrend filter on the price trends removes long-term market noise and makes it easier for you to see market bottoms.

Bitcoin (BTC) MVRV 7D Detrend Filter. Source: CryptoQuant

The long-term Bitcoin price has been dropping, especially since November. Over the past month however, the price increased. BTC’s daily channel decline channel indicates that it was on track to surpass the channel, but is unable to because of the $25,000 psychological resistance.

According to the crypto trading analyst, Michaël van de Poppe, Bitcoin’s ‘trend remains upward on higher timeframes.’ Poppe stated:

“Crucial to break $23.7K back. A flip of $23.7K will trigger longs if there is a $24K move. Higher timeframes will see the trend continue upwards. Still expecting $28-30K in the next weeks.”

Bitcoin price target. Source: Michaël van de Poppe

TradingView data shows that Bitcoin has a current market value of $449 Billion, an increase of 0.10% over the past 24 hours and a decrease in the week before.

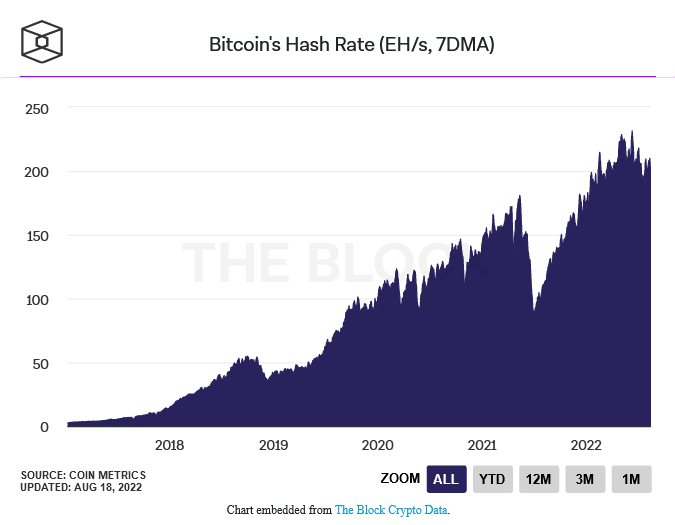

In a downtrend, mining difficulty is on the rise

A recent network upgrade resulted in an increase of 0.63% in the difficulty to mine bitcoins.

Source: The Block Crypto Data.

BTC.com changed its site to reflect the change. The Block Research’s data shows that the network’s hash rate has increased by roughly 1.5% since the last update on August 4.

Since May’s cryptocurrency market collapse, Bitcoin’s difficulty has largely decreased. After an August 4th increase of 1.74 per cent, the latest modest improvement is now.

Pixabay's Featured Image, Chart from TradingView.com and Cryptoquant.