Bitcoin, the most popular cryptocurrency, has been trading below $40,000 for the last few days. A wider market correction has caused altcoins trading below their support levels. Ethereum’s price dropped to $3000 when it was rejected by the market.

Bitcoin’s tough resistance stands at $40,000 as traders continue to exit the market over the last week. BTC fell by 3% over the last 24hrs and experienced a 6% decline in value during the week. The cryptocurrency market remains in accumulation mode.

Bullish market pressure is commonly linked to increased accumulation. However, the market shows a completely different picture. Additionally, higher accumulation correlates with increased risk/ratio. This is generally a bullish indicator.

There are other metrics that can be used to reinforce the idea that Bitcoin may rise in a bullish direction

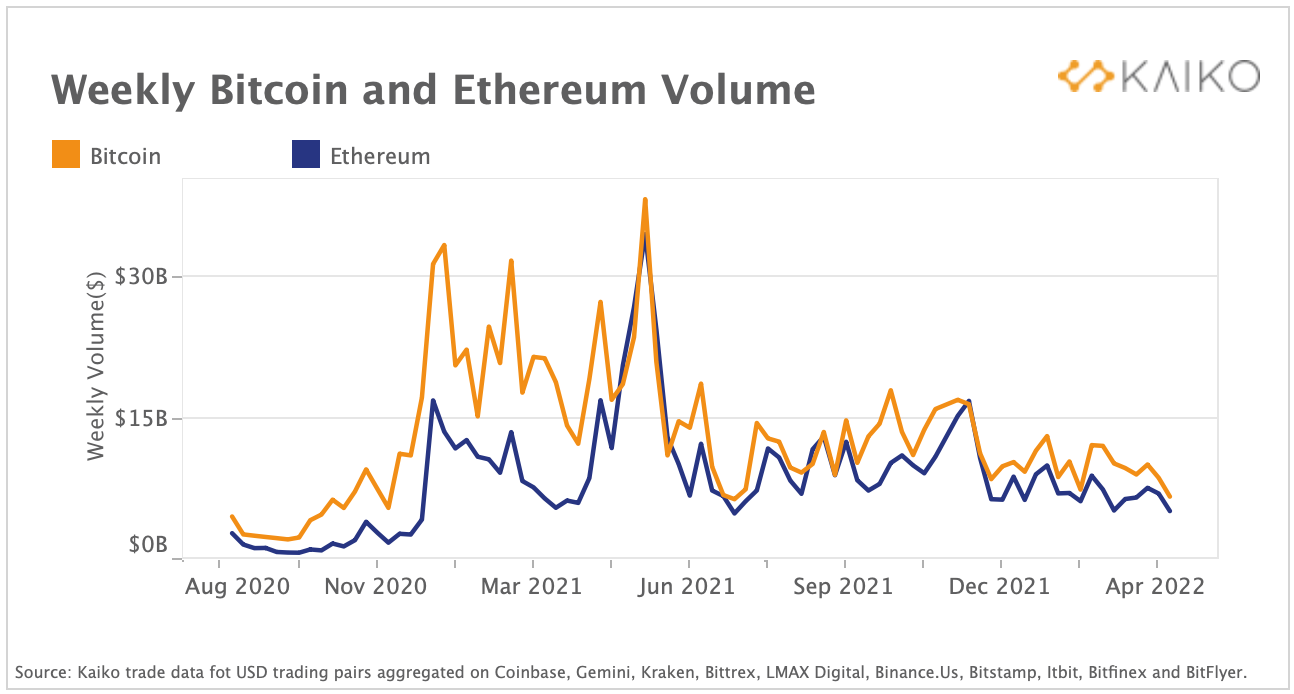

Kaiko data shows that both BTC as well as ETH trade volumes are down. This image shows that trade volumes have dropped on major centralized platforms. It also illustrates the fact that BTC and ETH trade volumes are now at their lowest level since the August 2020 bear markets.

This would imply that some people may be holding on to their assets longer than the accumulation phase implies and that prices will rise.

Currently, Bitcoin’s short-term price action remains bearish amidst a broader market weakness.

The Four Hour Chart: Bitcoin Price Analysis

Bitcoin was trading at $38,202 when this article was written. In the past, it fell below its support level at $39 800 in trading sessions.

BTC is currently battling for $40,000 since last week. The market has seen buyers exit, which has led to BTC continuing its struggle for the $40,000-$38,000 range.

BTC might trade close to $40,000 if prices turn. A slight push may help BTC reach the $42,000 mark. However, this level could prove to be a strong resistance. BTC could trade near $40,000 if prices fall. It will then reach $37,702.

Technical Analysis

Bitcoin traded below the 20 SMA, which indicates that selling pressure is growing. In the short-term, sellers were driving price momentum.

Buyers had just re-entered market 48 hours ago, which indicates that BTC is trying a rebound. BTC exchanged for $38,000 on 24th of December after the coin briefly crossed above the 20 SMA line.

Buyers have briefly left the Relative Strength Index market again, but could rebound if there is increased demand.

BTC displayed positive price momentum for the last 24hrs, but a new push made the coin reflect bearishness. While the Awesome Oscillator briefly flashed green histograms, AO was showing red at press time.

MACD, which indicates price momentum showed green histograms. However, this was confirmed by the AO because the indicator also displayed red signal bars. BTC is able to rise and down with very limited buying power.