On-chain data shows the Bitcoin exchange netflow has observed a sharp positive spike recently, a sign that could be bearish for the crypto’s price.

Bitcoin All Exchanges Netflow Jumps Up After 9% Inflation report

In a CryptoQuant blog post, an analyst noted that the exchanges are seeing a lot of BTC deposits in recent months.

The “all exchanges netflow” is an indicator that measures the net amount of Bitcoin entering or exiting wallets of all centralized exchanges as a whole. The metric’s value is calculated by simply taking the difference between the inflows and the outflows.

The netflow indicates that there are more coins in these wallets than the current value. This trend could be bearish on the BTC’s value as investors typically deposit their coins onto exchanges to sell them.

You might also like: The Bitcoin Funding rate turns highly positive, long squeeze in the making?| Bitcoin Funding Rate Turns Highly Positive, Long Squeeze In The Making?

However, a negative indicator value means that investors have stopped withdrawing their cryptos at the moment. This can signal accumulation by holders and be bullish for crypto’s value if it continues.

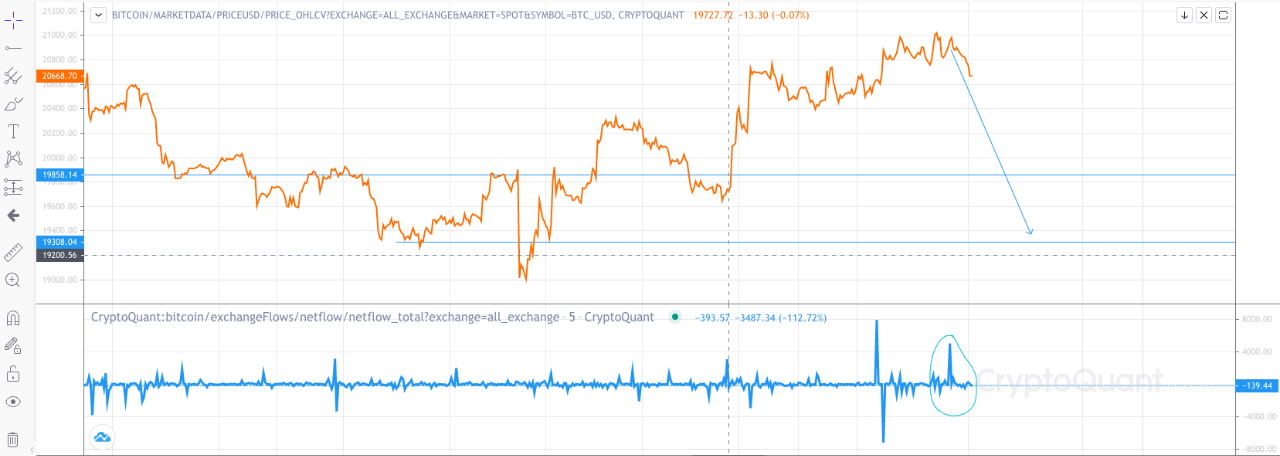

Below is a chart showing how the netflow of Bitcoin exchanges has changed over the past week.

Source: CryptoQuant| Source: CryptoQuant

The graph above shows that the Bitcoin exchange netflow experienced a positive increase over the last 24 hours.

The previous spike occurred not long after the latest, and that spike was offset by an equally large negative value for the metric.

Related Reading: Market Update: AAVE, MATIC and UNI Outperform While Bitcoin Struggles To Hold Above 20k| Market Update: MATIC, UNI And AAVE Outperforms While Bitcoin Strugles To Hold Above $20k

A quant noted in this post that the positive netflow value has been due to inflows from the crypto exchange Gemini. This is a popularly used cryptocurrency exchange by whales.

The deposits were made a few days after CPI for June was published. It revealed that inflation increased 9% in June.

The near-term outlook for Bitcoin can look bearish if the inflows come from whales who are looking to sell their coins.

BTC price

At the time of writing, Bitcoin’s price floats around $20.8k, down 4% in the last seven days. The crypto’s value has dropped 7% over the last month.

Below is a chart showing the change in coin price over the past five days.

Source: BTCUSD on TradingView| Source: BTCUSD on TradingView

Featured image by anvesh Baru, Unsplash.com. Charts from TradingView.com and CryptoQuant.com.