Given that the price of Bitcoin has been lingering above the $17K–$20K range over the past few weeks, Bitcoin’s sharp downturn has come to an end. After being rejected by the $20K support zone three times, the price is now testing the $23K resistance.

Bitcoin Advocates rejoice

The market flashed its first significant relief rally in at least a month, and crypto enthusiasts rejoiced at the sight of green on July 19 as the months of “down only” price action finally came to a stop.

According to TradingView data, Bitcoin’s (BTC) breakthrough over resistance at $23,000 to reach a daily high of $23,447—its first appreciable move above the 200-week moving average—is largely responsible for the renewed optimism.

Additional opposition is being experienced at the $23K and $50K levels, respectively. A further retest of the $20K support level and perhaps a deeper negative continuation are anticipated in this situation because it appears as though these two points are currently rejecting the price’s move downward. But, bulls are keen to capture the level.

BTC/USD barrels at $24k Source: TradingView

The price movement on lower time frames should be carefully monitored to determine the probability of a negative reverse. If a bullish breakout occurs above the $23K-24K range, a rally to the $30K supply area is likely.

Although many predicted an increase to mid-$30,000, some analysts expressed concerns that this might be another fakeout pump.

“Weekly Candle Close Above $22,800”

Rekt Capital, an analyst in cryptocurrency, posted the following chart with the comment that “For the first time in weeks, BTC is putting in a decent effort to try to reclaim the 200-week MA as support.” The analyst has been paying close attention to the move back above the 200-week MA.

Mid Cap Crypto Coins Lead In July, Best Way To Weather The Winter?| Mid Cap Crypto Coins Lead In July, Best Way To Weather The Winter?

Since it is a trusted indicator in bear markets that can give insight to when bottoms have been reached, the 200 week MA has seen a lot of attention over recent weeks.

As per Rekt Capital,

“BTC needs to Weekly Candle Close above $22800 to successfully confirm a reclaim of the 200-week MA as support.”

Miners Capitulate

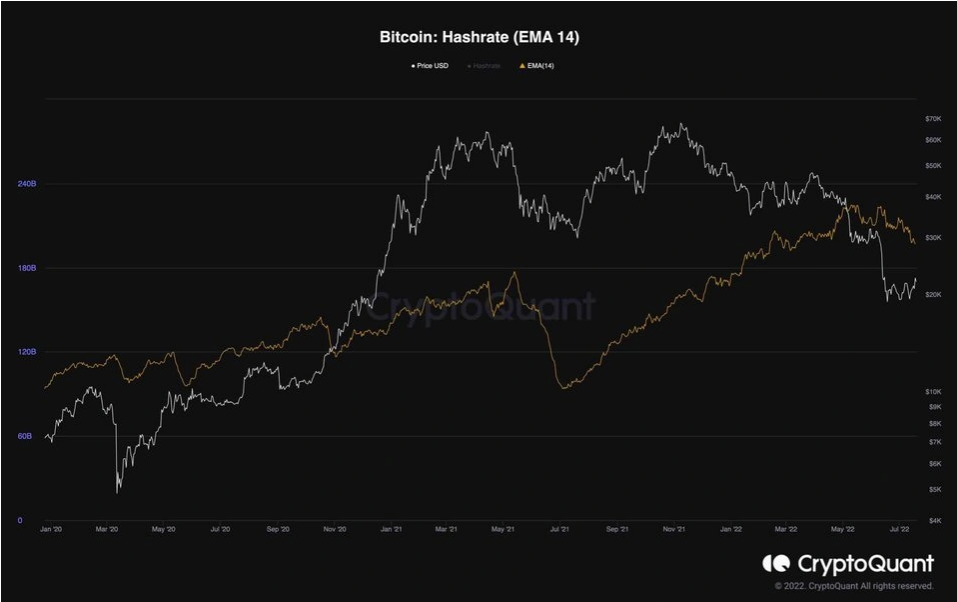

The capitulation phase has begun for miners, and they have been slowly distributing their holdings. After a recent all-time high, the hashrate for Bitcoin is showing the same behaviour.

In just 24 hours, bitcoin miners were able to remove up to 14,000 bitcoins, each one worth $300 million from their wallets.

Because of the declining value many digital currencies recently, miners decided to sell their bitcoin investments.

Source: CryptoQuant

This minor fall in the hashrate is expected given that Bitcoin’s price is currently approximately 74% off its all-time high and that mining may not be profitable for many miners and pools. But despite the current price correction’s size, the hashrate is still doing fairly well. In the past, the bear market’s ultimate phase has been identified by the capitulation of the miners. It is likely that Bitcoin will quickly reach its bottom long term and start an uptrend to higher prices.

Similar Reading: Bitcoin marks one month of negative funding rates, more decline incoming| Bitcoin Marks One Month Of Negative Funding Rates, More Decline Incoming?

Featured image taken from iStock Photo.