The May 2022 market insights report is available here Bitcoin.com Exchange. You will find this report, as well as the next, a summation of crypto market performance, along with a macro recap and analysis of market structure.

Crypto market performance

As a result, May began with a rough start. The Federal Reserve reiterated its hawkish bias in response to inflation. Risk-averse markets responded.

Crypto markets experienced historically high drawdowns due to the collapse of UST and LUNA.

BTC dropped to $25.4k USD. That’s 60% lower than its $65k all-time high. Similar drawdown was seen in ETH.

AVAX, SOL and other large-cap coins did worse than they had at their highs. They were down more 75% and 88% respectively.

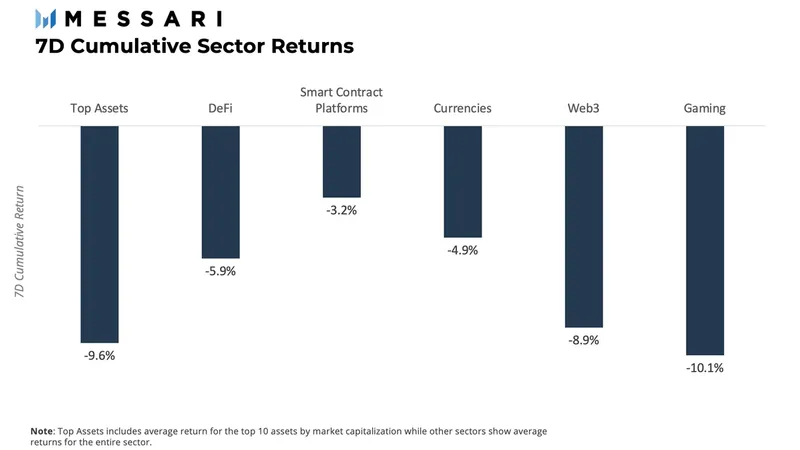

The worst performing crypto sector was gaming (play to earn), followed by large caps (large assets) which suffered losses of 9.6% and Web3, which fell 8.9%.

Macro Review: Quantitative tightening (QT), is here to stay

The market expected the Federal Reserve to announce that on May 3, it had approved a 50-basis point rate increase for the funds rate. This announcement was on the back of “robust” job gains and a decrease in unemployment, which has led to increases in inflation. Also, the balance sheet decreased from $47B per monthly to as high as $95B every month for the first three months. According to the Federal Reserve’s later statements, System Open Market Account (SOMA) will reduce its holdings of U.S. agency debt and U.S. agency mortgage-backed securities (MBS).

The narrative was focused on uncertainties regarding the macro environment, as Russia’s invasion of Ukraine intensifies and supply-chain issues in China contribute to lackluster growth globally.

CPI data did not provide any relief as the CPI reported 8.3% in April. This was 20 basis points higher than expected. April’s numbers were down only slightly from the 40-year high of 8.5% reached in March.

Market Structure: A decrease in flows and a continuing capitulation by long-term holders

Macro conditions are getting worse. We look at the on-chain metrics in order to understand how price action is changing. This will help us to see what’s next. Two areas will be our focus. Two areas will focus on are: 1) decrement in profitability for long-term owners (and capitulation) as well as, 2) stabilitycoin supply/demand.

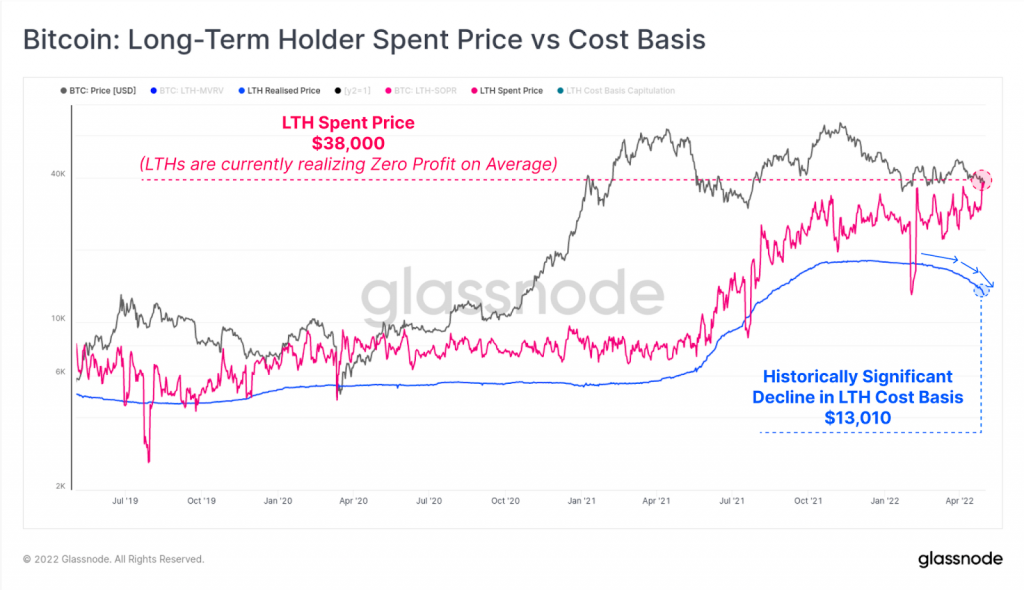

Below is the graph of the Long-Term Holders Spent Price and Cost Basis. This shows how Long Term Holders (LTHs) capitulate in the markets. The long-term realized price, or the average purchase price for coins LTHs have is shown in the blue. As you can see, this is decreasing which means that LTHs have been selling their coins. LTHs are spending an average amount of coins on a given day. This is represented by the pink line. As you can see, it’s trending higher, meaning that LTHs are selling at break-even on average.

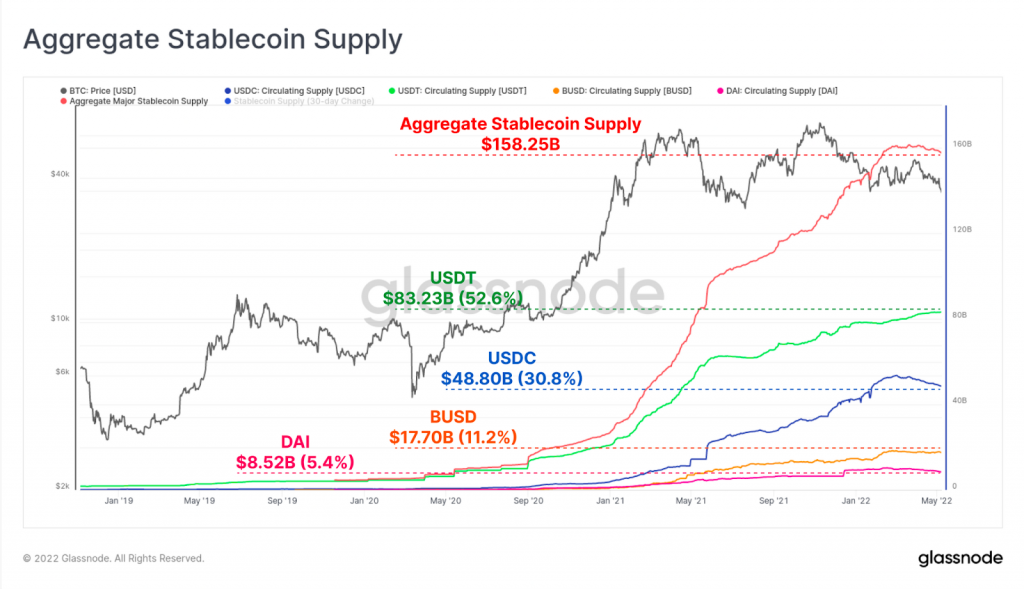

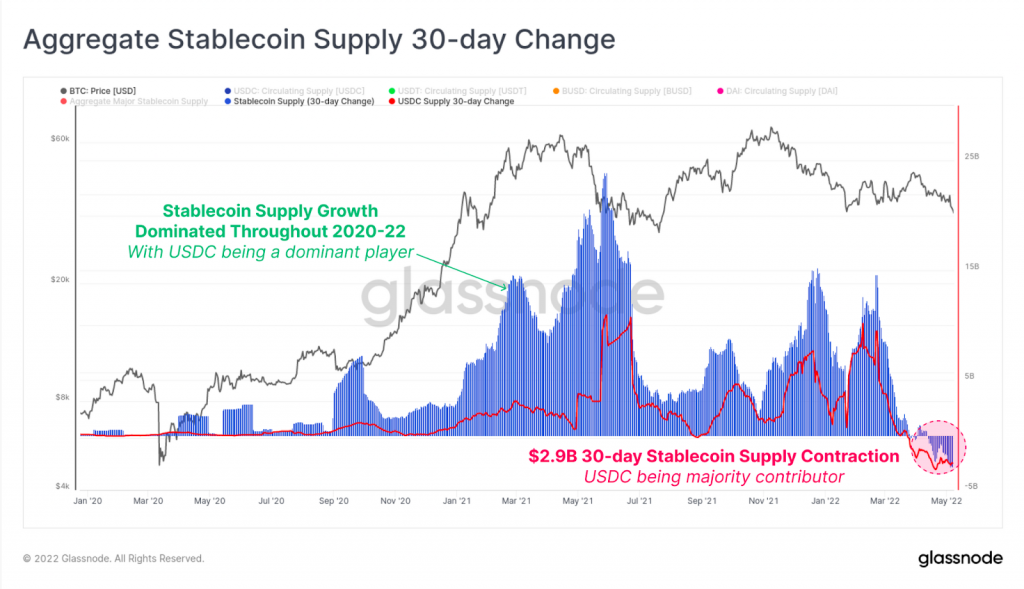

Because they allow new participants to enter the market and standardize a crypto-exchange unit, stablecoins play a crucial role in that part of it. If the stablecoin supply is high, it will be easy to determine if more people are joining the market. Below is a graph showing how stablecoins supply has increased dramatically during the last bull markets. This can be attributed to rising demand for crypto as well as new players joining the market. In less than three years, the supply of major stablecoins increased from $5.33 to $158.2 trillion. However, the overall stablecoin supply in 2022 has been relatively flat.

This increase was mainly due to an increase in USDC redemptions (into fiat), which totalled $4.77B from the beginning of March, despite an $2.5B increase in USDT during the same time period. The below chart shows the 30-day changes in aggregate Stablecoin Supply relative to the USDC Contribution. USDC experienced a decrease in supply by $2.9bn each month. This can be seen by looking at the circle dashed to the right.

USDC supply contractions are one of the most popular stablecoins. They indicate money moving from all stablecoins back to fiat. This indicates both a negative sentiment and weakness overall in crypto markets.

LUNA and Do Kwon: The Man who Flew too Close to the Sun

We will be discussing the fall and rise of UST, the Terra ecosystem and how it impacted markets. UST was one of the most stable coins ever made. It was an algo-stablecoin that had been undercollateralized in Terra’s Terra ecosystem. It was sponsored and created by Luna Foundation Guard, led by Do Kwon (founder).

UST was an algorithmic stablecoin that implemented a 2-token system. The UST supply and LUNA supply were equal and both tokens could be exchanged between them. Traders were encouraged to use LUNA to buy UST for 1 dollar.

Meanwhile, Anchor, a DeFi staking protocol within the Terra ecosystem, was offering “saving account” deals for users to stake their UST. The APY was a staggering 20% Anchor generated this yield through borrowing and lending UST collateral to other users. LUNA was the collateral that provided a large amount of this yield.

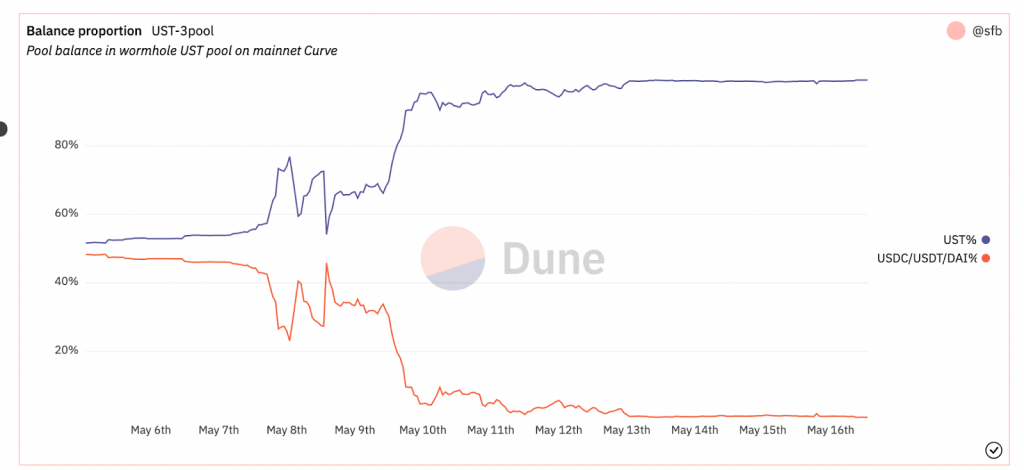

What went wrong? The Terra ecosystem was a huge success and became one of the most valuable projects in terms of market capitalization at $40B. Do Kwon and LFG started to look at ways to enhance the backing for UST. They decided to support a portion of their reserves using large-cap cryptocurrencies like AVAX and BTC, making UST a multicollateralized stablecoin. That made UST’s stability directly correlated to its collateral. 4pool Curve saw a 60% rise in UST supply as of May 8, 2022. The chart below shows this.

The pool was rebalanced by a $85 million UST to USDC swap. Eventually, big players came along and sold ETH on the market to bring the value of UST almost back to $1, as the chart below shows.

As you can see, the Curve pool’s balance was temporarily restored at its former levels. The peg was also temporarily saved. We see that a second massive sale of UST took place on Curve pool on May 9th. It caused an identical situation and pushed the pool’s imbalance up to more than 80%. Around the same period, UST prices fell to $0.60. In a spiral downwards spiral, the LFG collateral became less valuable as the crypto market panicked. This impacted the value of LUNA, as it’s supposed to be continuously sold to keep the peg – and this was the beginning of the end. From that moment on the peg was $0.8 and the value for LUNA plummeted by more than 99% to $0.00026 USD.

Many questions remain unanswered about the Terra/Luna Episode. Is it possible to identify the person responsible for selling a lot of UST via Curve. Was this an orchestrated “attack” to depeg UST? Why didn’t LFG come up with a contingency plan to stop the devaluation of LUNA and UST? Do Kwon, the foundation, and Do Kwon manually restored the token. Is it possible to keep BTC collateralized tokens secure in high-correlated situations?

As the Terra ecosystem (and UST) are primarily marketed to retail customers, we are still not seeing the full impact of this dark chapter in crypto-history. This is what you might see. IncreasingStablecoins are under scrutiny by regulators. This is because crypto, being a young market, is still in its infancy and is prone to high risks. Remember that investment comes with risk. Conduct your own researchIt is still a crucial issue.

Image creditShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com doesn’t offer investment, tax or legal advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.