Billionaire Carl Icahn, the founder of Icahn Enterprises, has predicted that the U.S. economy could be heading into “a recession or even worse.” The famous investor warned of “a lot of trouble ahead” and “a rough landing.”

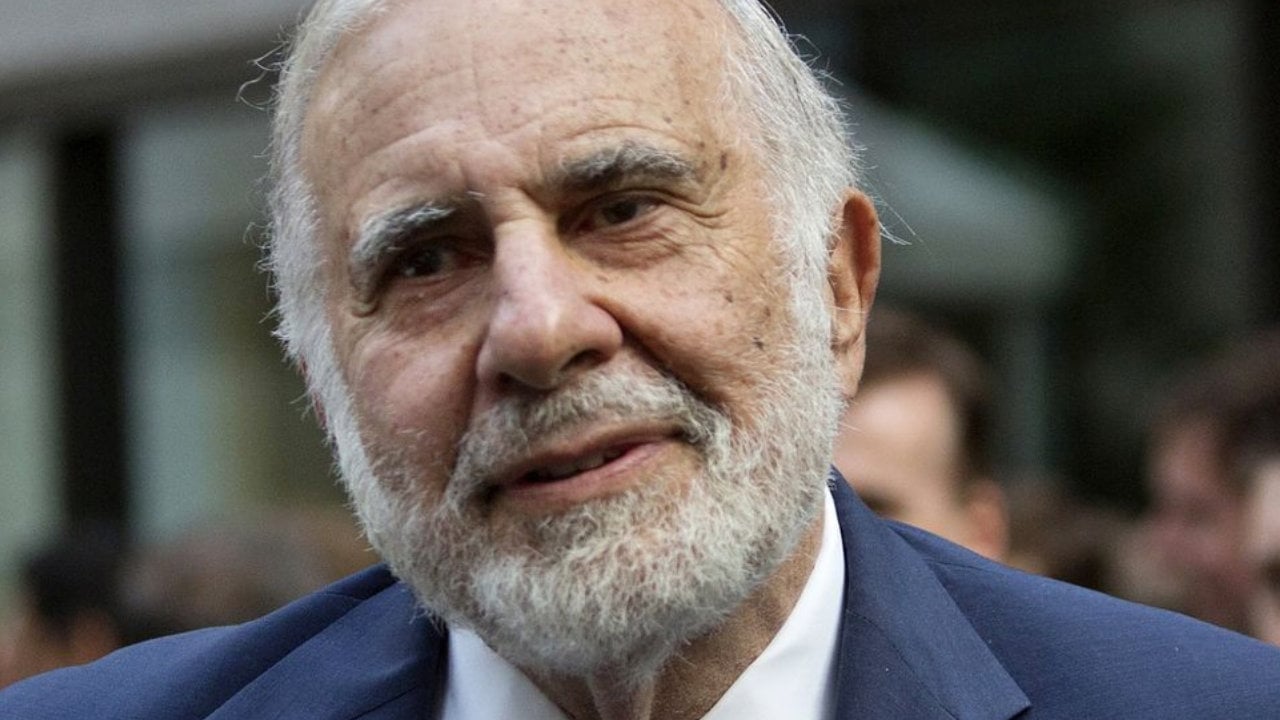

Carl Icahn, Billionaire Predicts Recession in USA

In an interview Tuesday with CNBC, billionaire investor Carl Icahn stated that the United States could face a recession or worsening economic conditions. Icahn founded Icahn Enterprises in New York City, which is a publicly traded company as well as a holding company for diversified conglomerates. His net worth currently stands at $17 billion.

He stated that the rising inflation is a serious threat to our economy.

It could very easily lead to a recession, or worse.

He explained that based on his experience sitting on the boards of a lot of companies, “when you get to understand what these boards do, the system is needing fixing.” He also noted that at this point, “we have supply chain problems” because “our companies are so badly run.”

Icahn offered this opinion:

There’s no accountability in corporate America. While there are many fine companies and some great CEOs, I feel that far too few of them can handle the job that is required.

He shared his investing strategies. “I have kept everything hedged for the last few years and I think now that we do have it, we have a strong hedge against the long positions that we try to be activists in and get that edge. So that’s the way I look at it, but I am negative as you can hear. Short term, I don’t even predict,” he detailed.

When asked by Icahn Enterprises’ founder, he replied that he believed there would be a soft landing. “I really don’t know if they [the Fed] can engineer a soft landing or not, but … I think we do have a lot of trouble ahead … I think there’s going to be a rough landing,” he replied, elaborating:

When inflation gets out of control, it can be a very bad thing. You can’t get that genie back in the bottle too easily. In the 70s we witnessed it, and saw what was happening.

“In the last 20 or 30 years … You had cheap goods coming in from the Far East, from China, for sure, and even from Russia … I think those days are over now, and you have this [Russia-Ukraine] war going on now which adds another problem to your inflationary picture,” the billionaire noted.

What do you think about Carl Icahn’s comments? Comment below to let us know your thoughts about Carl Icahn’s comments.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com doesn’t offer investment, tax or legal advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.