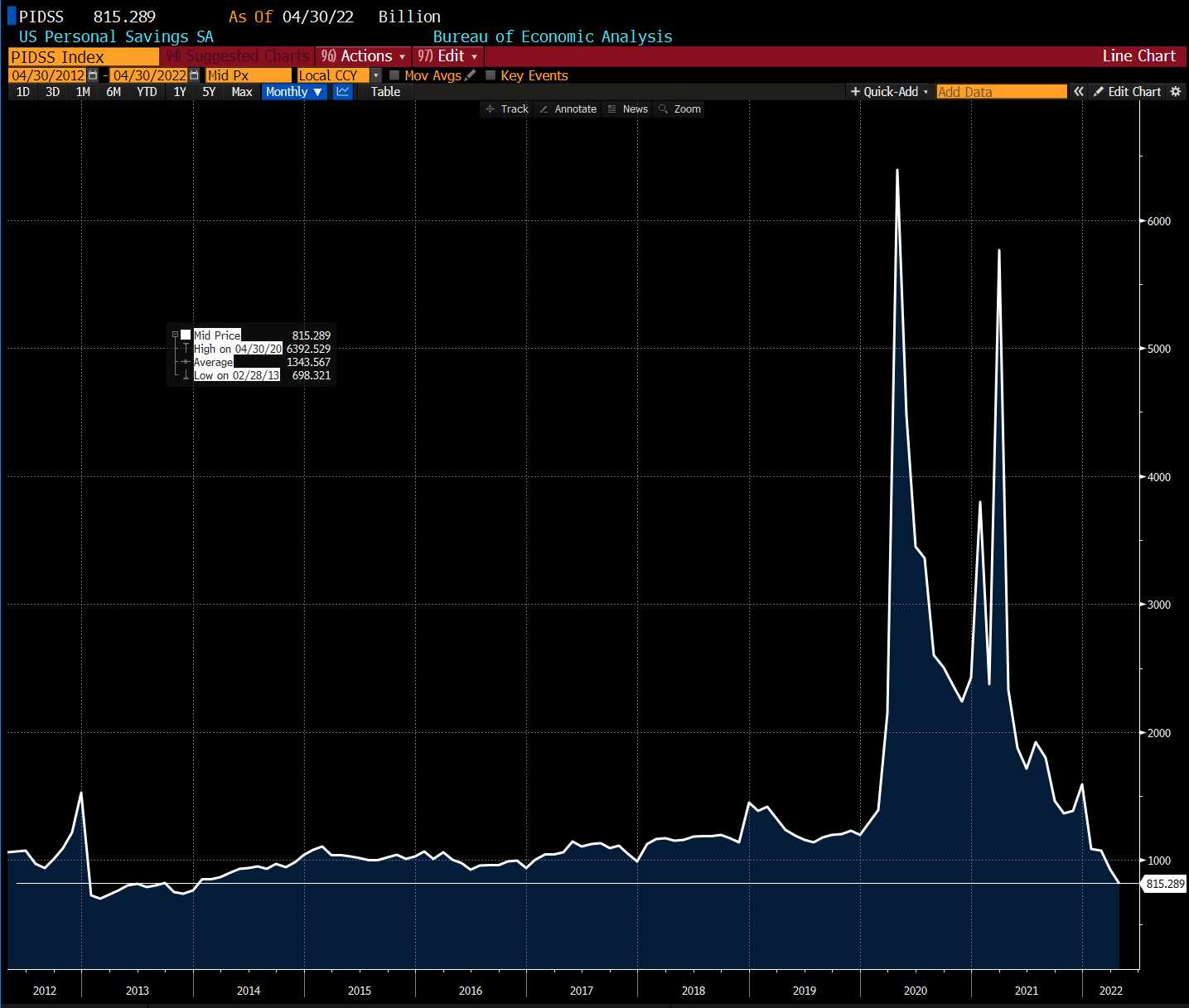

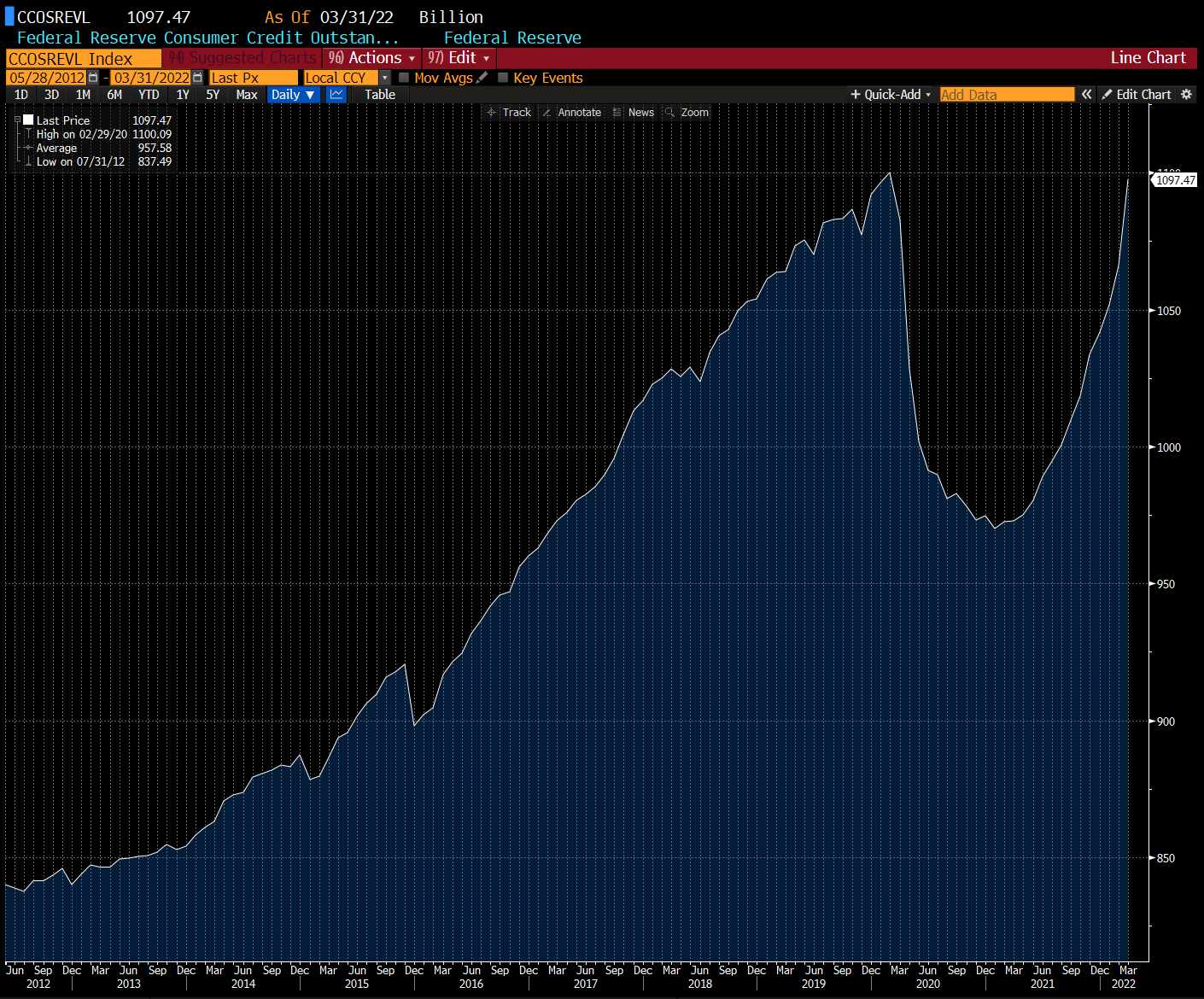

Michael Burry is a famous hedge fund manager who predicted the 2008 financial crises. The reasons he cited were falling U.S. personal saving and record-setting revolving debt on credit cards, despite billions of dollars in stimulus money.

Michael Burry’s Recession Warning

Michael Burry is a famous investor who founded investment company Scion Asset Management. He warned that there will be another recession soon and that more earnings troubles are likely.

His greatest achievement is being the first to profit and foresee the U.S. subprime crisis in mortgage lending that took place between 2007-2010. He is profiled in “The Big Short,” a book by Michael Lewis about the mortgage crisis, which was made into a movie starring Christian Bale.

Burry replied on Twitter to this question Friday

US Personal Savings fell to 2013 levels, the savings rate to 2008 levels – while revolving credit card debt grew at a record-setting pace back to the pre-Covid peak despite all those trillions of cash dropped in their laps. The future is bleak: more earnings problems and a consumer recession.

Two images were included in his tweet. One image shows sharply declining U.S. personal saving. Both the first and second graphs show a sharp rise in consumer credit.

At the time of writing, there were 476 comments on Burry’s tweet, which has been liked 11K times and retweeted almost 2.5K times. On Twitter, many people agreed with Burry. They thanked him for raising this issue and warned others.

One commented: “This is wild. We airdropped helicopter money on people and yet personal savings went down and credit card debt went right back to where it was.”

Another wrote: “Exactly what I said- inflation is not a problem. Consumer debt IS a problem. It is flawed to implement demand-side money policy. Market correction is impossible with rate manipulation. Americans have a lot of cash. Instead of spending your money, invest in long-term savings. Kill imports.”

Another user had a different opinion:

The media likes to portray a strong consumer, but the facts are clear. Decreased savings, increased debt, and inflation metrics that are still rising MoM, with energy prices near highs we haven’t seen since 2008.

Several people agreed that “numbers don’t lie,” and the U.S. economy is looking as grim as Burry suggested or even worse.

A growing number of people have recently warned that a recession is either here or is imminent, including Tesla CEO Elon Musk, Rich Dad Poor Dad Author Robert Kiyosaki, and Goldman Sachs’ senior chairman and former CEO, Lloyd Blankfein.

What do you think about Michael Burry’s warning? Comment below to let us know your thoughts about Michael Burry’s warning.

Image creditShutterstock. Pixabay. Wiki Commons

DisclaimerThe information contained in this article is intended to be informative. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused by the content or use of any goods, services, or information mentioned in the article.