After the Tuesday market drop, digital currency markets and precious metals as well as stocks fell another leg on Monday. Last week’s fall was one of the worst weeks in more than three months as market strategists believe a sizable Fed rate hike is coming this week. Bank of America’s analysts led by Savita Subramanian believes the U.S. Federal Reserve “has more work to do,” and an aggressive central bank may be “anathema for stocks that have benefited from low rates and disinflation.”

Crypto, Precious Metals, Equities Show Volatility Ahead of Fed Rate Hike — Pseudonymous Analyst Plan B Says Bitcoin and the S&P 500 Are Correlated but Are ‘Completely Different Worlds’

A hawkish Fed may be like repellent or kryptonite to assets that profited from easier monetary policy and stimulus, Bank of America’s market strategists led by Savita Subramanian said in a note this past weekend. The global asset market is having a tough start Monday. Wall Street’s four main stock indexes opened the day at 9:30 am. This follows a long week of trading. The benchmark stock indexes saw a small rebound by 3:00 PM (ET) indicating extreme volatility and uncertainty in the market.

Subramanian and his team predict the S&P 500 will lose another 8% this year, and he further stressed that the “summer rally is over.” On Monday, digital currency markets slid 1.61% in the last 24 hours, and the crypto economy is now just above the $900 billion mark at $933.17 billion. Bitcoin (BTC), which has fallen 1.67%, and ethereum(ETH), which fell 1.79% in the last 24hrs against the U.S. dollars.

As well as losing precious metals, silver and gold saw their currencies drop by 0.12% and 0.74% on Monday. Although the U.S. equity markets are highly correlated to bitcoin, some BTC market analysts think that bitcoin is an entirely different beast.

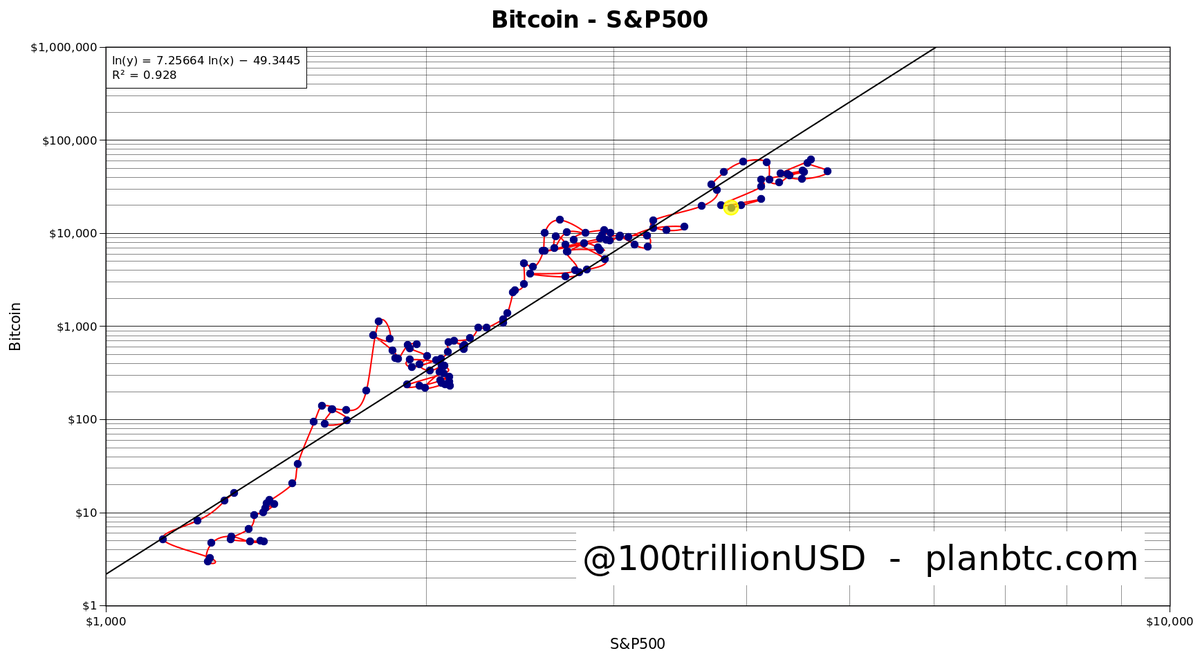

“[Bitcoin] and S&P 500 are correlated,” the pseudonymous analyst Plan B tweetedMonday. “However, in the same period that S&P increased from ~$1K to ~$4K, [bitcoin]The price of a car has risen from $10 to $20K. 4x versus 2000x … completely different worlds. Short-term moves are noise, long term trends are the signal.”

Bank of America Market strategists: ‘The Fed Has More Work to Do’ — Greenback Jumps Higher, 10-Year Treasury Notes Tap an 11-Year High

Economists and analysts believe that the U.S. Federal Reserve would raise its target federal funds rate by 75bps this week. Bank of America’s Subramanian detailed that “the Fed has more work to do” and lessons from more than four decades ago can tell us a lot about combating inflation.

“A hawkish Fed may be anathema for stocks that have benefited from low rates and disinflation (i.e. most of the S&P 500), but lessons from the ’70s tell us that premature easing could result in a fresh wave of inflation—and that market volatility in the short-run may be a smaller price to pay,” the Bank of America strategist’s note explains. Subramanian’s opinion follows the report Bank of America economists revealed in mid-July.

Something is bound to happen if the Fed doesn’t take care. pic.twitter.com/inTtO7CZaP

— Sven Henrich (@NorthmanTrader) September 16, 2022

At the time, the bank’s economists said it previously expected a “growth recession,” but the summer forecast suggested a “mild recession in the U.S. economy this year.” On Monday, market analyst Sven Henrich quoted Fed chair Jerome Powell’s statement during a press conference last June, when Powell said: “Clearly, today’s 75 basis point (bps) increase is an unusually large one, and I do not expect moves of this size to be common.” Henrich then mocked the Fed chair by noting the central bank is proceeding to execute the third 75bps rate hike in a row.

While nearly every asset class under the sun is showing a strong connection to inflationary pressures and the Fed’s monetary policy, the U.S. dollar has continued to skyrocket against other fiat currencies. The U.S. Dollar Currency Index DYX tapped 109.756 Monday afternoon ET, and once more the euro was at parity with it. The Japanese yen has a value of $0.0070. On September 19, the 10-year U.S. Treasury note reached an 11 year high of 3.518%.

What do you think about the Bank of America market strategist’s opinion about an aggressive Fed and the S&P 500 shedding another 8% by the year’s end? Comment below to let us know your thoughts on this topic.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThis article serves informational purposes. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com doesn’t offer investment, tax or legal advice. This article does not contain any information, products, or advice that can be used to cause or allegedly cause any kind of damage.