The price of terra (LUNA), which dropped 33.3% to new lows Monday due to bitcoin’s plunge, fell by 33.3% in the past 24 hours. Moreover, the project’s stablecoin terrausd (UST) has lost stability, dropping to $0.932008 per token. Additionally, the Luna Foundation Guard’s bitcoin wallet and ethereum Gnosis safe address has been emptied.

LUNA Price Puts Intense Pressure on Terra’s Stablecoin UST

In the 24 hour period, $830 Million has been taken out of the cryptocurrency economy. Bitcoin’s price (BTC) fell to lows it had not seen since Jan 2022. BTC lost 20.2% against USD over the last seven days and 11% during the previous 24 hours. Several crypto assets also suffered deeper losses, with terra (LUNA), dropping 33.3%.

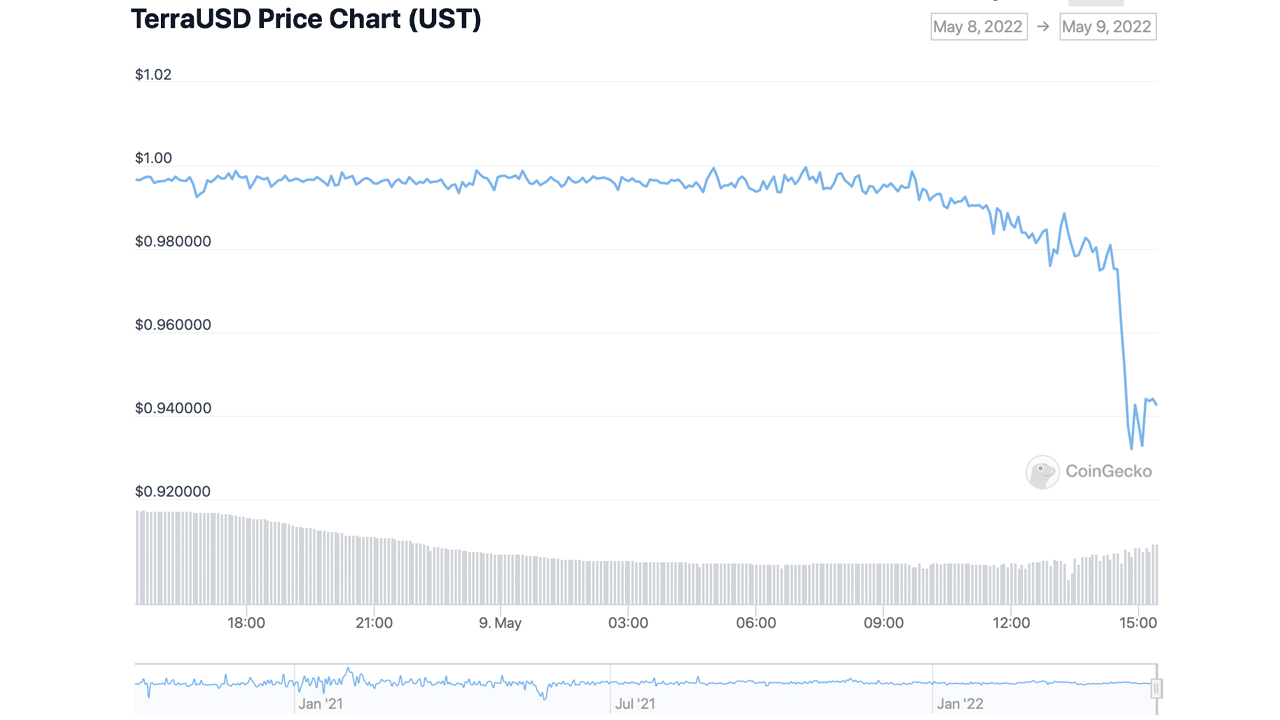

The stress has caused the project’s UST peg or $1 parity to slip beneath the dollar value. According to Coingecko.com statistics, the terrausd (UST), dropped to $0.932008 per unit on Monday. UST’s 24-hour price range on Monday has been between $0.932008 to $0.999601 per unit.

Luna Foundation Removes Bitcoin and Ethereum Wallets

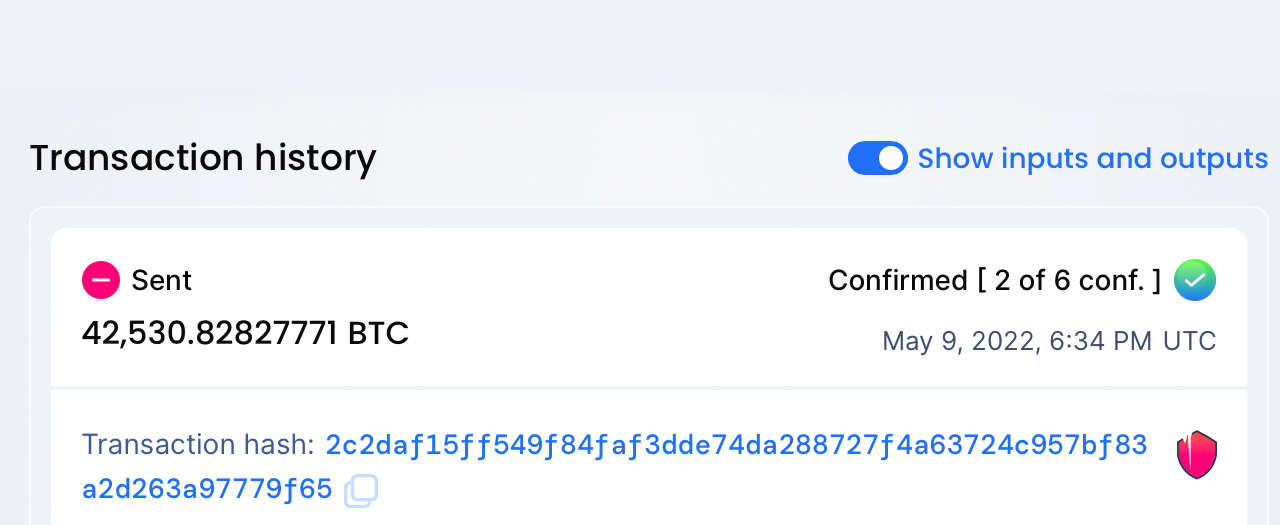

In addition to the losses, UST and LUNA took on Monday, after revealing the Luna Foundation Guard (LFG) would lend $1.5 billion in BTC and UST, both LFG’s public bitcoin and ethereum wallets have been drained. LFG’s bitcoin wallet held 42,530.82 BTC and sent it all in one transaction to another wallet. Additionally, LFG’s Gnosis safe address, which once held millions of dollars in USDC and USDT, has also been drained.

Deploying more capital – steady lads

— Do Kwon 🌕 (@stablekwon) May 9, 2022

LFG Gnosis’ safe address was $143 million on May 3. It currently has $195. At 2:36 p.m. (ET), Terra co-founder Do Kwon tweeted “Deploying more capital – steady lads.” UST’s price has seen some improvement on Monday after the deployment of capital, but has been down between 4.5 to 6.5% during the last few hours.

Other stablecoin assets such as USDC or USDT are experiencing less pressure, but the largest stablecoins in terms of market capital have maintained their pegs. The price of Tether dropped to $0.995691 per unit Monday. However, the value of USDC (usd coin) fell to $0.994630.

Binance USD (BUSD), is currently trading at $0.996616, while DAI trades for $0.995420. The USD pegged stablecoins, UST included, remained at least $0.975328- $0.99 per token. UST is still trying to regain $1 parity, but it has not succeeded. At 4:30 p.m. ET, stablecoin UST had jumped to $0.956017 an unit.

How do you feel about the stablecoin UST’s $1 perity dropping on Monday? Please comment below to let us know your thoughts on this topic.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com doesn’t offer investment, tax or legal advice. The author and the company are not responsible for any loss or damage caused by the content or use of any goods, services, or information mentioned in the article.