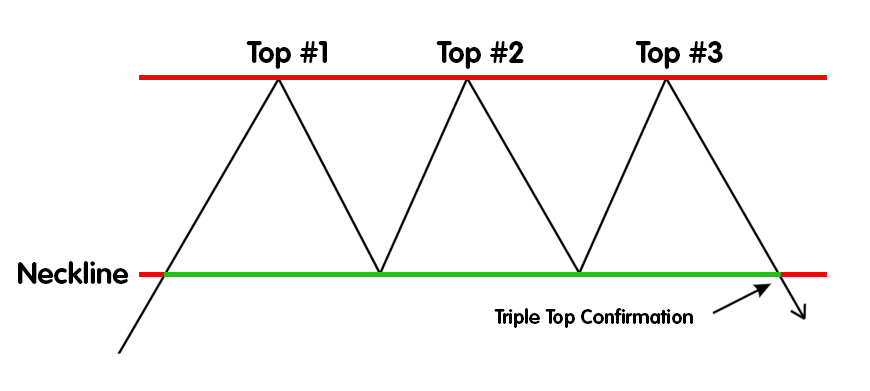

The cryptocurrency economy has shed a lot of value during the last six months dropping 48.70% from $3.08 trillion to today’s $1.58 trillion. Although crypto markets look very bearish, some crypto supporters believe the bear market won’t be as severe this time. Furthermore, there’s also the rare scenario that bitcoin’s price could reverse and see a triple top even though it’s commonly said in the finance world “there is no such thing as a triple top.”

Although it is unlikely that Bitcoin will experience a triple top scenario, there are still chances.

Five days ago, Bitcoin.com News reported on a theory that describes bitcoin (BTC) prices experiencing a softer bear market than the leading crypto asset’s 80%+ declines recorded in the past. This is the The reasoningThe theory stems from past Bitcoin price peaks, and most recently recorded peaks in May 2021 and November 2021.

BTC reached $64K and $69K respectively in May, but these peaks were smaller than the previous bull runs gains. From the looks of things it seems, BTC’s price experienced what’s called a double top. Now, coinciding with the theory the current market downturn will be a softer bear run, there’s also the rare possibility of a triple top scenario.

Basically, if a triple top scenario takes place, BTC’s fiat value will tap the same resistance it touched during the past downturn. BTC’s value fell to $31K after it reached a $64K high in May 2021. The price soared again and reached $69K in November 2021.

The upcoming bottom could be in the vicinity of the $31K level, which would allow for a triple top. This will then trigger another reversal. BTC needs to experience a complete reversal at the same resistance levels. This could mean that the third top is equal or less than the $69K area.

Reversal Theories Considered ‘Hopium’ as Many Won’t Bet on Such a Risky Play

Of course, many will assume theories of a triple top are based on pure faith and “hopium.” In the trading world, triple tops are very rare and quad tops are seemingly non-existent. In 2019, allstarcharts.com analyst JC says: “We rarely see triple tops, and I can’t even tell you if I’ve ever seen a quadruple top. Betting on these outcomes seems to never pay.”

It is therefore very risky to bet on bitcoin (BTC). A triple top would mean that you are betting on the formation of a double-top. It is also a message that everyone in the trading community hears. state:

Triple tops are not real.

While it’s common to say the statement, saying “there is no such thing as a triple top,” the comment is not entirely accurate. It is possible that they have happened in previous financial market situations, and traders who have placed their bets on them have enjoyed the benefits. However, when a triple top does execute and complete, the “party is officially over.” When a triple top is executed, the price will begin a bearish descent until the next price cycle regains bullish strength.

While many are likely still willing to bet on a triple top formation as far as bitcoin’s price is concerned, its even more likely they are not willing to bet on a seemingly non-existent quad top. Triple tops are rare, so traders may not be willing to place a third one. It is possible for a triple top to be realized in Bitcoin, but it is unlikely.

What do you think about the chances of bitcoin’s price seeing a triple top formation after hitting the next resistance level? Please comment below to let us know your thoughts on this topic.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. It does not constitute an offer, solicitation, or recommendation of any company, products or services. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.