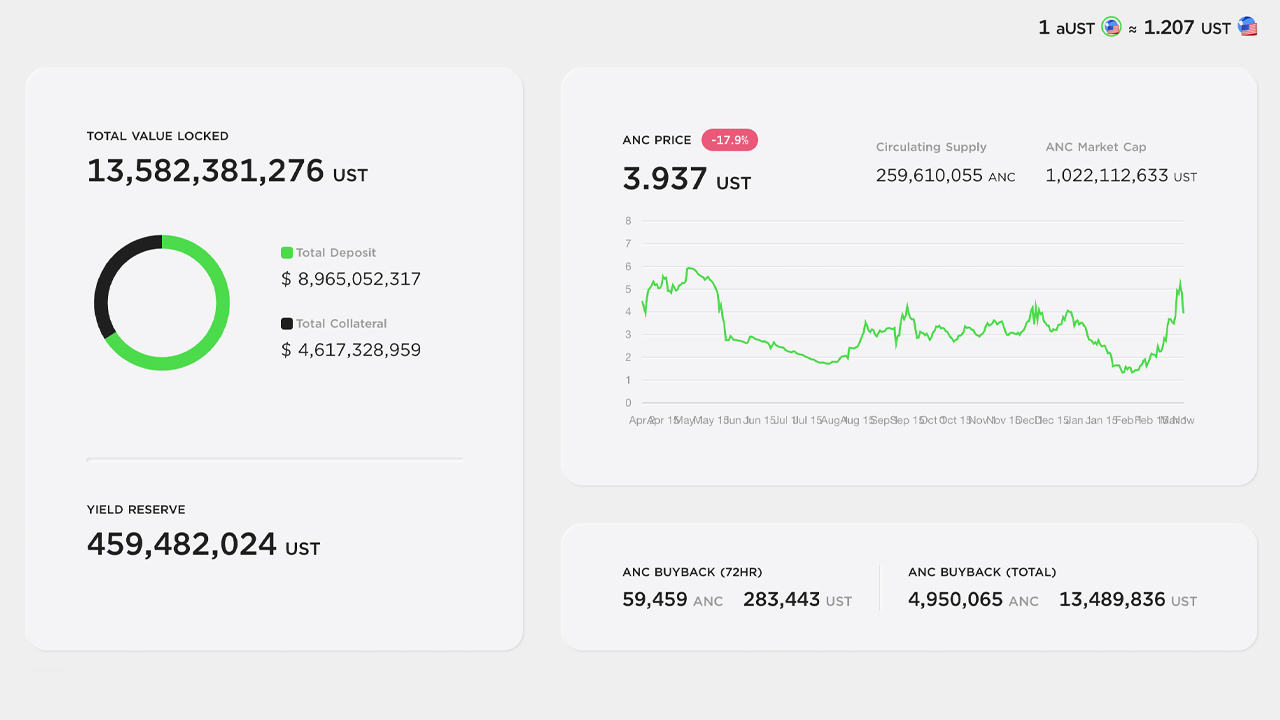

While the decentralized finance (defi) platform Anchor Protocol’s native digital asset ANC has gained more than 180% over the last month, the total value locked (TVL) in Anchor has increased a great deal during that time as well. Anchor Protocol is currently the second-largest defi lending platform in terms of TVL, and over the last month, Anchor’s TVL has increased by 40.13%.

Anchor TVL Surges More Than 40% in 30 Days, Protocol’s TVL Rivals Aave’s Lead

Over the past month, the Terra-based token Anchor Protocol (ANC) has experienced a substantial increase in value relative to the U.S. dollars. At the moment of writing, ANC’s 14-day metrics have shown a gain of 82.7%. 30-day statistics indicate that ANC is up 182.4%.

Anchor, a Terra-based lending protocol that uses the Terra blockchain network to gather liquidity from both lenders and borrowers, is called Anchor. Additionally, stablecoins terrausd (UST), which are deposited by lenders, provide a steady yield close to 20% annual percentage rate.

Anchor employs a liquid-staking system to collect yield. Anchor and Orion Money also offer Ethanchor, which allows depositors to gather yield on Ethereum-based stablecoins in contrast to Anchor’s UST functionality.

According to the metrics at defillama.com, Anchor currently ranks sixth among all defi apps. Anchor’s TVL has increased 5.55% over the last week, but monthly statistics indicate the protocol’s TVL jumped 40.13% since last month. Much of Anchor’s TVL increase to $11.5 billion occurred during the last 30 days.

Anchor currently holds the number two position in Aave for the largest defi lending protocols. Aave’s lending protocol is just one hair behind Anchor, with a TVL currently of approximately $11.6 million.

Below Anchor refers to lending apps made by TVL. These include protocol like Compound ($6.48B), Justlend (1.86B), Venus (1.62B), Banqi (1.11B) and Iron Bank (1.06B).

Anchor metrics shows that there is $2.46 Billion in loans today. Borrowers must also leverage bonded LUNA or bonded EHTH for collateral. Anchor’s documentation says that the defi lending protocol has three audits.

One audit published by Cryptonics goes over Anchor’s smart contracts and another audit by Cryptonics reviews Anchor’s distribution of ANC and smart contracts. Solidified published a report on Anchor’s audit last July.

Anchor is now the 2nd-largest Defi Loan Application. What are your thoughts? Comment below and let us know how you feel about the subject.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThis article serves informational purposes. It does not constitute an offer, solicitation, or recommendation of any company, products or services. Bitcoin.com doesn’t offer investment, tax or legal advice. This article does not contain any information, products, or advice that can be used to cause or allegedly cause any kind of damage.