Wall Street’s major indexes closed the day in red on Tuesday, alongside cryptocurrencies, and precious metals like gold and silver taking some percentage losses. Bitcoin, the most popular crypto asset dropped by 5.87% below the $19K mark while ethereum lost 8.7%. Gold’s nominal U.S. dollar value per troy ounce slipped by 0.50%, while silver dropped by 0.74% on September 6. One analyst is concerned that a recent spike in U.S. Treasury yields could cause a U.S. debt crisis.

Stocks Sink Lower, Crypto Economy Craters, Precious Metals Dip, Traders Await Fed’s Next Move

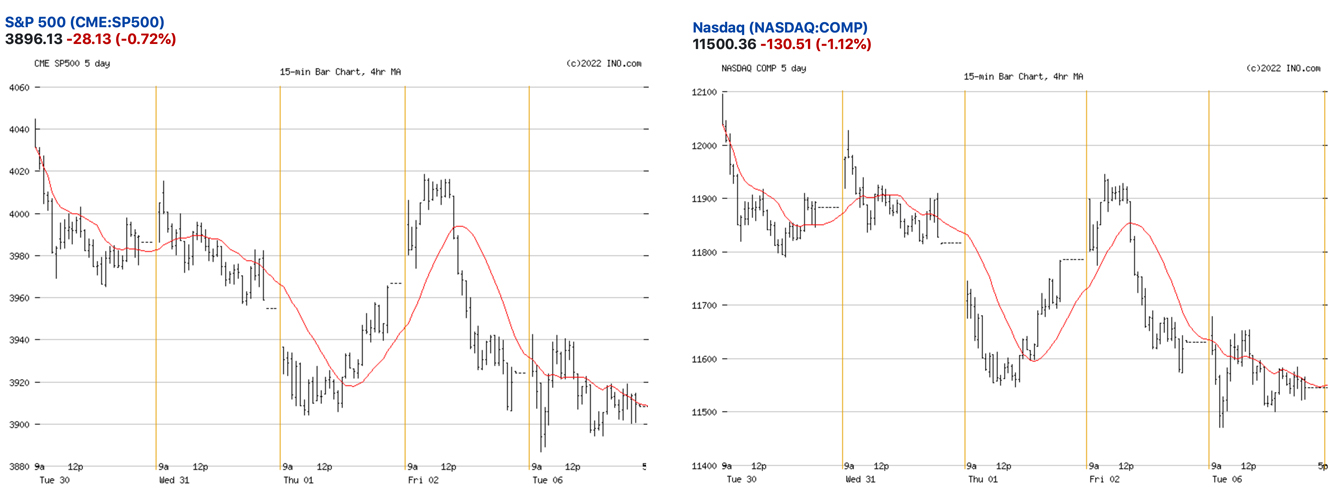

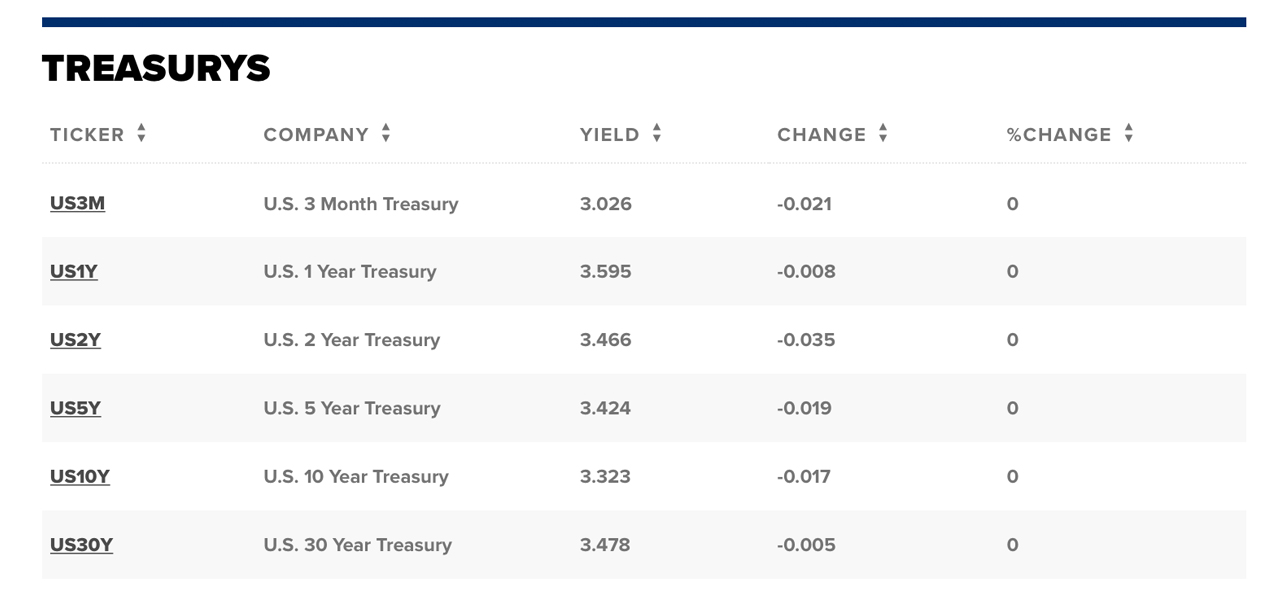

Wall Street traders and gold bug advocates lost significant amounts on Tuesday, making it a difficult day for them, as well as crypto supporters. As investors begin to consider the Federal Reserve rate increase, the benchmark U.S. Treasury Yields soared to the top tier within two months. Nasdaq, NYSE, S&P 500, and the Dow Jones ended Tuesday lower than expectations after the U.S. Labor Day holiday weekend.

On Tuesday, precious metals such as gold, palladium, and silver were also down. In contrast, Platinum and Rhodium rose between 0.71 and 3.97% against the U.S. dollars in the last 24 hour. Over the course of the day, global cryptocurrency market capitalization lost 4.2%. At the time of writing, on September 7, 2022, at 7:00 a.m. (ET), the crypto economy’s valuation stands at $940.10 billion.

Bitcoin (BTC), fell 5.87% on Tuesday. It dropped below the $19K range. Market traders and strategists are eagerly awaiting the U.S. Federal Reserve’s September 21 rate increase, which will be approximately 75 basis points. “You have all this fear that more rate increases are going to happen at the central bank level,” Tom di Galoma, managing director at Seaport Global Holdings in New York, said on Tuesday. “Inflation is not going to dissipate and then you’ve got the quantitative tightening that’s coming pretty rapidly.”

Portfolio Manager Says US Treasury Deviations and Other Market Anomalies Could Spark a ‘Sovereign Default Crisis’

Christine Lagarde and Luis de Guindos from the European Central Bank will likely increase their benchmark lending rates aggressively, in addition to the U.S. Central Bank. Michael Gayed is the Lead-Lag Report editor and portfolio manager. He believes the U.S. might be in a crisis of sovereign debt.

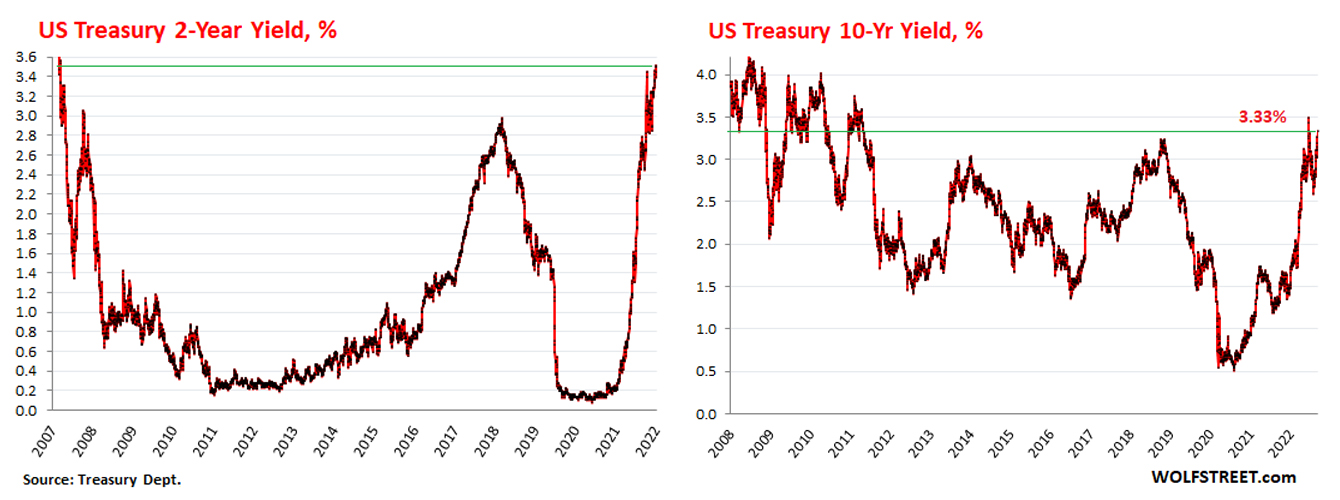

Gayed met with David Lin, Kitco News’ anchor and producer, to discuss the alarming trend of U.S. Treasury Yields increasing in an unpredicted manner. Gayed is concerned that U.S. Treasury yields could rise to a point where it makes it difficult for other countries in adhering to their debt obligations.

“When you have $170 trillion of unfunded liabilities and $30 trillion of visible liabilities … How could that not be inflationary? Lin was asked by Gayed during Lin’s interview. “The only way to resolve that is to pay down that debt.”

Additionally, Gayed noted that Wall Street had experienced some of its worst monthly falls since 2008. Skyrocketing Treasury yields, red-hot inflation, and the stock market rout could cause “multiple Black Swans,” Gayed stressed.

“The end result of all this is either some kind of sovereign default crisis, which is a deflation event, or the exact opposite, which is hyperinflation, which results in conditions under which something really bad comes,” the Lead-Lag Report publisher concluded.

Gayed noted that the predicted financial crisis could lead to an authoritarian-style government. “Something bad could happen, in terms of a new leader that you don’t want to see lead,” Gayed said.

How do you feel about the current market turmoil affecting precious metals and stocks? Please share your thoughts on this topic in the comment section.

Images CreditsShutterstock. Pixabay. Wiki commons. CNBC. Wolfstreet.com. Tradingview.

DisclaimerThis information is provided for educational purposes only. It does not constitute an offer, solicitation, or recommendation of companies, products or services. Bitcoin.com doesn’t offer investment, tax or legal advice. This article does not contain any information, products, or advice that can be used to cause or imply loss.