Sponsored

Finding the information required to file taxes for cryptocurrency can be difficult. Koinly is the leading crypto tax calculator, portfolio tracker, and trader’s guide.

Koinly’s Ultimate Bitcoin Tax Guide, 2022

Crypto tax regulations and laws can be confusing, leaving investors with many questions about what crypto taxation looks like – how much tax to pay on Bitcoin and the tax rate? Don’t worry. Koinly offers a comprehensive guide on crypto taxes that will answer any questions you may have about crypto taxes.

Bitcoin, just like any other cryptocurrency, is not recognized as a fiat currency – like USD, GBP and AED, by almost all countries worldwide. For taxation purposes, crypto is an asset & is taxed just like any other asset – much like property, stock, or shares. Bitcoin is subject to taxes.

As most taxation authorities worldwide crack down on cryptocurrency and tax Bitcoin, it doesn’t matter where they live. Different countries have different views about crypto and taxation. Koinly provides regularly updated information on many countries including Canada and the US.

Bitcoin can be considered an asset and must therefore be taxed whenever it is liquidated or disposed. What are the tax consequences of Bitcoin dispositions?

- Bitcoin selling for Fiat currency

- Bitcoin/crypto Swaps to another cryptocurrency including stablecoins

- Bitcoin-purchased goods and services

- The tax in Ireland, Australia, and the UK is levied regardless of whether Bitcoin is given.

Apart from Capital Gains Tax there are other instances in which Bitcoin could be taxed as income. This is because the transaction was also made in another way. These transactions could qualify as income and can be subject to tax:

- Bitcoin payment – like a salary.

- Mining Bitcoin – like income.

- Earn Bitcoin through loaning – like earning interest.

- Receive new coins starting at Bitcoin fork – a bonus.

The math is simple enough to determine the Bitcoin capital gains taxes someone will need to pay. You need to know the fair market value of Bitcoin on the day it is received, and on the day it is disposed in fiat currency terms – like USD or GBP. The difference in price will present either a profit or a loss, and it’s a profit that attracts capital gains tax. When an individual’s Bitcoin is taxed as income, it will be taxed at the same rate as their current Income Tax rate.

Noting that A Bitcoin owner who has already paid Income Tax is still subject to Capital Gains Tax It can be disposed off later. While it may seem overwhelming at first, the Koinly platform makes crypto tax easy.

Get a free Bitcoin tax calculator

To remain tax compliant, it is advisable that you use a cryptotax calculator such as Koinly. The IRS, HMRC and ATO are all cracking down on crypto daily. They are working with big crypto exchanges to gain customers’ information and send letters to investors who need to pay Bitcoin tax. KoinlyThis makes it quick and easy for you to calculate your tax and send reports to the IRS. Koinly can be used to calculate crypto-taxes.No costBitcoin tax calculator supports Bitcoin and major cryptocurrencies making it easy to calculate crypto taxes. Koinly also supports multiple coins and tokens, keeping pace with constantly changing and evolving crypto tax laws and legislation.

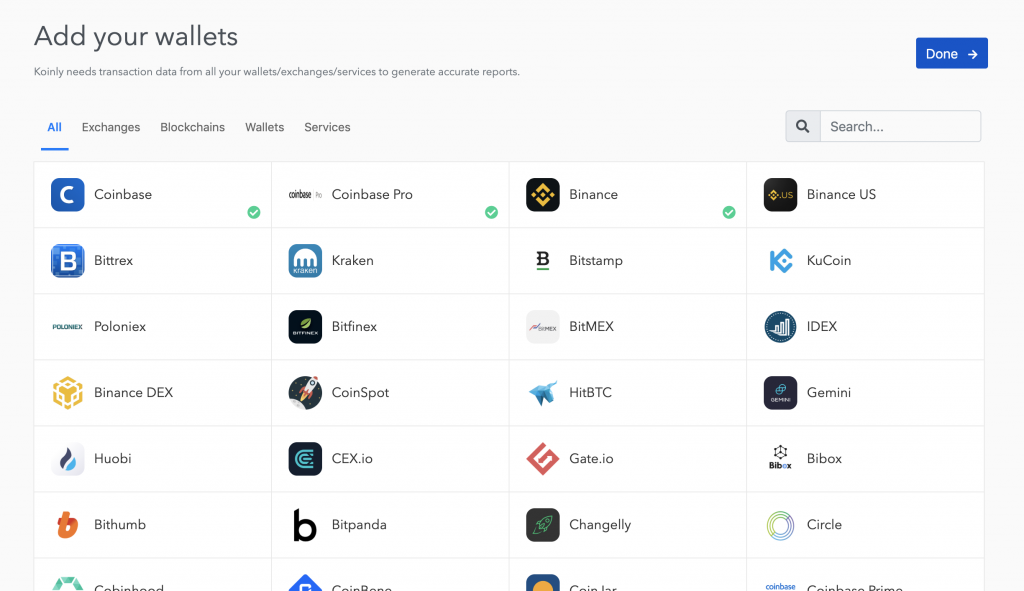

It is easy! sign upRegister for an account at Koinly Once a user has signed up for an account, they can use Koinly’s extensive functionality to sync all the crypto wallets, exchanges, or blockchains they use, with Koinly, via API or CSV file upload.Koinly can calculate your taxes instead of you manually entering tax rates, formulas and calculations. In minutes, it calculates Bitcoin income and loss as well as gains and losses.

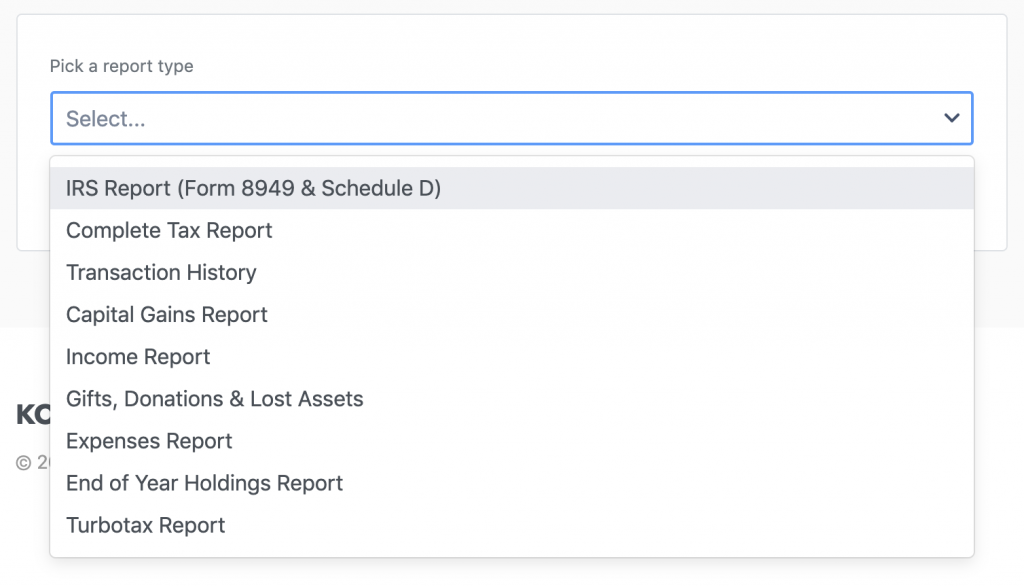

To see their Bitcoin tax history, the user can visit Koinly’s tax reports page. The user can scroll down to find the tax report that they are looking for. A specific tax report can be downloaded based on the country they reside in. – like the IRS Form 8949 and Schedule D for reporting Bitcoin gains for American investors or the HMRC Capital Gains Summary Form for reporting Bitcoin gains for UK investors. Koinly even creates tax reports that can be used with tax software like TurboTax or TaxAct.

Koinly is a great place to learn about cryptocurrency taxes for 2022.

This is an affiliate post. How to reach your audience? Read disclaimer below.

Image creditShutterstock. Pixabay. Wiki Commons

DisclaimerThis article serves informational purposes. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com doesn’t offer investment, tax or legal advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.