On-chain data shows Ethereum supply is barely changing anymore following the London hard fork. This indicates that ETH is becoming a precious asset.

The Ethereum Supply Rate of Change Has Dropped To Nearly Zero Following the London Fork

As pointed out by a CryptoQuant post, ETH’s supply curve has nearly flattened now as rate of change drops to almost zero. This makes the asset very scarce.

The Ethereum supply indicator tells us about the total amount of ETH that’s currently in circulation. The total supply of ETH increases as miners get a block bonus (in ETH), for mining blocks.

Another indicator is the Ethereum supply rate, which shows how quickly or slowly the total circulating supply goes up.

How ETH’s supply works is different from Bitcoin; the latter has its total potential supply locked from the beginning. This could mean that miners may run out BTC.

Ethereum does not have a limit on how many miners can keep it running, so they will continue to increase the supply. The crypto would find this problematic as higher volatility will be a result.

To address this problem, the London hardfork was created. Gas fees are required to make a transaction through the ETH network. These fees were originally granted to miners. They put the coins back into circulation. But since the London fork, the fees is “burned,” and miners no longer receive it.

Similar Reading: Discord Plans To Integrate Ethereum| Discord Planned To Integrate Ethereum. They Cancelled Everything After a Huge Backlash

What happens now is that the reduction in total supply by burning reduces its value. ETH is still being mined by miners, but the burning of it makes up the difference.

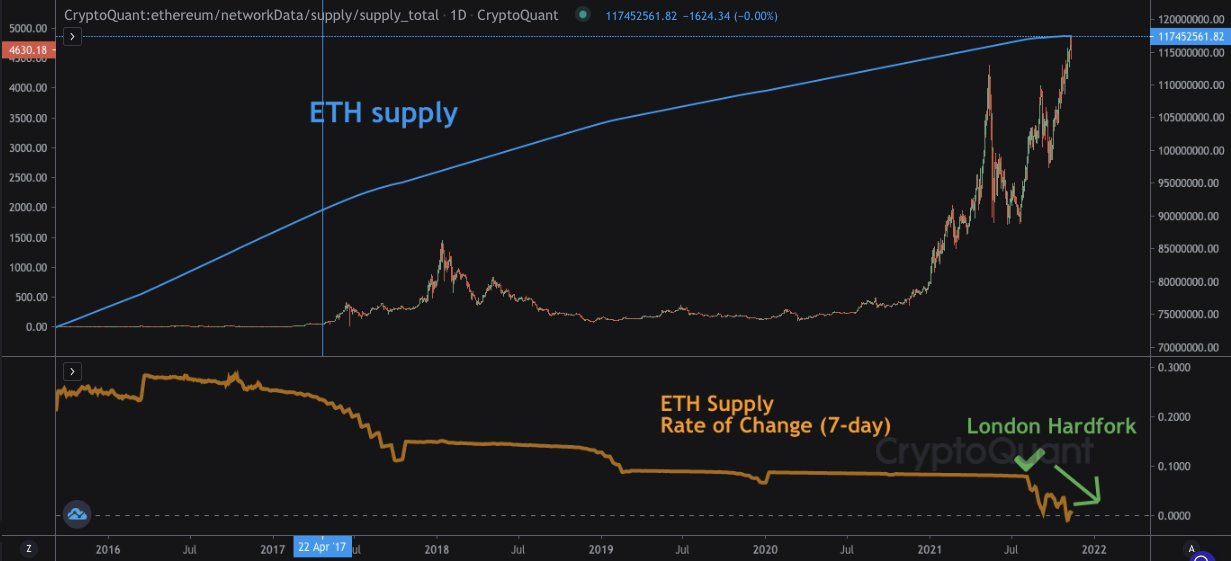

Here is a chart that shows what effect the London Fork has had on Ethereum’s supply:

Source: CryptoQuant. ETH supply curve appears flattening| Source: CryptoQuant

The above graph shows that the Ethereum supply rate has fallen to almost zero since the launch of EIP-1559.

The result has been a flattening in the total circulating stock. ETH, like Bitcoin, is becoming a rare asset. The demand-supply dynamics can cause a rise in the cost of crypto.

Read More: Ethereum Miner Revenue exceeds 2021| Ethereum Miner Revenue Outpaces Bitcoin In 2021

ETH price

At the time of writing, Ethereum’s price floats around $4.57k, up 2% in the last seven days. The crypto’s value has increased 30% over the last month.

Below is a chart showing the change in coin price over the past five days.

After setting an all-time record, Ethereum's prices have fallen in recent days. Source: TradingView.| Source: ETHUSD on TradingView

Unsplash.com's featured image. Charts by TradingView.com. CryptoQuant.com chart.