For all investors, to offer the most attractive option from traditional securities investment to cryptocurrency investment.

1. Berkshire Hathaway is a remarkable unbeatable retail investor

Berkshire’s investment practice is full of initiative. Berkshire’s investment practice is full of initiative. It uses its business sense and takes the initiative to find value targets.

● Anxiety of Retail Investors

Berkshire’s record or Buffett’s charm makes people want to exchange all their chips for more because everyone wants to earn more. We must admit, however, that this threshold is going to keep us from reaching our goals. Berkshire’s high return on investment belongs to institutional investors and has nothing to do with retail investors! How can individuals choose the best investment method?

2. Grayscale Fund, Refilling Old Bottle with Wine, Participating in Cryptocurrency Wall Street

Grayscale should be introduced before we learn anything about Digital Currency Group. This encryption giant is also known as Berkshire Hathaway in the encryption world. The company’s size has exceeded US $10 Billion. Including investment in Coinbase, the world’s largest exchange, Decentraland, the leader of metaverse concept, etc. The most well-known are Grayscale and CoinDesk.

The mere presence of Coca-Cola can shock even the most conservative investment firms. Buffett purchased 593 million US Dollars worth of Coca-Cola stock in 1988. The amount climbed to 1.024 trillion US dollars in 1989. The total amount invested was 1.299 trillion US dollars in 1994. This figure has not changed since. This is remarkable. Berkshire invests in the long-term growth trend.

● Only-In-No-Out, Rising Unilaterally

Grayscale trust fund can be considered an ETF from the point of view of its operation. In 2014, the SEC began investigating and dealt with it. Therefore, since then, Grayscale deliberately stopped the “redemption” function on the grounds that the SEC would not approve it and did not strive for it anymore, which led to the ETF becoming a multi-currency encrypted capital pool with multiple encrypted currencies led by bitcoin. Grayscale trust did not provide any channels to get back digital currency. Investors could only withdraw their funds in the OTC marketplace with Grayscale trust, and Grayscale’s currency hold would increase unassisted. Grayscale trust’s price has been high for years because of this.

● No Alternative for Retail Investors

Grayscale trust holds a total 13 currencies. They are subdivided into the top projects like BTC and ETH. While investors don’t have to worry about risk, there is still limited flexibility. Grayscale, as a cryptocurrency trust, has the same over-centralized management as that of Buffett’s Berkshire. Grayscale is closed to individuals investors. It is an investment hotbed, much like Berkshire. However, some investors are discouraged from investing there.

The Grayscale fund seems to be a poor choice for individual investment.

3. BlackHoleDAO Integration with Multiple Advantages

Superior Protocol Mechanism

BlackHoleDAO, an updated version of Olympus’ DAO is available. However, this description might be too restrictive. BlackHoleDAO created a new standard model based upon DeFi 3.0. It has a burn mechanism which solves the problem of high inflation and low deflation. This is based the concept of merging and splitting the stock markets. The new model also allows DAOs to launch a credit loan service. You can think of it as a protocol to manage enterprise assets. It includes splitting and merging functions, while also providing unsecure credit loans services. This is similar to a loan company of a bank.

● No Risk of Inflation

BlackHoleDAO uses the Olympus stack bond principles in a clever way. BlackHoleDAO developed the deflation system on the basis of the determination of the tokens total. This solved Olympus’ original problem with high inflation.

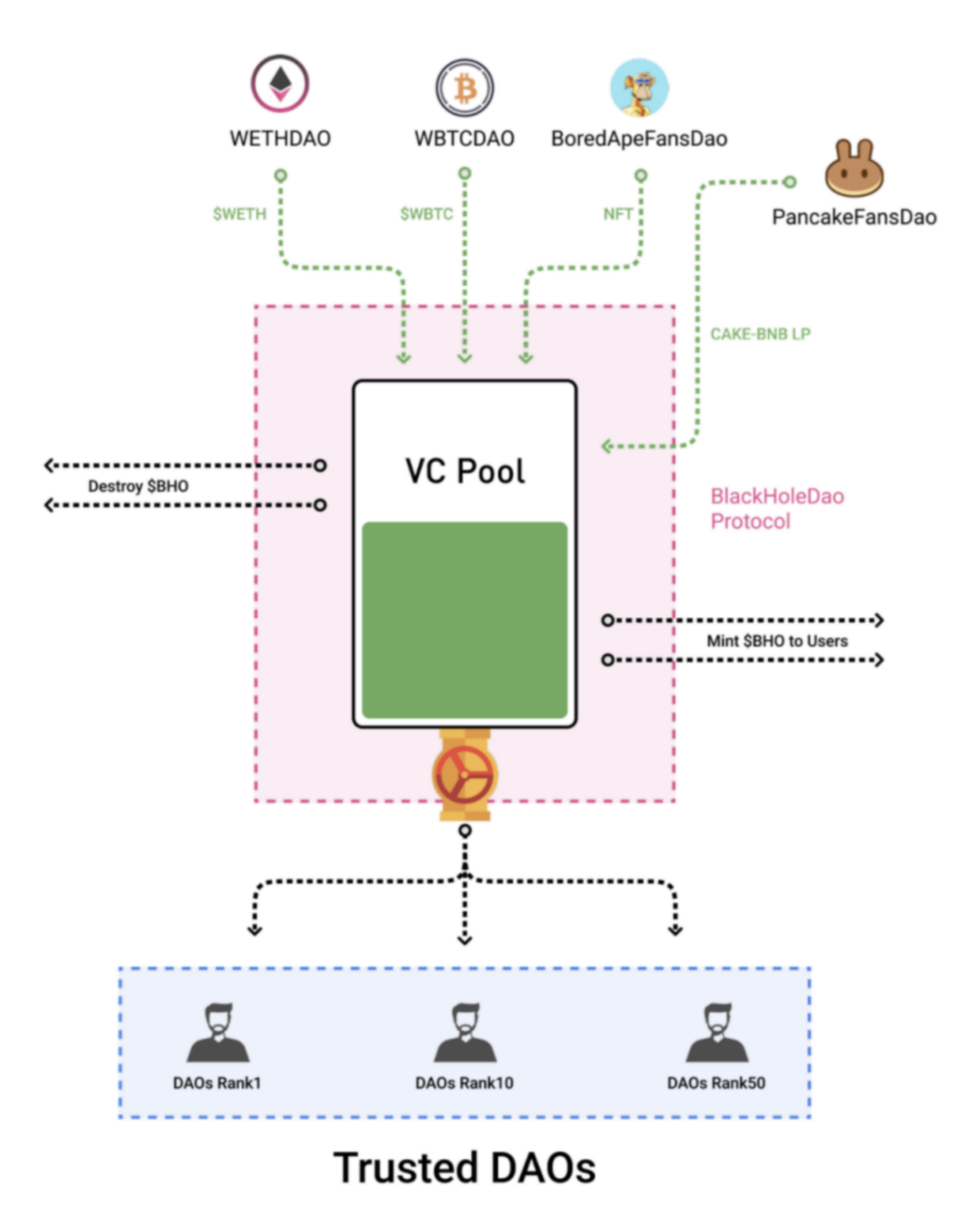

● Asset Management with DAOs

Treasury support the BlackHoleDAO Protocol. This protocol uses smart contracts to connect VC Pool & Donation Pool. VC Pool is able to support investment in multiple currencies. A portion of this money can be used for BHO token (BlackHole DAO) and credit loan. Donation Pool is the recipient of BUSD direct investments from investment institutions and DAOs teams. The Transaction Fee Pool provides operational support to Donation Pool and DAOs Community and Black Hole Reactor.

VC PoolThis is the BlackHoleDAO protocol’s best-known method to buy Bonds. The VC Pool does not accept valuable vouchers. Each DAOs group proposes tokens.

● Enhanced Supportive Stock (BHO)

Once the VC Pool reaches a set amount of assets, a proportion of the different tokens will be removed from liquidity LPs to group LPs, provide liquidity, and loan services for top products like Curve, Compound, and Aave. The VC Pool will receive all the earnings to increase the stock’s value (BHO).

DAOs need to carefully review tokens for inclusion in the VC Pool. By doing this, malicious behavior on tokens can be avoided, which will reduce the potential long tail effects that could affect assets, and thus prevent stocks shrinkage or inflation (BHO). It is similar to Grayscale Fund, but it is distributed more easily and is easier for individual investors. It is clear that the BlackHoleDAO Protocol’s shares will be supported by excellent precipitated assets, which should allow them to enjoy a lovely curve of steady growth. A solution which can be used by a wide range of investors has yet to emerge.

Summary

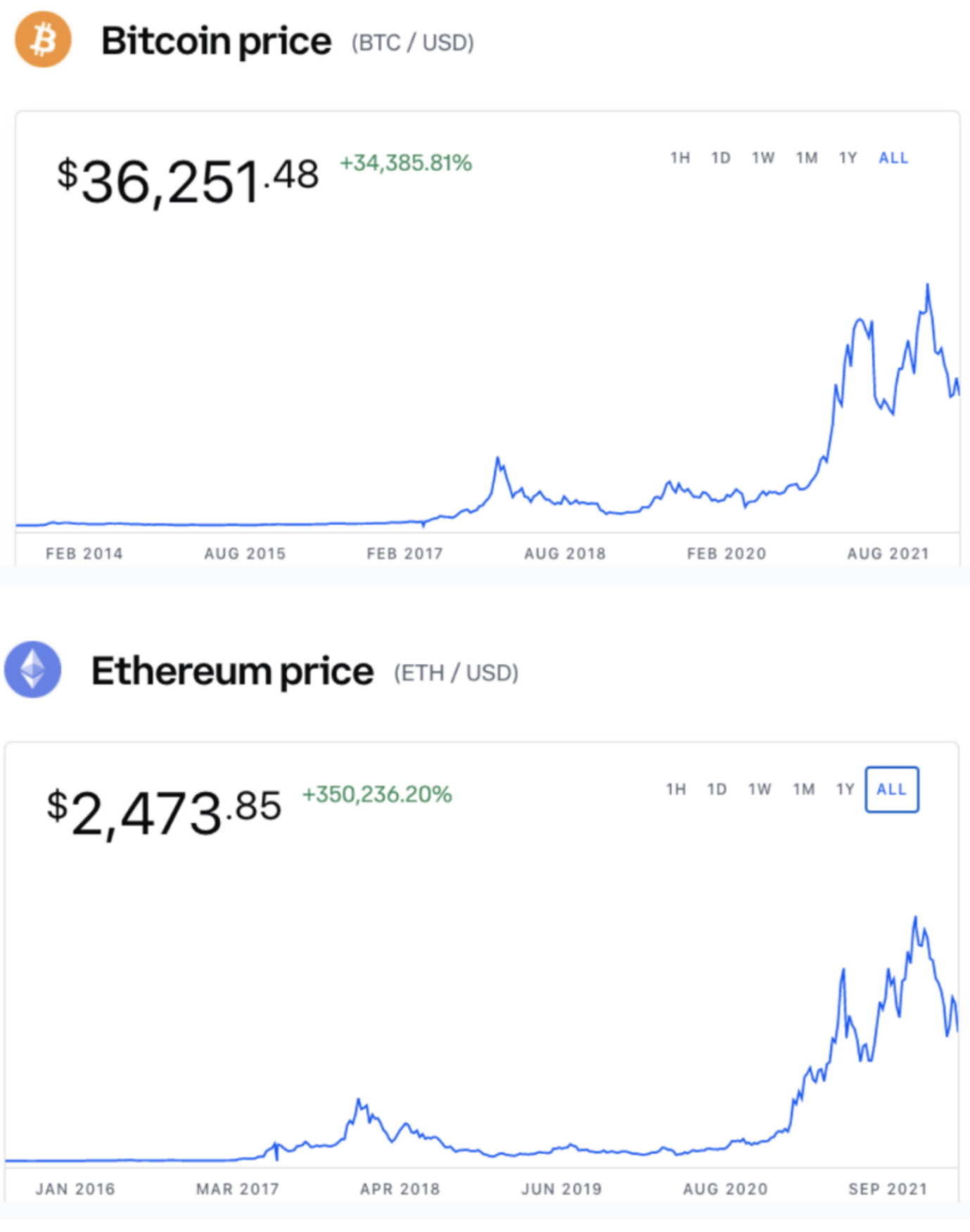

BlackHoleDAO operates more like an uncentralized Berkshire business. BHO is a digital asset exchange that allows users to invest and receive value. Digital assets are developing rapidly and at an upward rate. BHO manages passively digital assets from almost every category and converges them with digital assets.