After the Terra blockchain crash and the UST De-pegging Event, Terra’s ecosystem has become a wasteland filled with almost useless tokens and protocols. While both UST and LUNA were top ten crypto market cap contenders, Terra’s decentralized finance (defi) presence was second to Ethereum in terms of total value locked. Terra’s token holders, as well as defi protocol operator operators, seem to still be hoping for a miracle.

Terra’s Token Economy Has Lost 96% of Its Value

There’s been an abundance of news surrounding the Terra blockchain fiasco and how the team handled the terrausd (UST) implosion. A lot of people know that UST and Terra’s native token LUNA have lost considerable value over the last two weeks. UST’s 24-hour price range was $0.068-$0.054 per unit. This is a significant drop from the $1 parity that it had before the fallout.

LUNA, too, is falling a lot. On May 7, it traded for $72 per currency. Now it’s down 99.999849% to $0.00010853 per LUNA. Terra had a lot of other tokens, including MIR, ASTRO and MARS.

Anchor (ANC) the governance token for the defi protocol is down 96% over the past two weeks, and Astroport’s ASTRO token is down 98%. Mirror Protocol’s MIR lost 80.4% while Pylon Protocol’s MINE has shed 96.9% in the last 14 days.

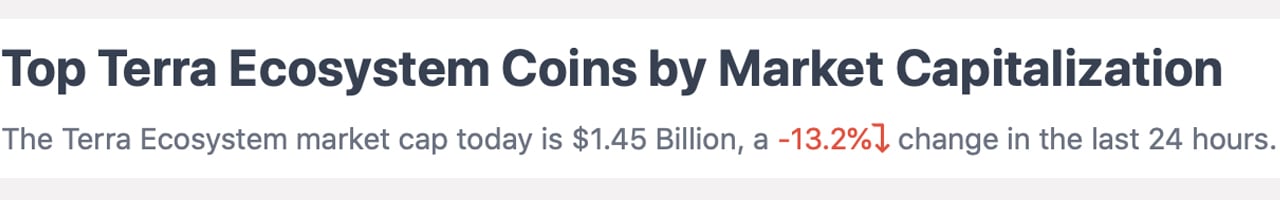

Similar to Mars Protocol (MARS), the Loop Finance token, LOOP has seen a 97.6% drop and is now down 98.3% in the last two weeks. Statisticians show that the Terra token ecosystem was valued at $44 billion on March 7, 2022. Today, it is down 96.70% and $1.45 billion.

From the 2nd Largest in Defi to the 33rd — Terra’s Defi Presence Has Been Eradicated

Terra’s presence in decentralized finance was once very large as it held the second-largest total value locked (TVL) out of all the blockchains in existence. On April 5, 2022, Terra’s TVL in defi was $31.21 billion and today, it’s down to $118.81 million.

The TVL for every Terra defi protocol has fallen between 90 and 99%. Applications are now inactive and block explorers such as finder.terra.money have very low activity for each Terra defi protocol.

This is true for both applications such as Terra Name Service (TNS), and non-fungible token (NFT) markets like Random Earth (Random Earth), Knowhere (Talis), Talis, Luart (Curio), and One Planet. Name domain registrations via TNS used to cost $16 for each name. However, now they are $0.91.

NFT Marketplaces on Terra are selling NFTs for a low price. However, the tokens can still be purchased at very affordable prices. NFT collectors may have taken down their listings in order to wait for Terra’s revival. The majority of Terra NFT marketplaces have little to no activity.

The Hope for Terra’s Rebirth

A revival is likely the hope for many Terra community members, as the project’s founder Do Kwon and many other Terra supporters have put forth a revival plan to resurrect Terra from the ashes. It is planned to split the chain in a snap before the UST De-pegging Event and to airdrop tokens to UST/LUNA holders.

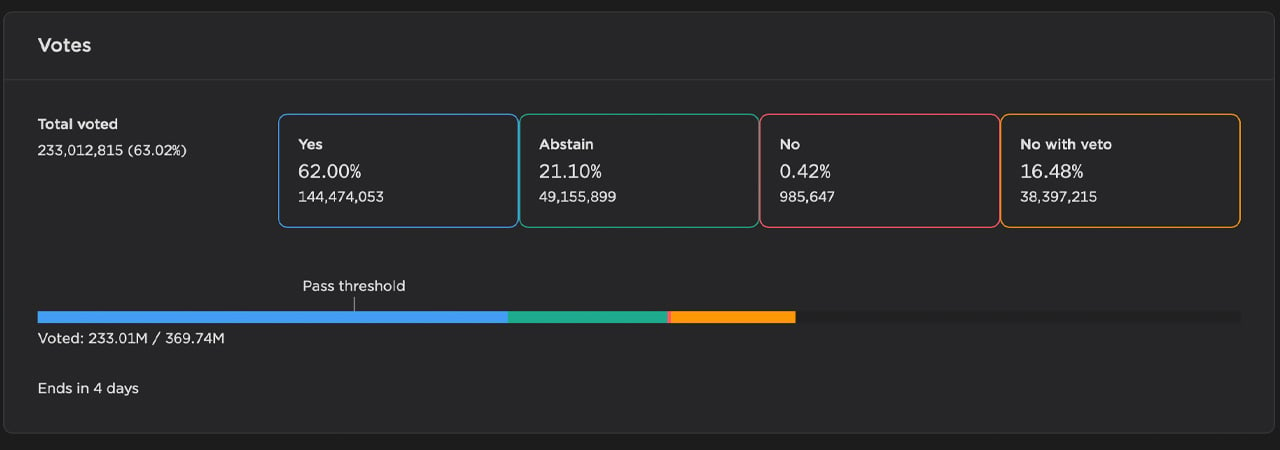

Presently, the rebirth proposal vote has four more days but the number of “yes” votes has passed the threshold at 62%. 21.10% have abstained from voting, 0.42% have voted “no,” and 16.48% voted “no with veto.”

What do you think about what’s left of the Terra blockchain ecosystem? Please comment below to let us know your thoughts on this topic.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThis article serves informational purposes. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.