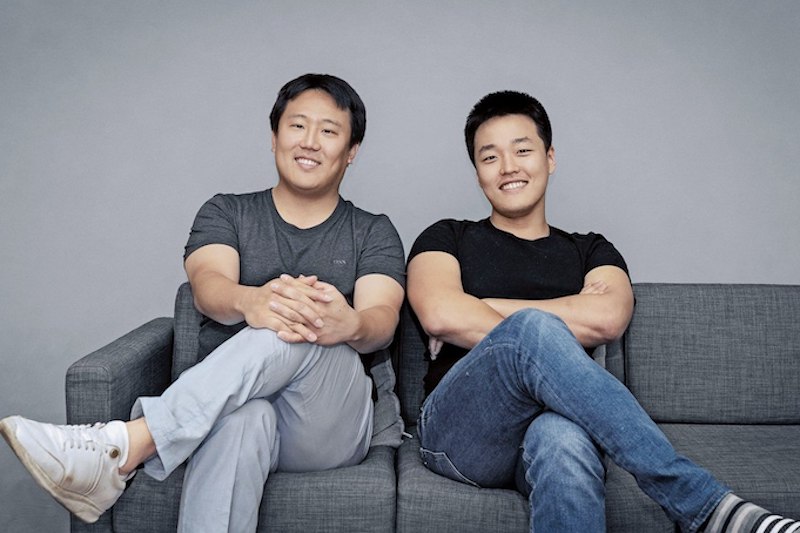

After the LUNA and UST meltdown, many crypto investors have been curious about the project’s rise in popularity and people wonder about the background of Terra’s co-founder Do Kwon. It is also not known that Terraform Labs was founded by Daniel Shin who co-founded CHAI, a payment company. After Shin left the company, the startup saw significant growth and Kwon became the main face of Terra’s ‘Lunatic’ movement.

Do Kwon — A Stanford Graduate That Became the Face of the Terra Money Project Following His Partner’s Departure

In crypto history, the Terra blockchain fiasco is one of the most bizarre events in the past 13 years. It began in the second week May when once stable cryptocurrency Terrausd lost its $1 perity. It caused an unprecedented bank run, whereby billions of dollars of cryptocurrency were withdrawn from Curve Finance and Lido as well as the decentralized finance (defi), lending app Anchor Protocol.

Terra blockchain’s native token (LUNA) fell significantly in value as well, as the network’s LUNA/UST swapping mechanism drove the coin toward a death spiral. Terra’s entire ecosystem was wiped off the top crypto projects list, and now it is placed at the bottom of the barrel, among a litany of failed digital currencies.

Terra had been a hot blockchain project for a while, with LUNA reaching an all-time high of $119.18 per Unit on April 5, 2022. Today’s situation is quite different. One LUNA unit is currently being traded for $0.00018000. While many disliked Terra’s co-founder Do KwonMany people loved his positive attitude.

Do Kwon, a 31-year old South Korean national is a Stanford University grad and, according to nymag.com he worked for Apple or Microsoft. Kwon received a computer science degree from Stanford University. While not much is known about Kwon’s prior history, he’s been a member of the crypto community for quite some time.

According to a report published by Coindesk authors Sam Kessler and Danny Nelson, Kwon was allegedly involved with another failed stablecoin project called “Basic Cash.” Former Terraform Labs employees claim Kwon operated the Basic Cash project under the pseudonym “Rick Sanchez.” Kwon is known for founding Terraform Labs with Daniel Shin, the founder of a payment firm called CHAI.

Terra’s White Paper, Terra Alliance, and Capital Injections From Well-Known Backers

The Terra project’s white paper was authored by Evan Kereiakes, Marco Di Maggio, Nicholas Platias, and Do Kwon. The white paper details that the main foundations of “Terra Money” include “stability and adoption.” The Terra project was created in January 2018 and LUNA’s first recorded market value was $3.27 per unit on May 7, 2019. LUNA traded at $0.20- $0.50 per unit in January 2020.

Then, in February 2021, LUNA started to gain significant market traction and eventually climbed 23,700% to the crypto asset’s all-time price high. Additionally, from October 2020 all the way until May 9, 2022, Terra’s stablecoin terrausd (UST) held its $1 parity with the U.S. dollar. Terra Alliance was the source of the original project before these tokens, and many other cryptocurrency assets that were built on top. It is an 16-member network made up of Asian ecommerce and financial advisory companies.

Terra Alliance reached 45 million people in 10 countries through its platforms Musinsa and Yanolja as well as TMON, Megabox, TMON, TMON, TMON, TMON and TMON. TMON, a multi-billion dollar startup founded by Daniel Shin in August 2018, was announced to the media that Shin’s new stablecoin project had raised $32 Million.

Arrington XRP was invested by Kenetic Capital and Binance Labs as well as FBG Capital, FBG Capital (FBG Capital), 1kx, Hashed and Polychain Capital. “We are pleased to support Terra, which sets itself apart from most other blockchain projects with its established and immediate go-to-market strategy,” Polychain Capital’s Karthik Raju said at the time.

The project’s official mainnet launch was in April 2019 and ecosystem tools were made available like the block explorer Terra Finder and the wallet Terra Station. In May 2019, Terraform Labs had a corporate funding round led by Arrington XRP Capital, and in August 2019, Hashkey Capital backed the team.

Terraform Labs was able to raise $25 million from Coinbase Ventures (Galaxy Digital), Pantera Capital and Galaxy Digital in January 2021. Arrington XRP Capital Blocktower Capital, Galaxy Digital and other investors poured 150 million dollars into the Terra ecosystem fund. Terraform Labs made investments in Hummingbot Labs, Stader Labs Espresso Systems and Leapwallet.

Anchor: The So-Called ‘Gold Standard for Passive Income’

Terra began to see more interest in the project, and it was June that the network received its first protocol upgrade. A year later in July, Shin’s firm CHAI launched the CHAI card and by January 2020, Shin left Terraform Labs after two years of working with the project.

Shin is still the leader of CHAI and he also runs TMON. While Shin was the face of Terra’s initial leap getting backing from Binance in August 2018, it was Kwon who accepted the $25 million in January 2021, and the $150 million in July 2021. Moreover, in the summer of 2020, a concept built on Terra called the “Gold Standard for passive income on the blockchain” was born.

In June 2020, Anchor Protocol’s white paper was published and it was written by Nicholas Platias, Eui Joon Lee, and Marco Di Maggio. “Anchor offers a principal-protected stablecoin savings product that pays depositors a stable interest rate,” the white paper explains. Nicholas Platias introduced Anchor on July 6, 2020, explaining that the team wanted to get rid of the “highly cyclical nature of stablecoin interest rates” in defi.

Anchor Protocol provided depositors with a 20 percent compound interest rate for quite some time. Then, at the beginning of March 2022, the project switched to a dynamic earn rate. Anchor began to face more criticism and sustainability issues at that time. Anchor was recently called a Ponzi scheme by a variety of people over the course of the last months. social mediaPosts on forums written by crypto-proponents.

Do Kwon: ‘I Don’t Debate the Poor on Twitter’ and ‘95% of Coins Are Going to Die’

Terra’s stablecoin UST was also criticized by the Galois Capital executive Kevin ZhouThe de-pegging incident was predicted by Do Kwon long before its actuality. Do Kwon was admired by a large army of ‘Lunatics’ and despite Zhou’s early criticisms, Kwon proudly told people to continue staying “poor.” “U still poor?” Kwon asked on social media, “I don’t debate the poor on Twitter,” the Terra founder explained.

Notice how the cockroaches are silent tonight as the 🌕 shines bright

The moon did not give quarter, as promised

— Do Kwon 🌕 (@stablekwon) December 22, 2021

Kwon can also be used once remarked that “95% [of coins] are going to die, but there’s also entertainment in watching companies die too.” The Terra co-founder additionally had problems with the U.S. Securities and Exchange Commission (SEC) as the regulator took issue with Terra’s Mirror Protocol.

Kwon then said he decided to sue the SEC for not using the proper channels to deliver his subpoena and that the regulator lacked jurisdiction over Terra’s properties. “The SEC attorneys were well aware that TFL and Mr. Kwon had consistently maintained that the SEC lacked jurisdiction over TFL and Mr. Kwon, and at no time asked Dentons lawyers whether it was authorized to accept service of subpoenas,” Kwon’s lawsuit stated. Similar to Terra’s suite of stablecoins, Mirror Protocol allowed people to mirror stocks like Amazon or Apple via Terra’s blockchain network.

We would prefer you to tell us what your net worth and place a bet of 90%

Maybe this is the way it is.

— Do Kwon 🌕 (@stablekwon) March 13, 2022

Terra’s Story Continues With No End in Sight

Terra Project is now looking to recover from near death by forking its network without stablecoin. However, a lot of controversy surrounds the Terra project today and Terra’s co-founder Do Kwon has been blamed for a number of miscalculated errors. Questions have surrounded the bitcoin (BTC) reserves the Luna Foundation Guard (LFG) held in order to defend UST’s $1 parity.

LFG in Singapore later revealed the actions of the nonprofit organization with its 80K+ Bitcoin (BTC). Then three members of the Terraform Labs (TFL) in-house legal team abruptly resigned after the project’s fallout and reports further noted that Do Kwon dissolved TFL before UST and LUNA collapsed.

Woah. Do Kwon, describing Terra’s Protocol Armageddon in 2021. “A kill switch” where TFL “pulls the trigger” and disappears from the project after cutting all of their ties – “in 24 hours we’re gone.” Could this be connected to Terra 2? pic.twitter.com/jFDx0zLcIy

— FatMan (@FatManTerra) May 20, 2022

Terra rose to popularity rather quickly, but the project’s demise was even quicker. The Terra project has not been put out of its misery, and the platform’s native tokens still have a small amount of value. Terra advocates are optimistic today, while Do Kwon’s detractors remain skeptical that Terra or Do Kwon will be able to revive the fail-safe blockchain ecosystem.

The market is already deciding that LUNA, UST and other tokens are no longer as valued. Whether or not a Terra fork and airdropping new tokens will help the project come back remains to be seen and it’s safe to say, Terra’s story has not ended.

Do you have any thoughts about Terra LUNA’s success and the help of Do Kwon’s family? Please comment below to let us know your thoughts on this topic.

Credits for the imageShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com doesn’t offer investment, tax or legal advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.