The Bitcoin price drop to $37,000 on February 7 spurred some buying interest and led to a rebound to $39,000 on March 8. Surprisingly the trendline with an upward slope that was used as an accumulation zone by traders in 2022 was also the source of the uptrending retracement.

Prices fall signals a retracement

Bitcoin’s price reached another record-breaking high in the fourth hour, which shows that bears still have control over Bitcoin and that they are most likely to lose more.

The world is expecting today to bring some relief from the stress cooker in Ukraine. Global markets remain nervous and on edge. This positive news will be turned into another round bullish uplift of the cryptocurrency. Expect more decompression heading into the U.S. session.

Over the last few days, bitcoin’s price has suffered a significant retreat from its latest major swing high of $45,600. BTC/USD dropped by 15% at the beginning, and then the pair fell further over the weekend.

BTC/USD 4-hour chart. TradingView

The 14-day RSI, although slightly undersold at 45.6 seems to be heading for the 47 level. It has served previously as resistance.

BTC/USD could trade at the $40,000 level if price strength is reached. A breakout would likely rekindle bullish optimism.

Although bears continued to probe the negative yesterday, bearish momentum is slowing.

Risk Aversion Pulls Crypto Market Down, Bitcoin Still Below $40K| Risk Aversion Pulls Crypto Market Down, Bitcoin Still Below $40K

Bitcoin may have upside

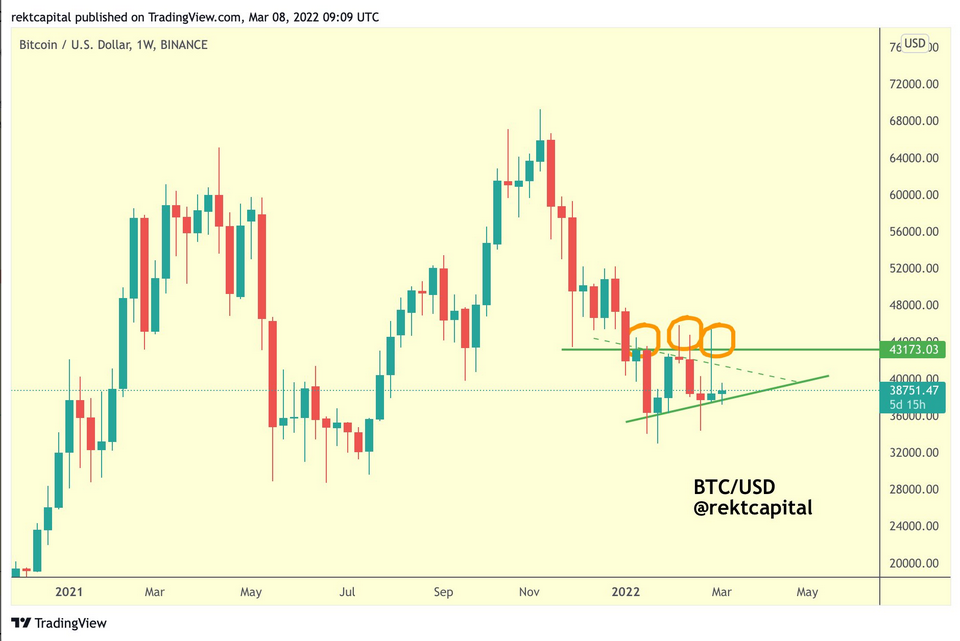

Rekt Capital’s latest view noted that Bitcoin had successfully retested the trendline. He speculated that this move could push Bitcoin to $43,100, above its current level if it surpasses the diagonal green resistance in the chart.

BTC/USD Weekly Price Chart Source: Rekt Capital, TradingView

Throughout Q1/2022, Bitcoin remained trapped in a trading range — between $34,000 and $45,000 — indicating an interim positive outlook. BTC was capable of enduring significant selloff pressure because of persistent macroeconomic concerns and geopolitical issues, like expectations of rate rises and the conflict between Russia.

Last weekend, Filbfilb, the creator of trading platform DecenTrader, said that “Bitcoin is rangebound on a macro level,” but that its long-term structure suggests it would break to the upside.

“In the immediate term, if the 50 DMA and 3-day level can prove to be supported, a retest of the $43K and high timeframe level could occur,” said Flibflib, adding that a further break above Bitcoin’s yearly pivot level of $48,000 would be “very significant and implicit of a fundamental change.”

Similar Reading: Crypto Markets Recover Following Weekend Decline| Crypto Markets Slightly Recover After Weekend Decline

Featured Image from iStock Photo. Chart by TradingView.com