According to on-chain data, the Bitcoin supply seems to have stabilized over the last several months. This marks the end of a two-year downtrend.

Bitcoin Exchange Reserve begins to move sideways, as inflow and outflows attain equilibrium

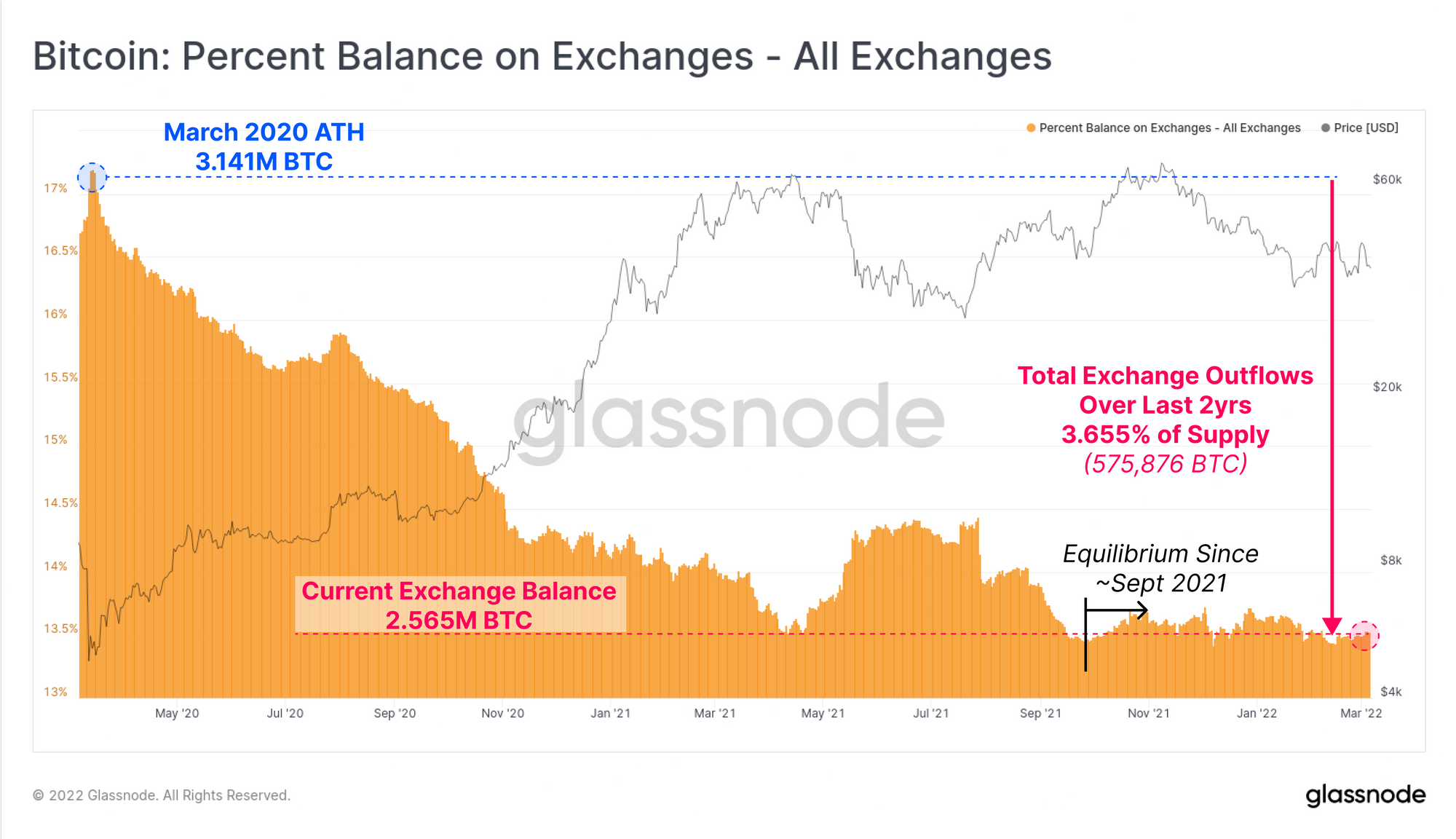

The latest Weekly Report from Glassnode shows that the proportion of BTC available on exchanges has stabilized, and appears to be in decline.

The “exchange reserve” is an indicator that measures the total amount of Bitcoin stored in wallets of all exchanges.

If this metric’s value rises it indicates that there are net inflows on the exchanges at present. This trend could be negative for the cryptocurrency’s price as it indicates an increase in its sell supply.

On the other hand, when the reserve’s value decreases, it implies outflows are overwhelming the inflows at the moment. As it could be an indicator of accumulation by holders, this trend might be positive for Bitcoin’s value.

Risk Aversion Pulls Crypto Market Down, Bitcoin Still Below $40K| Risk Aversion Pulls Crypto Market Down, Bitcoin Still Below $40K

This chart shows the changes in the amount of exchange reserve accountable for over the years.

It seems like the indicator's value has moved in a sideways direction recently. Source: Glassnode’s The Week onchain Week 10, 2022| Source: Glassnode's The Week Onchain - Week 10, 2022

You can see that this graph shows the Bitcoin supply percentage on exchanges dropped steadily from March 2020 to May 2021. There was an increase of 1% due to the October selloff.

The indicator resumed the downtrend shortly thereafter, however, after September 2021, the metric has generally consolidated sideways.

Goodbye, Russia – A Number Of Goldman Sachs Employees Are Leaving Russia To UAE| Goodbye, Russia – A Number Of Goldman Sachs Employees Are Leaving Russia To UAE

It means that, at the current exchange reserve’s value, there is an equilibrium between outflows and inflows.

This sideways trend is fascinating because, while Bitcoin’s price has fallen recently and macro uncertainty like the Russian-Ukraine War are overshadowing the market, the indicator has not seen a significant rise in its value.

A large selloff usually occurs in periods like these. However, the metric is still going sideways. This means that there was enough demand (or outflows) for any potential inflows. This could indicate that Bitcoin is on the rise.

BTC price

At the time of writing, Bitcoin’s price floats around $38.7k, down 13% in the past week.

Source: BTCUSD on TradingView| Source: BTCUSD on TradingView

Unsplash.com's featured image. Charts by TradingView.com. Glassnode.com's charts.