Wall Street is still worried about a possible recession, along with a 1970-style stagflation economy. Numerous reports indicate that the recession signs have intensified. With oil and commodity prices surging, Reuters reports that investors are “recalibrating their portfolios for an expected period of high inflation and weaker growth.”

While Wall Street Fears Stagflation, Analyst Believes ‘Global Markets Will Collapse’ This Year

This week there’s been a slew of headlines indicating that fears of a 1970s-style stagflation economy have risen and economic fallout is coming soon. Three days ago, Reuters’ author David Randall noted that U.S. investors are scared of a hawkish central bank, oil prices surging, and the current conflict in Ukraine. Randall spoke with Nuveen’s chief investment officer of global fixed income, Anders Persson, and the analyst noted stagflation isn’t here just yet, but it is getting near that point.

“Our base case is still not 1970s stagflation, but we’re getting closer to that ZIP code,” Persson said.

Bitcoin.com News published a Saturday report on skyrocketing energy stocks and precious metals as well as global commodities setting new market records. The same day, the popular Twitter account Pentoshi tweeted about a pending “greater depression.” At the time of writing, the tweetThis post was retweeted nearly 69 times. Pentoshi shared this with his 523.500 Twitter followers.

It’s the most important thing of this year. Are global markets about to collapse? A market trading above 0 would be considered too high. They will call this: ‘The greater depression’ which will be 10x worse than the Great Depression.

US Treasury Yield Curve Highlights ‘Recession Concerns Showing up More Prominently’

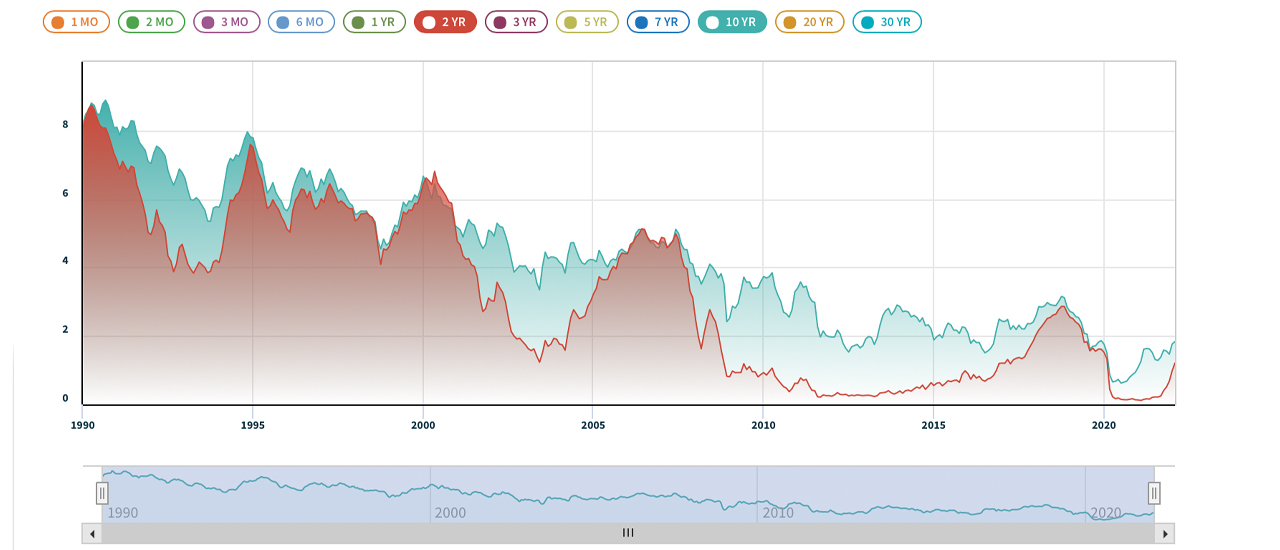

The following day, Reuters’ author Davide Barbuscia detailed that “recession concerns are showing up more prominently in the U.S. Treasury yield curve.” Data from Barbuscia’s report stresses that the “closely watched gap between yields on two- and 10-year notes stood at its narrowest since March 2020.”

Many financial publications highlight how commodity and oil prices rise are often associated with recessions. Furthermore, recent filings indicate that Warren Buffett’s Berkshire Hathaway obtained a $5 billion stake in Occidental Petroleum. Berkshire Hathaway has also doubled the firm’s exposure to Chevron as well.

Are you concerned about reports that the economy is in recession? Or are there signs of stagflation like the 1970s? Comment below and let us know how you feel about the subject.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. It does not constitute an offer, solicitation, or recommendation of any company, products or services. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused or alleged caused by the content or use of any goods, services, or information mentioned in the article.