The first cryptocurrency has seen a spike in just over 10 years. This was followed by the creation of the virtual reality metaverse experience and widespread adoption of DeFi. DeFi disrupts financial intermediaries and revolutionizes global economics. DeFi is a protocol that uses blockchain to power a distributed network.

Experts think that DeFi’s massive adoption will increase exponentially due to DeFi financial product like DeFi stablecoin trade, DeFi lending or Yield farming, DEX, Decentralized exchanges, and DeFi insurance.

CELO is one project that uses DeFi to support the creation DApps as well as smart contracts. This project aims at creating a global financial system open and free from borders. The platform aims to make financial tools accessible for anyone worldwide with a mobile phone so that the world’s 6 billion smartphone users may safely buy and sell items send and borrow money to anybody in the world.

CELO, which is decentralized digital asset/cryptocurrency, serves as the core utility, reserve and staking asset, and governance asset of the Celo platform. Celo Dollars and Celo Euros are stablecoins based on dollars and euros that can be used to fund the Celo platform.

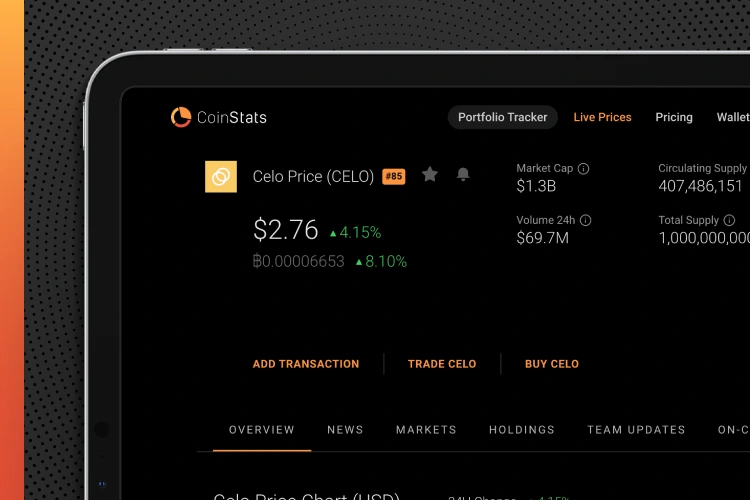

You can check the CELO market price, current supply, trading volume and historical statistics. CoinStats has all of these features, and more, making it one the top crypto platforms.

Continue reading to find out everything about Celo, the Celo community and how you can make Celo purchases in just a few steps.

Let’s jump right in!

What exactly is CELO?

Around 1,7 billion people across the globe don’t have access to financial services, making it harder to reach prosperity. Celo is a project that aims to solve financial exclusion.

Celo, which is a Blockchain ecosystem, makes financial tools available to all. It allows people to transfer funds from their mobile phones to other Celo users. It’s a payments infrastructure platform that uses phone numbers as public keys to let phone owners create DApps and smart contracts as part of decentralized finance (DeFi) products.

Celo features Celo Dollars (cUSD) and cEUR, stablecoins pegged to the value of dollars and euros native to the Celo platform. The Celo token (CELO) is the protocol’s native asset, serving as a utility token that enables users to participate in network consensus through its Proof-of-Stake system and pay for on-chain transactions. CELO can also be used to support governance, which allows token owners the ability to vote in governance matters.

How does CELO work?

The support of three people is what makes the CELO Network possible:

- “Light clients” – CELO Network apps operating on mobile devices, like Celo’s mobile wallet.

- Validator Nodes – Computers that participate in Celo’s consensus mechanism, validate transactions, and create new blocks.

- Full Nodes — Computers operating as the bridge between Validator nodes and mobile wallets, receiving requests from “light clients” and transmitting transactions to “Validator nodes.”

The Byzantine Fault Tolerance

Celo has a Proof of Stake governance system known as the Byzantine Fault Tolerance, or BFT. It is an essential component.

In order to vote for modifications and power the blockchain, validation nodes must hold a minimum 10,000 CELO tokens. This allows everyone to participate in the administration of the network. For verifying transactions, each validator node is entitled to a portion of the block rewards. They are limited to 100 at any one time, as determined by votes of full nodes. Full nodes receive the fees from light clients.

CUSD

Securing cryptocurrency transactions with the accountability and effectiveness of stablecoins, such as the cUSD, is at the heart of CELO’s business model.

CELO uses a so-called “programmatic reserve,” an overcollateralized reserve of CELO and other cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH), to ensure that the value of each cUSD is always equal to one US dollar. CELO and cUSD can both be traded for CELO.

CELO owners will have the ability to vote and propose the establishment of stablecoins with the same value as other fiat currencies like the Pound or Chinese Yuan.

CELO Gold, the native CELO coin, is available on several cryptocurrency exchanges. CELO Gold has an ERC-20 interface so that users can interact with CELO via the token standard, but it’s important to note that not all CELO transfers are required to go through the token contract. This stable coin is kept at $1 by balancing the price of CELO and cUSD. With an increase in Celo users, transactions, and the balance of CELO prices, the CELO price will rise. CELO tokens can be used to validate tokens and governance tokens in the future.

CELO’s Story in a Nutshell

Celo was founded by Marek Olszewski, Sep Kamvar and Rene Reinsberg. Celo was launched in 2017 by Marek Olszewski, Sep Kamvar and Rene Reinsberg. Celo also has the backing of a talented team of people who have experience with Visa, MIT Google and GoDaddy as well as Harvard University, Bank of America and Twitter.

Venture capitalists, such as Social Capital and General Catalyst are among the top investors on the Celo platform.

Celo, an open platform for financial tools that anyone can access via a smartphone or tablet is able to use. It’s decentralized and programmable. Celo allows users to send cryptocurrency to their phone numbers without having to manually copy long addresses. To make this happen, Celo designers have created a distributed address-based encryption protocol that allows sending and receiving value directly with a phone number. A wallet address accepts CELO and cUSD, then your phone number is tied to the blockchain network server. The phone number code will be recorded, which ensures that all amounts sent to your mobile phone are forwarded only to you, not third parties. CELO utilizes various cryptographic algorithm to verify your number and finalize account creation. CELO allows you to link multiple devices to one address. A small fee is required for verification. “CELO is like WhatsApp for money,” said Polychain Capital’s CEO.

Celo is a user-friendly network, and users don’t have to know anything about blockchain. They can store all information in their phone book. Their contacts are the addresses that users can send funds to or receive them from. To avoid confusion, all notifications sent by Celo will be received via familiar SMS messages.

Many major crypto exchanges have supported the CELO token since the mainnet was launched on Earth Day 2020. CELO, which has a market capital of more than $2B and an average trade volume of about $100M, is currently ranked as one of the most important cryptocurrencies.

How to Buy CELO

If you’ve decided to invest in digital assets, it’s essential to understand all of the risks involved. These are some of the factors to consider before you make a CELO purchase

- Celo has a programmatic reserve that ensures CELO USD remains equal to 1 US Dollar. This stable coin is kept at $1 by balancing the price cUSD with CELO. With an increase in Celo transactions and users, the CELO price is likely to rise.

- CELO can be bought in fixed quantities and has variable values that are proportional to stablecoins total. There will soon be 1 billion CELO tokens available to purchase, and 250 million are already in circulation.

- CELO constantly adjusts stablecoin supply to ensure that they remain at the desired price.

- Celo network’s security is provided by the PoS (proof-of-stake) governance mechanism that syncs the distributed computers. Blockchain validators are selected through a complicated election process as part of the network’s security.

There are many ways to purchase CELO

OKEX, Binance and Coinbase are the most active CELO trading platforms. You must create an account to start trading. You can follow the steps below to get started.

Step 1. Choose an Exchange

CELO can be found on many cryptocurrency exchanges. You’ll have to compare them to choose the one that supports CELO and has the features you want, such as low transaction fees, an easy-to-use platform, and 24-hour customer support. When you invest through some crypto brokers, you’ll pay nothing in commissions, which is a major benefit compared to others. You should also consider whether the cryptocurrency exchange permits you to buy CELO using your preferred payment method such as a debit or credit card, another cryptocurrency, or a bank wire transfer.

Step #2: Register an account online

After you’ve decided on a reliable exchange, the next step is to open a trading account to buy or sell CELO. Different platforms have different requirements. Personal information such as your name, contact number, email address, home address, social security number, and a copy of your driver’s license, passport, or government-issued ID will be required in most transactions. This information is required to authenticate your trades.

Step #3: Fund Your Account

Once your account has been verified, funds must be deposited to purchase CELO coins or other cryptocurrency. To buy REN, you can either use your credit card or debit card or a bank account. The location of the platform and your preferences will dictate which payment method you use for buying REN coins.

Step #4: Finish your Purchase

First, you must place a Buy CELO Order with your broker. Wait for their response. As with stock trading, there are many orders you can place. Below are the two most common orders:

Orders on the market: Market orders tell your broker you would like to immediately purchase CELO at current market rates. Market orders don’t provide you with much control over the price you spend per coin, and you may wind up paying a rate that differs from the one displayed on the exchange.

Limit orders:Limit orders are when you order CELO below or at a specified price. Your broker will ask you the number of coins you wish to acquire and the maximum price you’re ready to pay for each once you’ve placed an order. Your broker must fulfill your order at the requested price. If the order price exceeds your limit, the broker can cancel the order.

Step #5: Create a wallet (Optional).

Once you’ve completed your CELO purchase, the next step is to select a crypto wallet to store CELO securely. Your coins can be stored in your brokerage exchange wallet; however, in this case, they’ll be exposed to hacking. It is highly recommended that you create a private wallet using your personal keys. It depends on what your investment preferences are. You might decide between software and physical wallets. However, the former is safer.

How to sell CELO

Your CELO can be cashed out on the same exchange you bought in just a few steps.

- Log in to the exchange

- You can place a sale order in the market.

- From the drop-down menu, select the amount of CELO that you want to sell.

- Complete your transaction by clicking “Submit.”

- Confirm and complete the sale by confirming the purchase price and the associated costs.

How to store your CELO

Now, let’s look into various types of wallets where you can securely store CELO coins. The amount of CELO coins you own and the purpose for which you intend to use it should be considered when choosing a wallet. It is possible to distinguish between software wallets (Hot Wallets), and hardware wallets (Cold Wallets).

Cold wallets such as Trezor and Ledger are safer options. They offer offline storage and backup. This is a better option for those who have accumulated large quantities of CELO tokens. Software wallets make it easy to access and simple to use. Software wallets store your keys online so they are less secure that hardware wallets. But, because of their simplicity and ease of use, it is great for those who have just a few tokens.

Hardware wallet

Ledger (The Ledger Nano X and SThe hardware wallet company, (has been around since 2014) is an industry leader. BOLOS is an operating system that integrates a secure chip into their crypto-hardware wallets. The system provides security through a pin code as well as a 24-word backup recovery phrase. Celo support Ledger integration so the Ledger hardware wallet can be used for CELO yield farm and authorization transactions. It supports over 1000 coins as well as all ERC20 tokens.

Ledger Live is an application that Ledger provides for you to use on your mobile and desktop computers. It allows you to lend and stake crypto currencies.

Software Wallet

Hot wallets or software wallets can connect to the internet 24/7. These wallets store keys online, making them less secure. Software wallets come with no cost and can be easily used by anyone who has a handful of tokens. Coinbase and CoinStats wallets, which are free to download from Google Play and on the App store respectively, are some of the most well-known and popular software wallets.

You can trade or sell your cryptocurrency

If you intend to trade your cryptocurrencies regularly, you’ll need to keep your funds on an exchange. The risks associated with this are more significant than storing your assets in a hardware wallet; therefore, the exchange’s security should be your primary consideration. Some exchanges, such as Coinbase, store most users’ assets in cold storage, making it an exceptionally safe option.

Like any cryptocurrency, you can also trade CELO actively. Active traders buy and sell currencies and tokens when the market is favorable to them. Active trading is more difficult than long-term investment and selling but it can help you gain profits sooner than other investments strategies.

Take a look at the future use of cryptocurrency

The cryptocurrency world is fascinating – ranging from the technology put in place by Bitcoin to new and intriguing initiatives like Celo. The cryptocurrency industry is full of exciting opportunities. To diversify your portfolio, it is a good idea to look into other projects before you invest in cryptocurrency.

Information about Investments Information on this site is for informational purposes only. CoinStats does not endorse any recommendation to sell, buy or hold securities or financial products or instruments. This information does NOT constitute financial advice or investment advice.

It is highly volatile, so do your own research. Only invest in what you can afford. The past performance of CELO does not guarantee its future. Performance can be unpredictable.

CFDs and stocks trading can pose significant risk. CFDs can result in losses between 74 and 9% for retail investors accounts. It is important to consider all options and carefully evaluate your circumstances before you make any investments.