However, cryptocurrency prices fell towards the end of this week. But, the value of precious metals and energy stocks as well as global commodities soared amid the continuing war in Ukraine. A one-ounce fine gold weighing in at around $2K is on the horizon, benchmark coal prices continue to rise, aluminum values break records, and nickel reached an 11 year high.

Metal and Oil Markets Rip Higher, Elon Musk Insists ‘Extraordinary Times Demand Extraordinary Measures’

On Friday, stock markets tumbled as Nasdaq, NYSE, S&P 500, and the Dow Jones Industrial Average closed the day in red. The conflict in Ukraine continues to shake investors that don’t know how to cope with a wartime market.

After cryptocurrency markets had performed well over the last week, it turned out that the week ended in a very different fashion. The global crypto-economy market value fell below $2 trillion. The crypto economy hovers just above $1.85 billion in USD value at the time of writing Saturday, March 5.

The price of gold, however, has risen 1.76% for an ounce of.999 pure gold in the past 24 hours. One ounce is.999 silver up 2.37%. The conflict in Ukraine has been a blessing for precious metals gold. An ounce of gold rose 7.25% USD in value in the last 30 day. The economist and gold expert, John Goldbug, reported March 4. Peter SchiffTweeted about how gold is rising in value with the rise of oil prices.

“Today both gold and oil are at record highs priced in euros,” Schiff said. “For years the ECB was complaining that inflation in the Eurozone was too low. The ECB was determined to fix this non-existent problem. Well, congratulations ECB, now you’ve got a real problem to solve,” Schiff added.

Global investors are not only giving gold special treatment this week. According to reports, benchmark coal prices in Asia have risen by 46%, bringing them up to their highest point since 2008. The aluminum prices have broken records, and nickel values jumped up to 5.6% over the week.

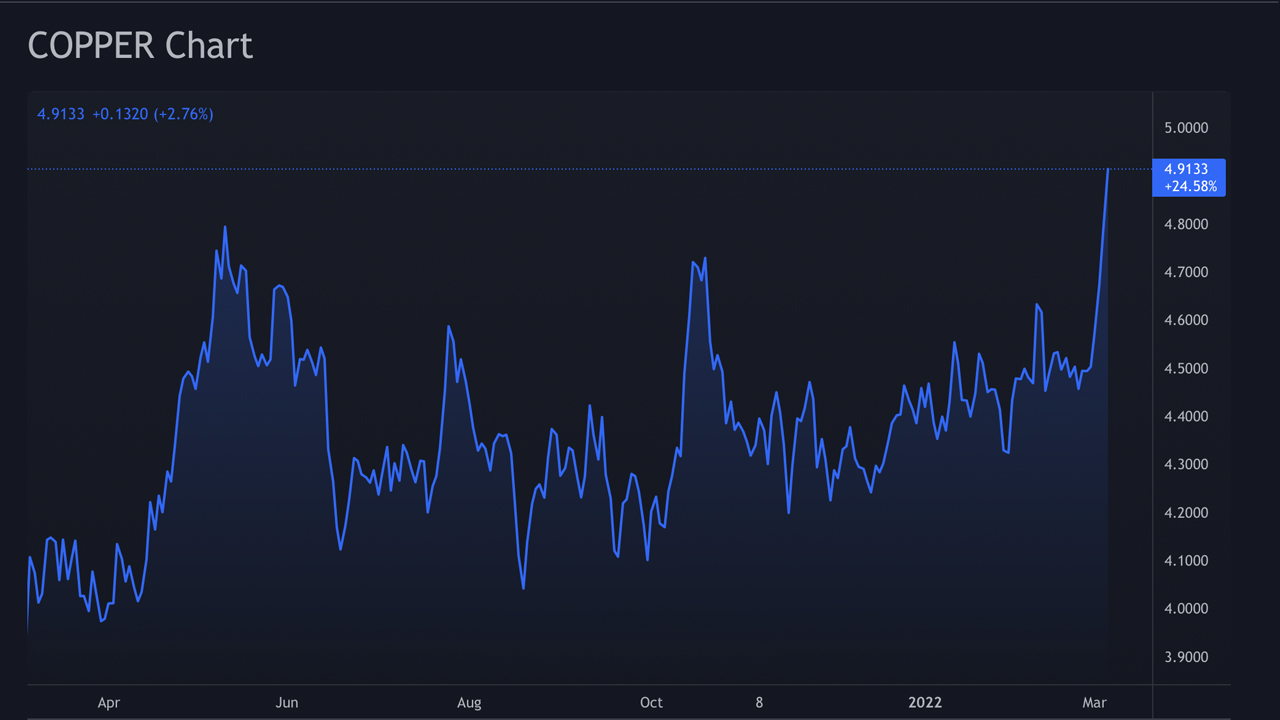

Copper’s price smashed an all-time high on Friday, and the price of zinc skyrocketed to a 15 year high. Electric prices in some regions have increased dramatically, and electric vehicle stocks (EV) have begun to increase. While EV stocks may see a bigger rise and Tesla could gather more gains, Tesla’s Elon Musk tweetedConcerning increasing oil and natural gas production. Musk tweeted the message to close to half a billion people. said:

“Hate to say it, but we need to increase oil [and]Gas production immediately Extraordinary times demand extraordinary measures.” Musk further added:

Although this could negatively impact Tesla, it is clear that sustainable energy solutions are not able to react immediately in order to compensate for Russian oil. [and] gas exports.

The week ended with a significant drop in the value of EV stocks, precious and certain commodities. Companies with a well-known brand like McDonald’s Coca-Cola are being criticized on social media for still operating within Russia’s borders. Furthermore, many reports are noting that “recession signals are surfacing” and this weekend some investors are expecting another leg down on Monday.

Let us know your thoughts on the rise in energy stocks, skyrocketing gold and new record breaking global commodity prices. Comment below and let us know how you feel about the subject.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. It does not constitute an offer, solicitation, or recommendation of any company, products or services. Bitcoin.com doesn’t offer investment, tax or legal advice. The author and the company are not responsible for any loss or damage caused or alleged caused by the content or use of any goods, services, or information mentioned in the article.