On-chain data has shown that, despite the current low Bitcoin price and the fact that it is still in decline, the currency reserve just reached the lowest point since September 2018.

Bitcoin Exchange Reserve Sinks to Lows, Not Seen since Sept 2018,

In a CryptoQuant blog post, an analyst highlighted that BTC’s exchange reserve had fallen further recently and has now reached its lowest level in over 3 years.

The “all exchanges reserve” is an indicator that measures the total amount of Bitcoin present on wallets of all exchanges.

This indicator is worth more if it goes up. It means that the amount of coins available on the exchanges has increased as investors deposit money. This trend can be bearish on the cryptocurrency price as crypto holders often transfer their coins to exchanges in order to sell them.

On the other hand, the reserve’s value decreasing would imply that investors have been withdrawing a net amount of Bitcoin recently. The trend may indicate accumulation and could prove bullish to the coin.

Battle Of The Hedges: How Gold And Bitcoin Have Performed With Russia-Ukraine Conflict| Battle Of The Hedges: How Gold And Bitcoin Have Performed With Russia-Ukraine Conflict

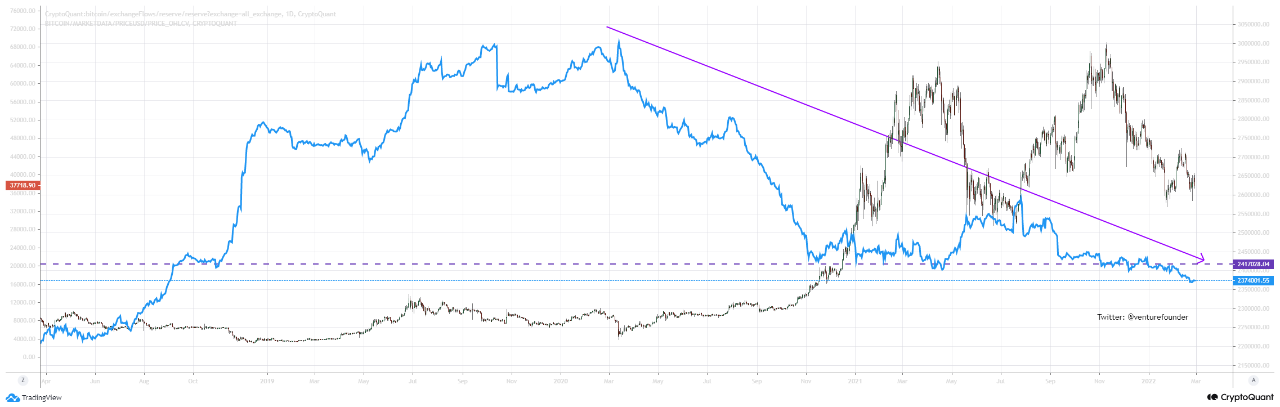

Below is a graph that illustrates the changes in BTC’s price during the past four year.

It seems that the indicator's value has declined over the years. Source: CryptoQuant| Source: CryptoQuant

The graph above shows that the Bitcoin reserve has been in a downward trend for the past two years.

Although the indicator did show a temporary uptrend in May 2021 it began to decline after several months of sideways movements. The indicator is now at its lowest level since September 2018.

Similar Reading| TA: Why Bitcoin Must Close Above $40K For Trend Reversal

The exchange reserve is often considered the “selling supply” of the crypto. Analysts believe that the exchange reserve is causing a supply shock to the Bitcoin market by reducing its value over a long time.

This is because supply-demand dynamics are very bullish on the cryptocurrency price in the long-term.

However, others think the lowering reserves are simply because of the market structure being redistributed, and that exchanges aren’t the only major source of selling pressure today.

However, the trending downwards of the reserve despite the current struggling Bitcoin price due to uncertainty from the Russia-Ukraine conflict can still be considered a sign that there is conviction among the holders.

BTC Prices

At the time of writing, Bitcoin’s price floats around $38.3k, up 1% in the last week. The crypto’s value has increased by 3% over the last month.

Below chart displays the five-day trend of Bitcoin’s prices.

Bitcoin seems to have moved sideways over the last few days. Source: BTCUSD at TradingView| Source: BTCUSD on TradingView

Unsplash.com featured image, Charts from TradingView.com and CryptoQuant.com charts