Chainalysis published research that shows criminal organizations have more than $25 billion worth of cryptocurrencies. The blockchain intelligence firm’s study shows that there was a significant increase in crypto balances held by criminals in 2021 as the metric jumped by 266% since the year before.

Chainalysis Research Crypto Whales Have Balances That Are Tied To Illicit Addresses

Chainalysis, a blockchain surveillance firm published a report that showed criminals have $25 billion worth of digital assets. Officials could theoretically seize the crypto assets worth billions of dollars that were stolen by law enforcement agencies last year despite the large number of seizures.

Chainalysis’ findings explain that 2021 saw a “huge increase in criminal balances.” In 2020, Chainalysis says the metric was $3 billion but in 2021, criminal entities held roughly $11 billion. Moreover, out of stolen funds, ransomware, fraud shops, and darknet funds, the balance of stolen funds represent the lion’s share of crypto held by criminals.

“As of the end of 2021, stolen funds account for 93% of all criminal balances at $9.8 billion. Darknet market funds are next at $448 million, followed by scams at $192 million, fraud shops at $66 million, and ransomware at $30 million,” the Chainalysis report details. “Criminal balances also fluctuated throughout the year, from a low of $6.6 billion in July to a high of $14.8 billion in October.”

Darknet workers hold Crypto for the longest, criminal Crypto whales have longer addresses than Typical addresses associated with stolen funds

Chainalysis also identified the types of criminals that held crypto for the longest time without liquidating it, while darknet market vendors, administrators, and other agents ruled. The research shows that those who have crypto assets are the ones holding onto the money for the most time.

Although, there are “extremely large wallets that hold longer than is typical for others in the stolen funds category.” By analyzing the balances of criminal whales, the firm was further able to notice that the whales showed “more variation.”

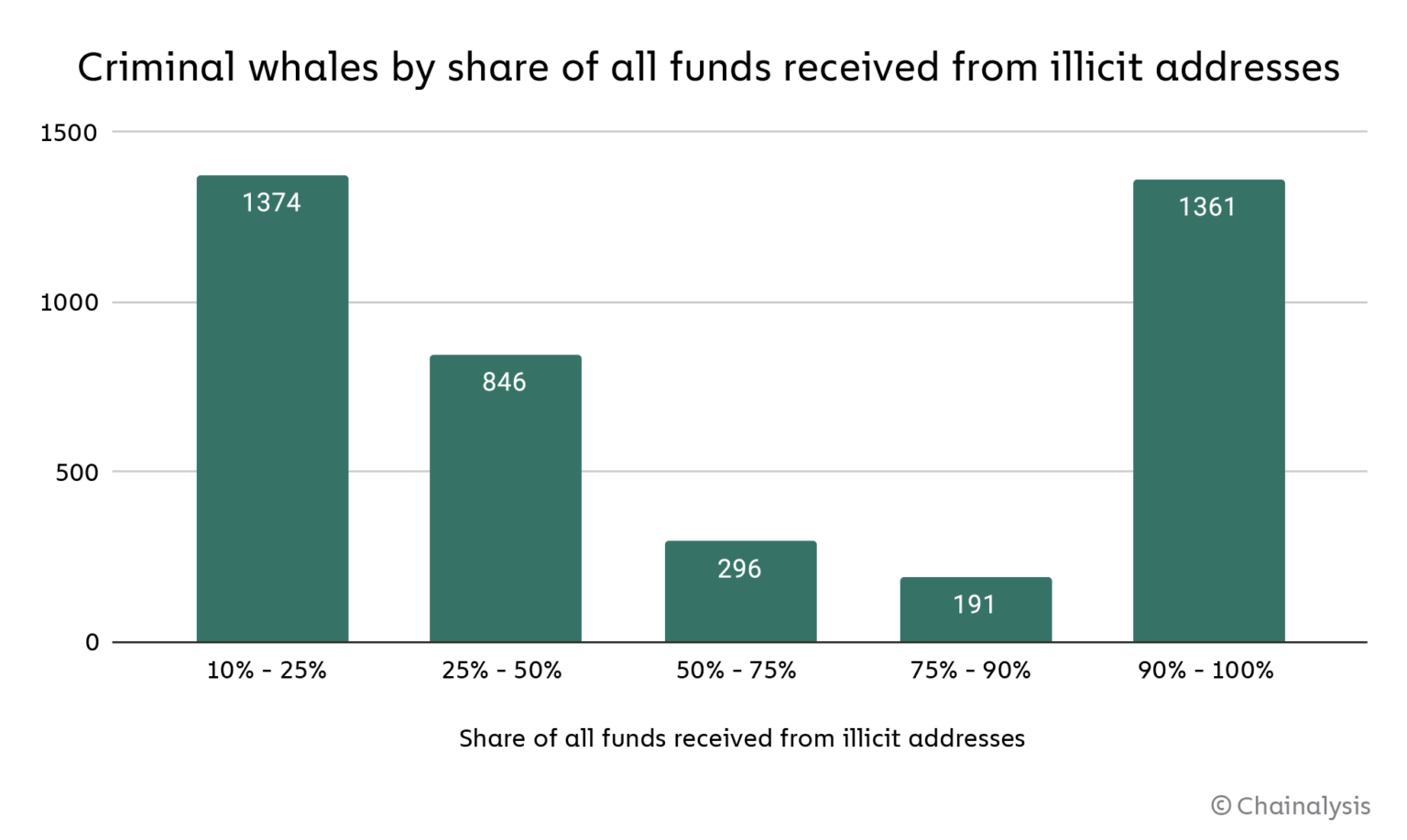

Chainalysis researchers defined a criminal cryptocurrency whale as any wallet that holds $1 million worth of crypto, and 10% or more from illegal addresses. Chainalysis discovered that there are thousands of alleged criminal crypto whales and it seems that most criminal whales can be placed in one of two categories — “whales received either a relatively small or extremely large share of their total balance from illicit addresses.”

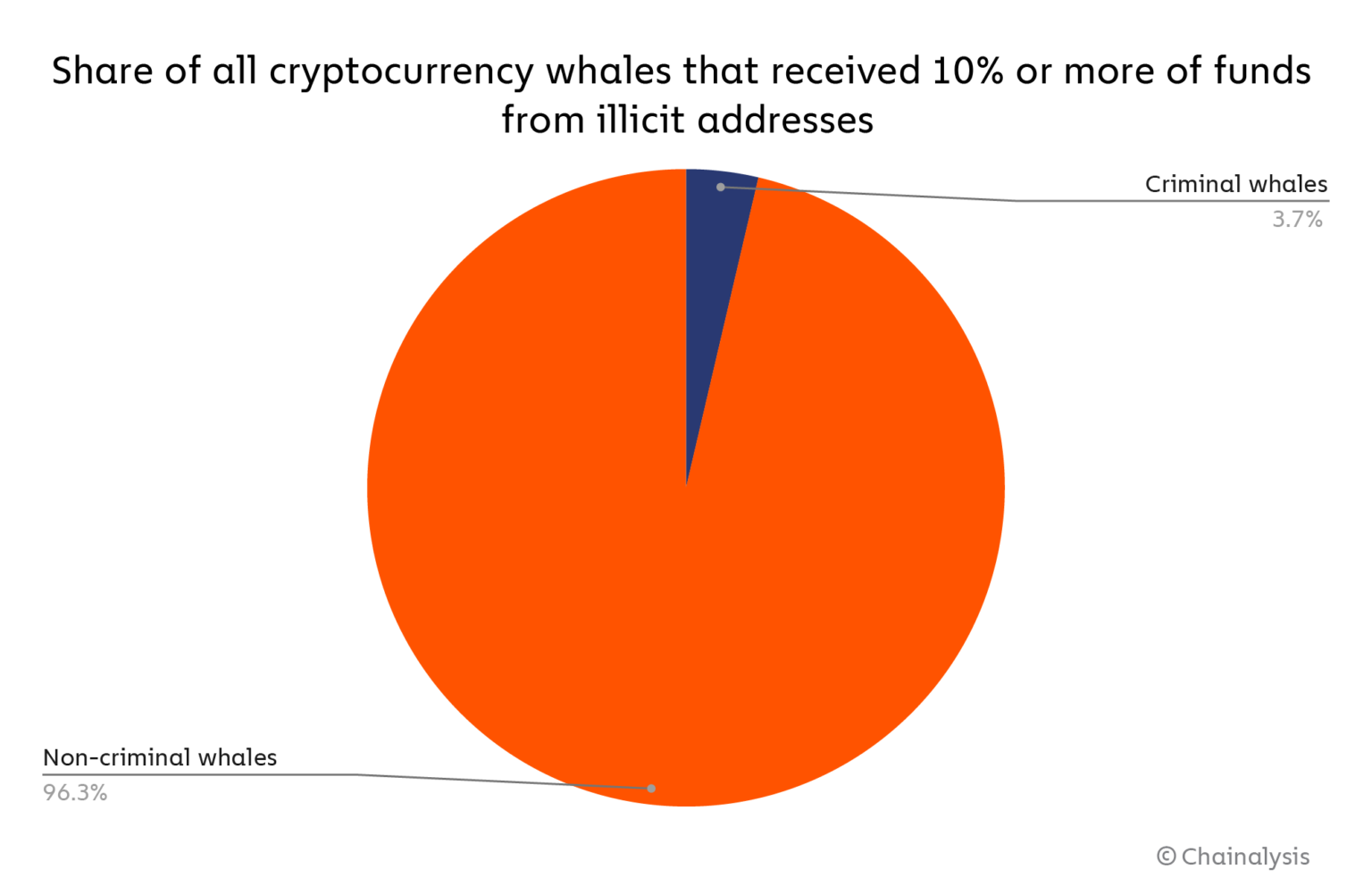

“Overall, Chainalysis has identified 4,068 criminal whales holding over $25 billion worth of cryptocurrency,” the company’s study said. “Criminal whales represent 3.7% of all cryptocurrency whales — that is, private wallets holding over $1 million worth of cryptocurrency.”

Chainalysis found that criminal whale address have 25 billion dollars in cryptocurrency assets. What are your thoughts? Please comment below to let us know your thoughts on this topic.

Image creditShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. This is not an invitation to purchase or sell directly, nor a suggestion or endorsement of products, services or companies. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. This article does not contain any information, products, or advice that can be used to cause or allegedly cause any kind of damage.