Global markets were volatile Wednesday as Ukraine declared an emergency in the face of Russian aggression. Wall Street’s top indexes shuddered during the day’s trading sessions, and cryptocurrency markets slipped more than 4% during the 24 hour period. The price of gold, however, has increased by 1.47% in the past four days and is now at $1,925 an ounce.

Wall Street continues to see sell-offs despite global investors being concerned about the relationship between Russia and Ukraine

The world is becoming more tense due to ongoing tensions between Russia and Ukraine. However, the stock market continued to lose money on Wednesday. The U.S. State Department says that Russia has not backed down, and officials from Ukraine have declared an emergency.

John Kirby, the Pentagon spokesperson, stated that Russia’s military is prepared to make advances. “Russian forces continue to assemble closer to the border and put themselves in an advanced stage of readiness to act and to conduct military action in Ukraine at virtually any time now,” Kirby explained.

The global economy, soft currency and geopolitical tensions are all of the concerns that investors worldwide have. “If anything, Putin is digging his heels in despite the increased sanctions,” Michael James, the managing director of the investment firm Wedbush Securities told the press on Wednesday. Another Wedbush official added:

That’s really adding to elevated nervousness about further aggressive actions and what that will mean for commodities and inflation overall.

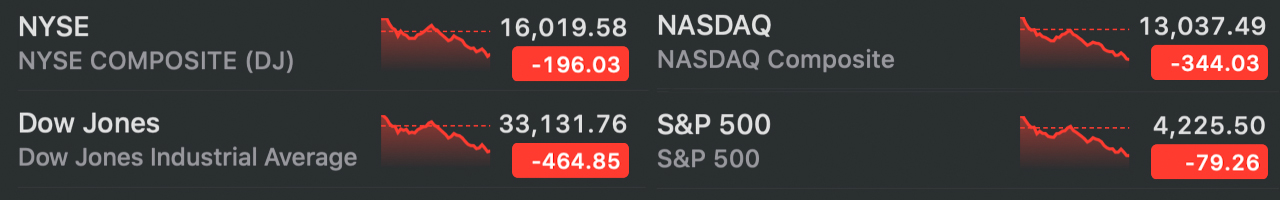

Wall Street’s top indexes have shed significant losses amid the uncertainty between Russia and Ukraine. Standard and Poor’s 500 (S&P 500) has dropped to the lowest levels in eight months. On Wednesday afternoon, EST (Nadaq) and Dow Jones Industrial Average saw sell-offs.

Nasdaq ended the day at -344, NYSE slipped by -196, the Dow dropped -464, and the S&P 500 slipped to -79 by the closing bell. The day saw 2.6% declines in Equities arising from the Information Technology (IT) Sector.

Crypto Economy Flounders, Investors Find Solace in Gold as the Precious Metal’s Value Soars Higher

After some volatility throughout the day, Wednesday night (EST) saw the cryptocurrency economy’s 12,798 coins drop 4.7% against the U.S. Dollar. Crypto economy fell to $1.71 Trillion with $78 Billion in global trade volume. Stablecoins are currently taking $50 billion of this current trade volume.

Although bitcoin (BTC) reached an all-time high of $39.231.52 per Unit on Wednesday (EST), it was down to $36K by 10:00 p.m. Ethereum (ETH), which had a maximum of $2,752 per unit, fell below $2,500 by 10:00 p.m.

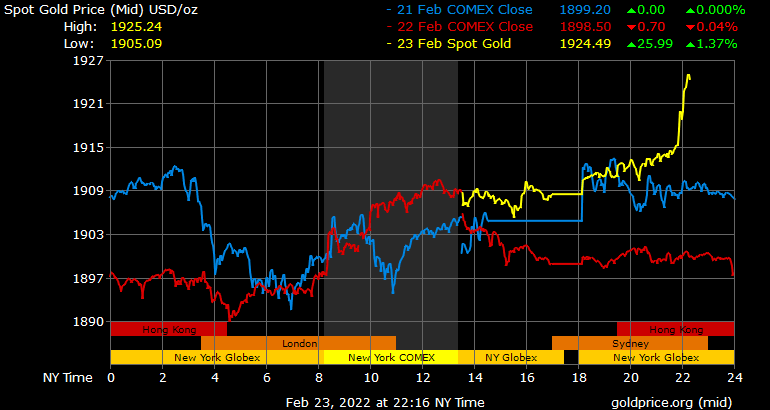

The price of gold, a precious metal that is still in high demand, continues to climb despite the fall in crypto and equity markets. The gold price per ounce traded for $1.925 during Wednesday’s trading session at 10:00 PM.

Gold was trading at $1,897 per ounce four days ago. It traded at 1.47% less than it did four days earlier. Two days ago in Japan, the price of the precious metal jumped to its highest level ever and experts believe the rise was due to “geopolitical risk and worries over a weakening yen.”

What do you think about the global economy’s volatility amid the geopolitical risk and gold’s continued surge in value? Please comment below to let us know your thoughts on this topic.

Image creditShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. This article does not contain any information, products, or advice that can be used to cause or imply loss.