The on-chain data indicates that the Ethereum netflows have been sharply turning in the positive direction, which could be a bearish sign for the cryptocurrency.

Ethereum Exchange Reserve Grows When Netflows Are Positive

An analyst pointed out in a CryptoQuant article that exchanges have seen net ETH flows recently and this has boosted their reserves.

The “all exchanges netflow” is an indicator that measures the net amount of Ethereum moving into or out of wallets of all exchanges. The metric’s value is calculated by taking the difference between the inflows and the outflows.

If the indicator’s value is positive it indicates that exchanges have more inflows than outflows. This can have a negative impact on the value of the coin, as it means that investors often deposit their ETH onto exchanges to sell.

Conversely, the negative netflow value indicates that the outflows are overtaking the inflows. As an indication of accumulation, it can be considered bullish for Ethereum if such values are sustained.

Related Reading | Here Are Two Scenarios For Bitcoin A Month Prior To FED Announcing Possible Interest Rate Hike

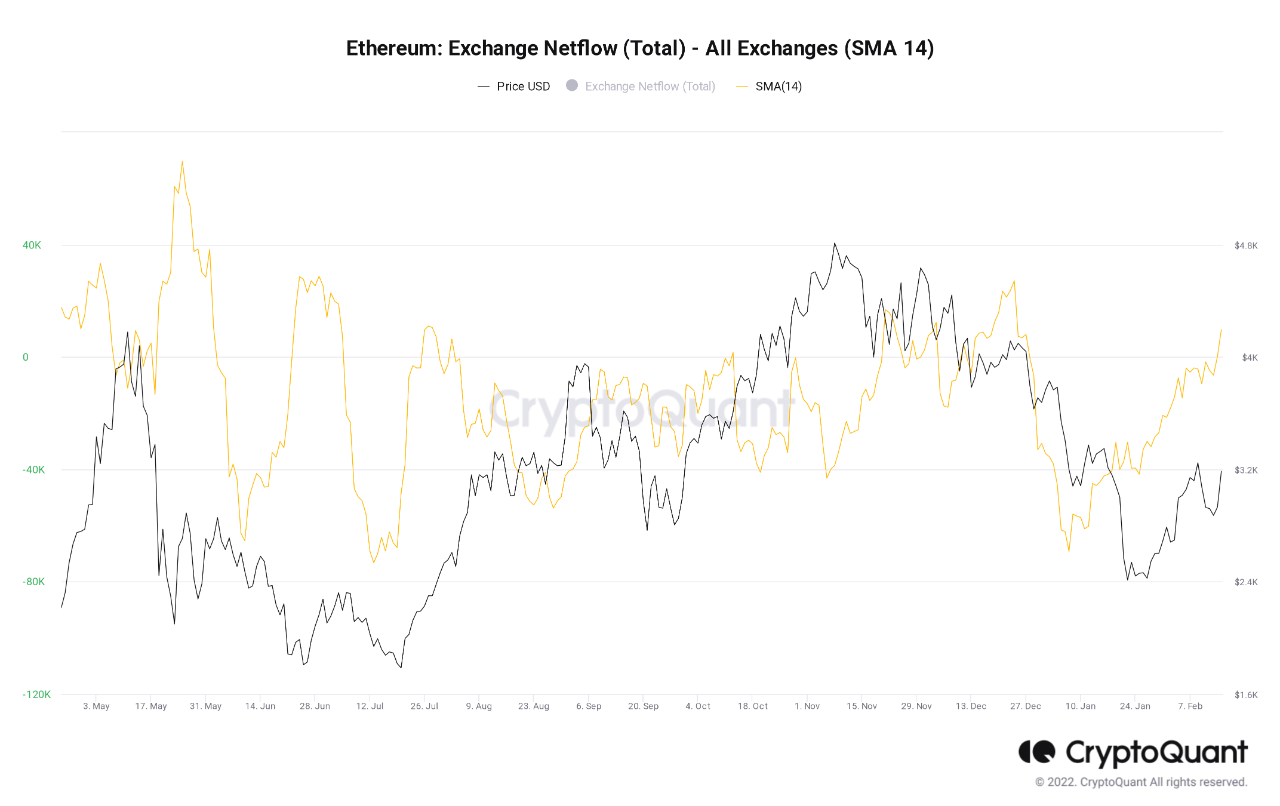

Here’s a chart showing the trends in ETH netflows for the last year.

The indicator looks like it has increased in value since the last zero. Source: CryptoQuant| Source: CryptoQuant

You can clearly see that Ethereum netflows are now at a positive level, as shown in this graph.

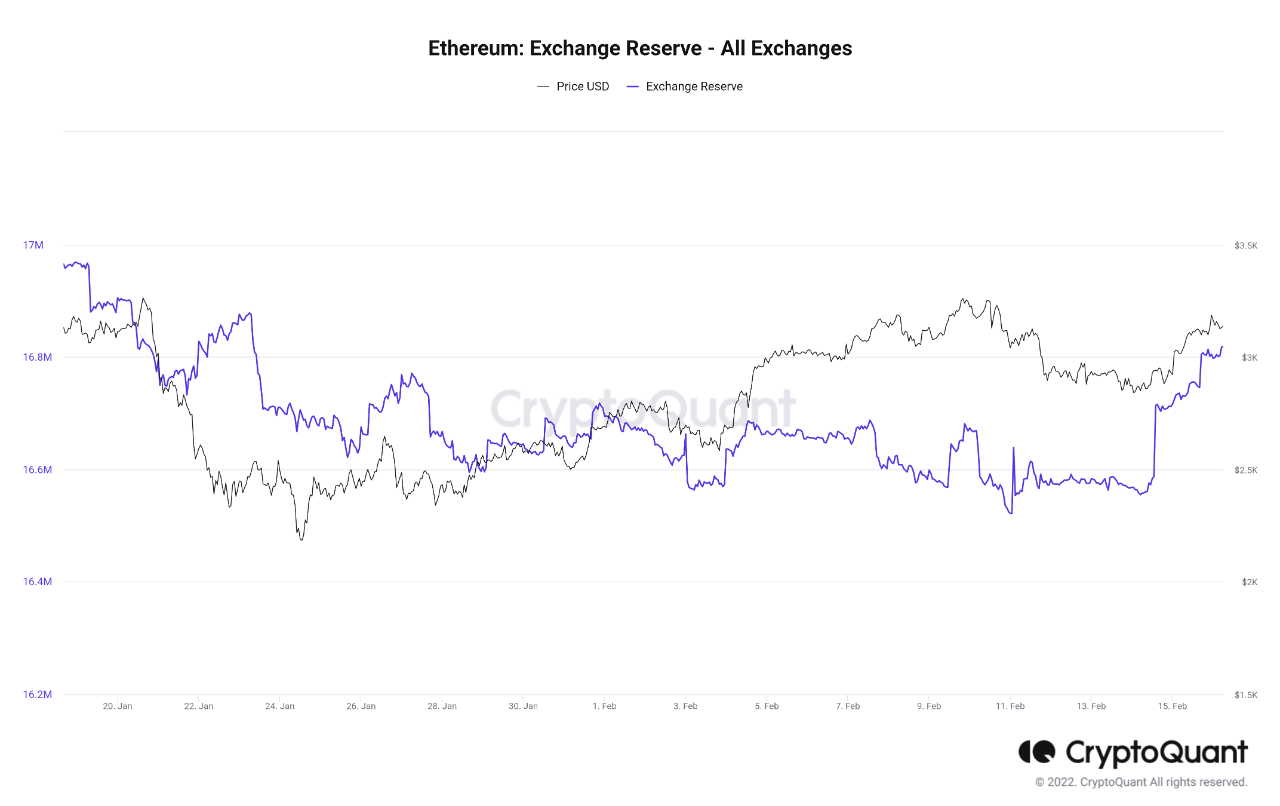

An indicator that measures the amount of ETH currently sitting on an exchange can show the impact of net inflows. Here is the chart.

Source: CryptoQuant| Source: CryptoQuant

The graph below shows that the Ethereum exchange reserve’s value has increased sharply in the last week. It is not surprising, considering the positive netflows in recent weeks.

Bitcoin Option Traders Seem Doubtful At Entering Directional Trades| Bitcoin Option Traders Seem Doubtful At Entering Directional Trades

The exchange reserve is often called the “sell supply” of the crypto. If this trend continues, and the reserve is increasing, then the short-term outlook could prove bearish for price.

ETH Price

At the time of writing, Ethereum’s price floats around $3k, down 6% in the last seven days. In the last month, Ethereum has lost 8% of its value.

This chart displays the change in price for cryptos over the last 5 days.

The price for Ethereum appears to have fallen in the past 24 hours. Source: ETHUSD at TradingView| Source: ETHUSD on TradingView

Ethereum’s price had surged up to almost $3.2k a couple of days back, but has since come back down a bit to the current levels. At the moment, it’s unclear when the coin may show further recovery.

Unsplash.com featured image, Charts from TradingView.com and CryptoQuant.com charts