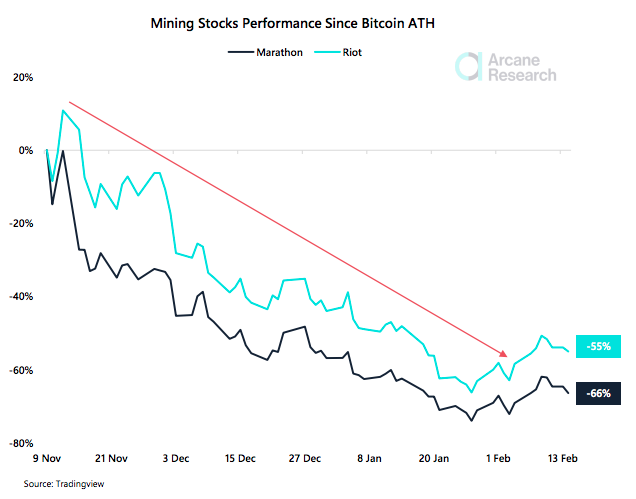

Bitcoin mining stocks have drastically collapsed since November following the effect of the hashrate’s 23% growth and bitcoin’s downtrend on the miner’s rewards.

Miners Stocks in Sharp Rectangle

Arcane Research data reveals that there is no way to know if the largest bitcoin mining stocks have collapsed since November after being caught up in the market’s volatility.

The miner giant Marathon Digital Holdings’ (MARA) stock first plummeted on November 9th falling from over $81 to $79, followed by more dramatic drops and little upward movement. MARA currently stands at $28,63, which is a 66% decline since November.

Riot Blockchain, another large mining company, has dropped from $45,97 in November to $19,000.73 as of the writing of this article, a drop of 55%.

Core Scientific (CORZ), which dropped from $14,5 to $6,99 in November, recovered 70% in February and is now trading at $10.54. Investors have responded positively to operations updates and production updates.

Related Reading| Intel Announces Mining Chips’ First Clients: BLOCK, Argo Blockchain, and GRIID

On the other hand, following bitcoin’s slight recovery in January, MARA saw an increase of 33%, and RIOT jumped 34% from its low points.

Arcane Report suggests that the industry was undervalued in November. Investors might have overseen how the industry’s new capacity would make it more competitive. This factor plus the miners decreased profits and bitcoin’s downtrend are likely behind the mining stocks’ big drop.

“This massive decline should have taught bitcoin mining investors that the high beta behavior of bitcoin mining stocks is a double-edged sword.”

Miner Profits Low

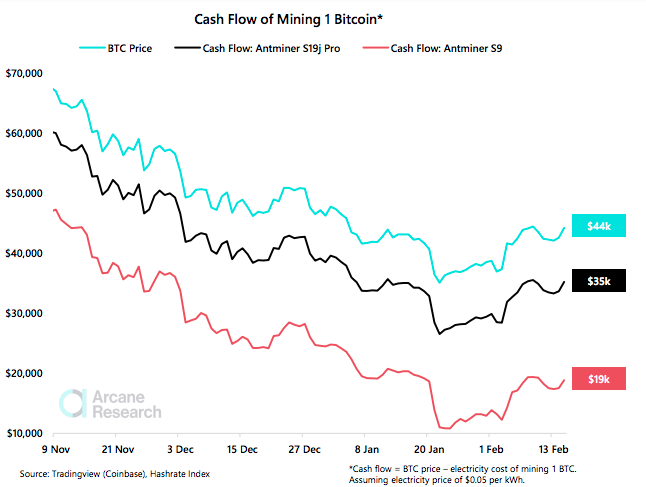

The bitcoin miner’s rewards took a hit as the price of the coin declined since its November $69k All-Time High, which reflected in the mining stocks downtrend.

Miners increased capacity last year as the dropping hashrate that followed China’s ban on crypto mining promised high profits for the activity. However, the increase of the capacity came online later in the year, thus the rising hashrate levels did not follow bitcoin’s price, as usual, rather they met the coin at its fall.

Consequently, it was not only the decrease of bitcoin’s price that lowered miners’ profits but also the contrasting rising hashrate, which led to more competitiveness and an increase in mining difficulty.

There have been slight gains in mining stocks as bitcoin continues its upward trend. But, the mining stocks could continue falling if there’s not a new bull market soon.

Furthermore, Arcane Research data estimated the cash flow of mining one bitcoin for Antminer S9 –often described as the most powerful miner in the market with 13.5TH/s, but demands more power than s19 to mine the same amount of BTC– and Antminer S19 –which can reach 110 TH/s hashrate–.

Vulnerable to the digital coin’s volatility, S9 cash flow dropped 60% since November 9th and S19’s decreased 41%.

Similar Reading| Environmental Debate: New York Crypto Mining Plant Permit Delayed

Bitcoin Prices

Bitcoin is showing steady recovery with 4.2% gain in the past 24 hours. Digital coin has seen a 3% increase in value over the last month.