Experts claim that crypto trading is like risk assets, looking more like growth equities. As the volatility in the traditional markets continues, institutional adoption of cryptocurrency is slowing until stability is achieved on the global equity markets.

Crypto Institutional Adoption

To ensure the market’s future stability and maturity, institutional adoption is key. In the years ahead, the world of cryptocurrency will change due to changes in regulations worldwide, as well as the macro environment and mass adoption.

While many corporations are slowly moving to digital currencies like bitcoin, institutional money may still be a ways off.

Recently, Bloomberg reported a JPMorgan strategists’ note in which they claim that “The biggest challenge for bitcoin going forward is its volatility and the boom and bust cycles that hinder further institutional adoption.”

Similarly, Alex Kuptsikevich, a senior financial analyst at FxPro, explained to Forbes that Bitcoin’s price “is determined not so much by volatility as by crowd interest. It quickly loses investor interest and then picks back up again. In bitcoin’s favor is the reduced supply growth rate and its finiteness.”

“We should also note that the entry of institutional investors, the increasing acceptance of bitcoin as an asset for portfolio diversification, and the increased trading turnover in cryptocurrencies make the price less volatile over time.”

Similar Reading: Goldman Sachs: Bitcoin’s Mainstream Adoption Will Not Boost Its Price| Goldman Sachs: Mainstream Adoption Won’t Boost Bitcoin Price

How Growth Stocks can Drive Investors in

In a Bloomberg Television interview with Adam Levinson, chief investment officer at Graticule Asset Management Asia, the expert noted that the current volatility of growth stocks and the traders’ fear over the Federal Reserve (FED) raising interest rates is slowing down the pace at which institutions decide to invest.

Levinson says that although many institutions already have decided to invest in crypto, the current volatility is keeping them away.

“They don’t want their first foray into the space to be a money-losing proposition quickly.[…] Institutional allocations will wait until the global equity markets, particularly growth equities, have stabilized.”

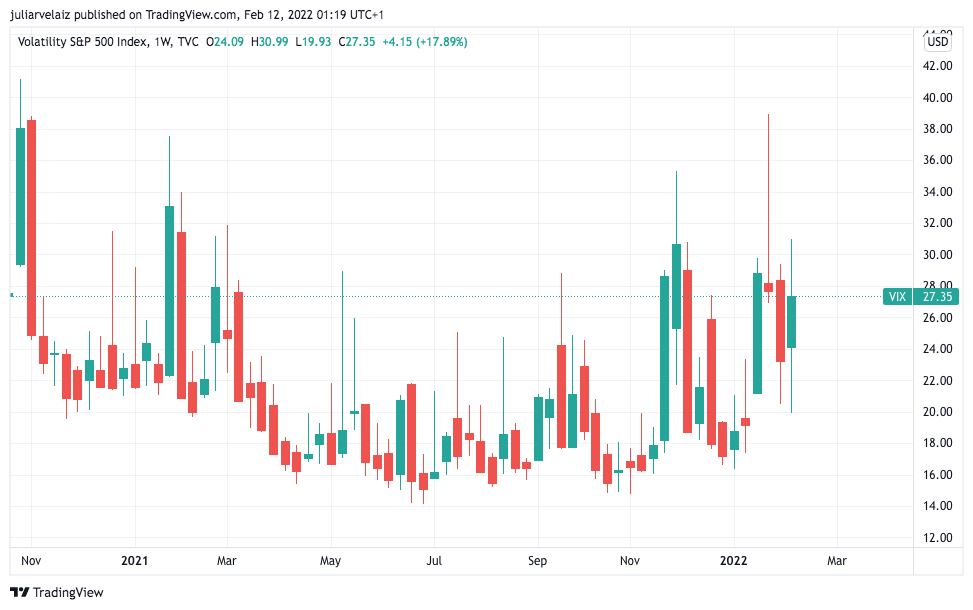

The U.S. inflation has increased significantly and consequently so did the Vix ‘fear’ index, which measures the expectation of volatility for the stock market based on S&P 500 index. Investors believe that the market is in danger of a major sell-off due to high inflation.

The crypto market has suffered because bitcoin is trading like stocks. The market capitalization may see volatility, although it has seen some recovery over the past week.

As Levinson noted, “What has happened this year is that you move to an environment where the Fed is being forced to raise rates, as are other central banks, and you are seeing a change in the extremely abundant liquidity environment.” As a result, “Crypto suffered. Crypto is basically traded as a risk asset, looking like a growth equity,” he added.

However, Lenson thinks that over the middle of the year there will be a situation “where crypto trades better than growth equities,” which could result in more institutional investors going forward and investing in crypto.

Read Related Article: Crypto Adoption Could Be a Compliance Option for Banks| Could Crypto Adoption Represent a Compliance Opportunity for Banks?