The crypto market cap has just lately begun to get well regaining $2 trillion. Nonetheless, an analyst thinks a bear name might be in place given a number of similarities between the dot-com bubble in 2000 and the present crypto market.

Associated Studying | Crypto Market Cap Regained $2 Trillion With Bitcoin Reaching At $45K

Crypto Mirrors The Web. Good Or Dangerous Information?

Latest research present that the adoption curve of cryptocurrencies is wanting much like the early adoption of the web round 1993, which may level in at a hyper-inflection level to occur quickly the place crypto and its associated applied sciences change into a daily software utilized in everybody’s day-to-day lives. This might name for demand to extend and worth to rise with it.

Nonetheless, an analyst predicts that similarities with the web may flip right into a repetition in historical past the place the crypto market would drop round 80% because the Nasdaq did again in 2000 amidst the dotcom bubble, a results of speculative investments and an overabundance of capital markets funding dotcom startups that later did not make a return.

Investopedia explains that the dotcom bubble “was a fast rise in U.S. know-how inventory fairness valuations fueled by investments in Web-based corporations within the late Nineteen Nineties.” The Nasdaq rose five-fold between 1995 and 2000, however then dropped reaching nearly 77% in losses by Oct. 4, 2002.

“Even the share costs of blue-chip know-how shares like Cisco, Intel, and Oracle misplaced greater than 80% of their worth. It could take 15 years for the Nasdaq to regain its peak, which it did on April 24, 2015.”

Analyst Tasha Che shared by way of Twitter a take that traces the chance for the crypto market to enter an prolonged bear market with an identical drop to the Nasdaq’s within the 2000s. Che sees these major similarities:

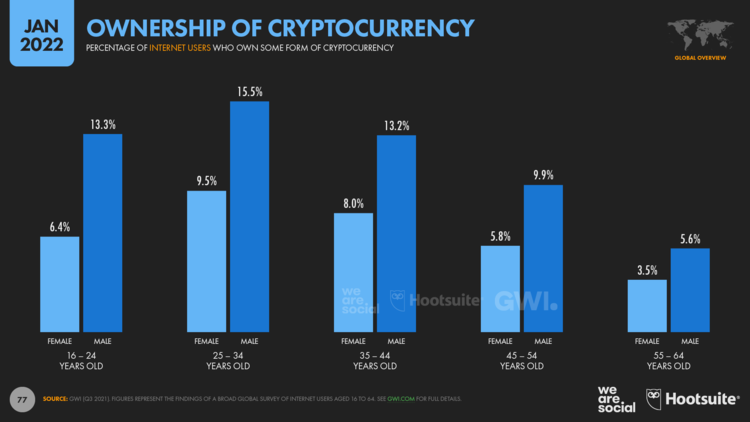

- By 2000, the web had a person base of 413 million individuals, round 6% of the world’s inhabitants. These days, round 60% of the worldwide inhabitants is utilizing the web, says Web World Stats. In parallel, latest information collected by the GWI signifies that 10% of working-age web customers personal some type of cryptocurrency, roughly 6% of the present world’s inhabitants as nicely.

- Each markets had a multi-year bull run as a result of hype over “breakthrough tech” whereas being “thinly supported by precise use circumstances”.

- “Financial coverage headwind”. In an identical macroeconomic state of affairs, in 2000 The Federal Reserve lifted 6 fee hikes by quarter-point in 1 12 months in an effort to decelerate the rising costs of products and companies.

- “In 2000 Bloomberg Web Index reached a peak market cap of $2.9 trillion (about $3.5 trillion to right now’s {dollars})”, which then fell to $1,2 trillion by the top of the identical 12 months. Chen believes that “Given web shares again then cowl wider subsectors than crypto right now, a $2.5-3 trillion market cap would put crypto at par w/ dot-com valuation then.”

The professional additional famous that the 2 years that Nasdaq dropped 80%, “It was blessing in disguise for web trade–weeded out opportunists, gave actual builders respiration room to construct & allowed natural development. However completely brutal for buyers.”

Chen states that this opinion just isn’t “a straight bear name” on condition that “historical past doesn’t repeat blow by blow”, however with such an identical setup she thinks it could be “within the playing cards”. The lacking issue is a blow-off prime, which is outlined as “a sudden rise in worth and quantity, adopted by a pointy decline in worth additionally with excessive quantity.”

If that blow-off prime occurs within the subsequent few months by going again to the $3 trillion cryptos complete market cap vary, Chen thinks we might “nearly certainly see historical past rhymes.”

Associated Studying | Crypto Winter Is Thawing With Bitcoin And Ethereum Rebound Sign

The Reverse View

Nonetheless, different customers identified that Chen’s information doesn’t correctly take into consideration the almost 5x M2 cash provide enhance over the past 20 years, which has risen from $4.6 trillion in 2000 to $18.45 trillion in 2020.

One other person noted that the 2 markets will not be systemically correlated exterior of sentiment on condition that the Web hypothesis in 2000 gave foot to the overly inflated market, however the now hypothesis in crypto might be seen as “a parallel liquid market.”