The governor of India’s central financial institution, the Reserve Financial institution of India (RBI), has reiterated his issues that cryptocurrency is a “huge risk” to the nation’s monetary and macroeconomic stability. He additionally warned buyers of the dangers of investing in crypto, stating such a funding has no underlying worth.

RBI’s A number of Issues About Crypto

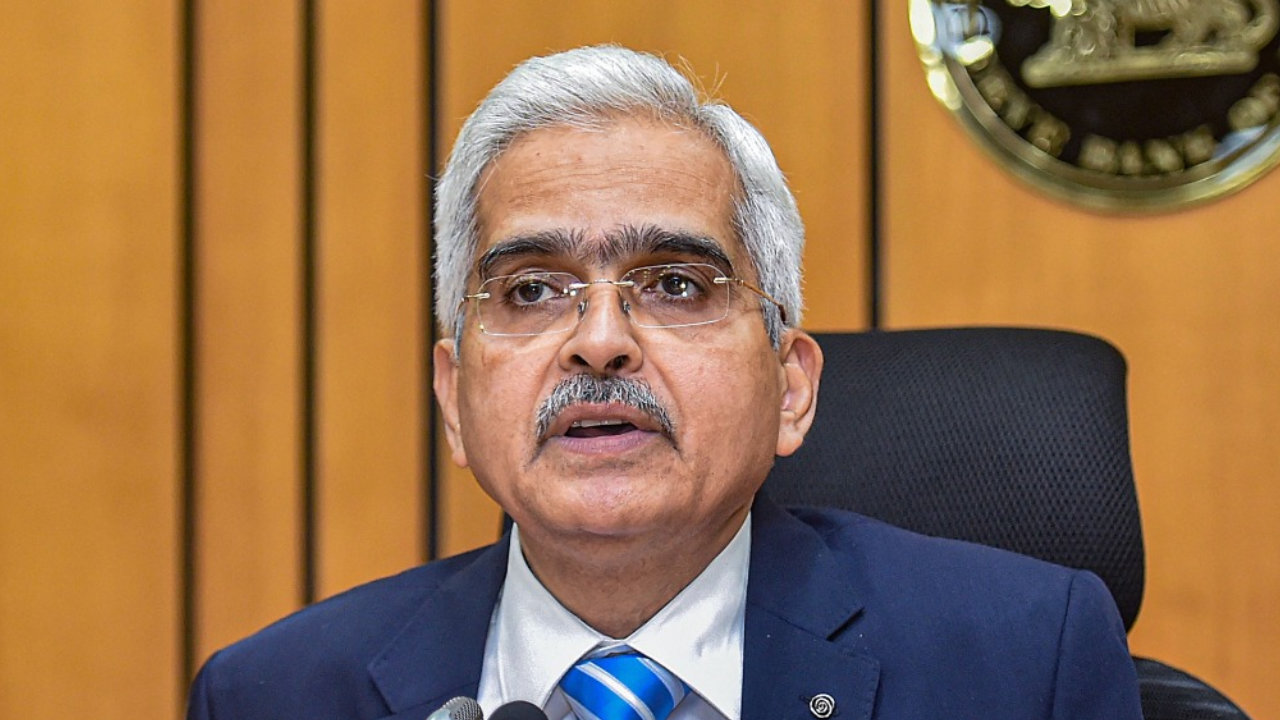

Reserve Financial institution of India (RBI) Governor Shaktikanta Das mentioned throughout a press convention Thursday that cryptocurrency is a significant risk to India’s macroeconomic and monetary stability.

Referring to any crypto not backed by the central financial institution as “non-public cryptocurrency,” Governor Das was quoted by native media as saying:

Non-public cryptocurrency, or no matter title you name, is an enormous risk to our macroeconomic stability and monetary stability.

He defined that any cryptocurrencies with currency-like property will undermine the RBI’s means to cope with monetary and macroeconomic stability points.

The central financial institution governor proceeded to warn buyers concerning the dangers of investing in cryptocurrencies. Referring to the Dutch tulip bulb market bubble within the seventeenth century, he cautioned:

Traders in cryptocurrency ought to remember the fact that they’re investing at their very own threat. They need to additionally remember the fact that the cryptocurrency has no underlying, not even a tulip.

Das famous that the RBI’s place could be very clear on crypto. He mentioned in early January that cryptocurrencies are “susceptible to fraud and to excessive value volatility, given their extremely speculative nature.” The governor confused: “Lengthy-term issues relate to capital movement administration, monetary and financial stability, financial coverage transmission, and forex substitution.”

In December final yr, the RBI urged the Indian authorities to fully ban cryptocurrency, stating {that a} partial ban won’t work. Nevertheless, the federal government continues to be consulting with numerous stakeholders to give you an applicable crypto coverage.

In the meantime, the RBI is engaged on a central financial institution digital forex (CBDC), the digital rupee. India’s finance minister, Nirmala Sitharaman, introduced final week throughout her funds speech that the digital rupee will probably be issued within the monetary yr 2022-23.

What do you concentrate on the feedback by the RBI governor? Tell us within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, instantly or not directly, for any harm or loss triggered or alleged to be brought on by or in reference to using or reliance on any content material, items or providers talked about on this article.