Regardless that Bitcoin (BTC) was rejected at $45,500, hope for one more substantial advance within the cryptocurrency market has reappeared. Bulls are actually aiming to beef up their protection on the $43,000 help stage.

In line with TradingView information, after reaching a weekly excessive of $45,500 early on Feb. 8, bears had been in a position to decrease the worth of Bitcoin to $42,900 throughout afternoon buying and selling as traders realized income and ready to put bids at $38,000. On the time of writing, the pioneer token is price $44,091.

Bitcoin Steadies At $44k

Bitcoin (BTC) bulls have efficiently returned the primary digital forex’s value to the $44K help stage, boosted by encouraging occurrences. Most notably, the Canadian subsidiary of accounting main KPMG just lately introduced that it has built-in BTC and ETH to its company treasury. As well as, Tesla Inc reported in a just lately filed 10-Okay that it possessed almost $2 billion in BTC on the finish of final 12 months.

The short rise caught many merchants off shock, as headlines throughout the crypto neighborhood predicted the beginning of a prolonged bear market, however such grim predictions might have been untimely, in response to information from a latest Glassnode analysis. In line with the blockchain analysis firm, “costs have bounced off quite a few elementary ranges which have traditionally signaled undervaluation or a “honest worth” value.”

The founder and CEO of multi-strategy agency Banz Capital, John Iadeluca, commented on this pattern, saying:

“Tesla’s 10K SEC submitting replace was launched yesterday, reaffirming notions that Tesla held onto their BTC holdings amidst declines in Bitcoin’s value to the decrease 30 hundreds. Mixed with the information of KPMG Canada including Bitcoin onto its steadiness sheet, inspired a pointy rise in constructive Bitcoin value sentiment.”

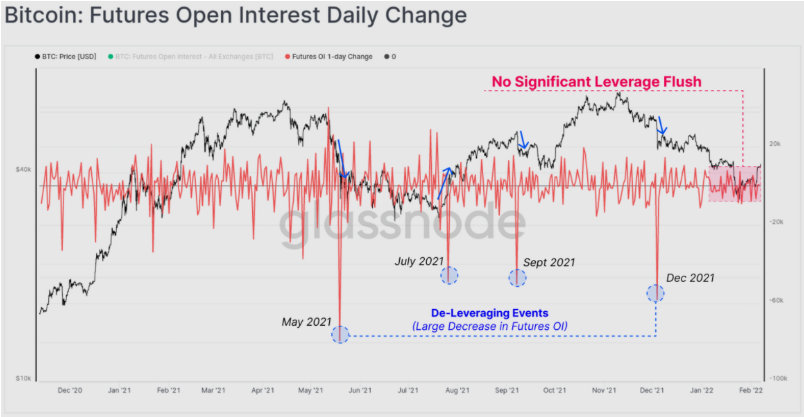

Bitcoin futures open curiosity each day change. Supply: Glassnode

Glassnode noticed that in earlier cases of extreme value losses, futures open curiosity (OI) skilled large drawdowns or “de-leveraging occasions,” as evidenced by the massive downward purple spikes on the graph above, a function that’s strikingly absent from this latest value decline. The agency mentioned:

“This will likely point out the likelihood of a brief squeeze is decrease than first estimated, or that such an occasion stays potential ought to the market proceed greater, reaching clusters of brief vendor stop-loss/liquidation ranges.”

Associated article | Valkyrie Bitcoin Mining ETF “WGMI” Accredited For Nasdaq Itemizing

Bitcoin In Longest Rally

Bitcoin new rally is BTC longest streak since final September. After the latest dip, investing in a number of of those dangerous asset teams has turn into significantly extra snug.

Whereas the market isn’t out of the woods but, there may be nonetheless a lot uncertainty on quite a few fronts, together with how swiftly the Federal Reserve can act to fight rising inflation.

In the meantime, veteran merchants, notably the pseudonymous Twitter consumer Pentoshi, are seizing the chance. This consists of accumulating some earnings and repositioning your self for what the long run holds. Pentoshi put it this manner:

“Taking the final highs now. Searching for one final spike up however $44,000–$46,300. For my part, great place to shut longs out and re-evaluate.”

BTC/USD trades $44k. Supply: TradingView

Regardless of BTC’s elevated sense of optimism when it comes to pricing, some merchants stay gloomy on the highest cryptocurrency. Allen Au, a Bitcoin skilled and Twitter consumer, shared a graph depicting the final value motion’s affect on futures markets. Following a drop in open curiosity, there was a $71 million liquidation of Bitcoin shorts. Au described this as a “brief squeeze” that can most definitely proceed to advertise value will increase. As well as, he said:

“Perpetual futures funding charges are adverse regardless of BTC breaking above $44K. Merchants are nonetheless bearish about BTC.”

Associated article | As Bitcoin Value Jumps Above $40k, Tesla Reveals Holdings Tapped $2 Billion

Featured picture from iStockPhoto, Charts from TradingView.com