sponsored

Within the rising DeFi panorama, each institutional merchants and retail traders are beginning to discover the inherent privateness points with the preferred Layer-1 blockchains.

The acute transparency of L1s corresponding to Ethereum, Solana, and Avalanche, to call a couple of, leaves traders susceptible to assaults corresponding to front-running and MEV. In the meantime, the dearth of interchain options to grab the various alternatives of a thriving ecosystem retains billions of {dollars} in worth separated. And, after all, traceability and surveillance are points completely looming on the horizon.

Introducing Panther Protocol, the Lacking Piece within the PriFi Ecosystem

Whereas many of the crypto ecosystem is conscious of the privateness pitfalls of in any other case ground-breaking blockchains, Privateness Finance has not but had its probability to blossom.

It is because lots of its proponents provide fragmented, siloed options to the privateness vs. belief paradox, hindering their utility and adoption. Privateness cash are typically not programmable or EVM-compatible. At present obtainable L2 options are normally centralized. On-chain mixers are single-use and may’t develop their very own ecosystem. Even on-chain L1 options have, by nature, single factors of failure. Furthermore, the privateness ecosystem consisting of a number of remoted initiatives yields scant community results, hindering development throughout the board.

Panther protocol goals to unravel this by creating a singular system filled with synergic merchandise and on-chain providers. These embody non-public liquidity and transactions for all crypto belongings, an inexpensive and scalable non-public interchain DEX, trustless knowledge proofs enabling privacy-preserving knowledge sharing in Web3, and a number of different impactful PriFi options.

Customers of Panther will be capable of wrap any token, in any chain, as a zAsset used to transact privately. For instance, 1 zETH can be a 1:1 shielded illustration of an Ether, prepared for use throughout DeFi functions and on a number of chains. Panther is at present constructing on Ethereum, Polygon, Close to, Avalanche, Elrond and Flare.

On the middle of Panther protocol’s design is its token, $ZKP, which performs a vital position in Panther’s imaginative and prescient to infuse DeFi with privateness. $ZKP’s quite a few utilities and considerate tokenomics based on sport principle are designed to assist the token accrue worth whereas the protocol captures TVL. This text explores the necessity for Panther in PriFi, $ZKP’s potential, and the primary elements that may affect Panther’s TVL.

Panther’s Roadmap, in Much less Than a Minute

Panther’s go-to-market methods will be summarized in three phases:

- Launching with an viewers of retail traders looking for privateness on Layer-1 and Layer-2 blockchains. Panther’s interchain options can entice customers looking for yields in several blockchains, creating constructive Alpha for establishments to comply with.

- Constructing credibility and use circumstances to ultimately embody your complete present DeFi economic system and people drawn to it because of enhanced privateness. Establishments can use Panther as a decentralized model of institutional Darkish Swimming pools, defined under.

- Finally, changing into a centerpiece within the design of all Web3 functions, enabling a totally non-public on-chain economic system, and DeFi as an entire.

Utilities of the ZKP Token

Among the behaviors that Panther incentivizes by $ZKP are:

- Staking $ZKP to earn rewards for including tokens to Swimming pools and growing the privateness set, that’s, the standard of its privateness. This decreases the availability of $ZKP and drives its worth up. Panther can act as a value discovery mechanism for privateness, bringing in new customers for a constructive suggestions loop, ultimately decreasing the price of privateness for everybody.

- Bootstrapping the expansion of the Protocol by encouraging the Panther DAO to purchase again $ZKP tokens to create reward applications.

- Having a system of bridges to a number of chains that pays charges privately on behalf of customers, furthering anonymity, to earn $ZKP.

- The DAO can buy $ZKP from the open market utilizing the charges collected from customers receiving reductions. These charges will then be utilized by the Panther DAO to pay for all of the providers above. This might make $ZKP deflationary relying on community exercise.

Tokenomics, Inflation, and Distribution

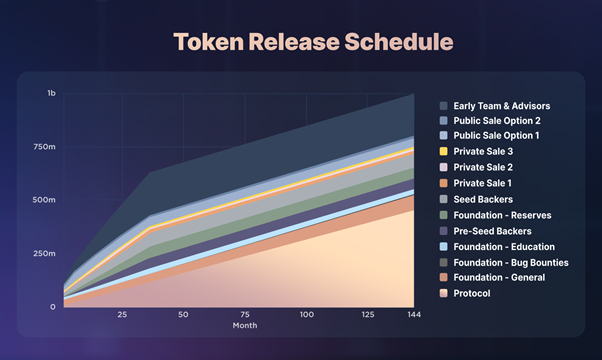

These three charts maintain indispensable data round $ZKP’s tokenomics:

Chart #1 – Allocation per stakeholder.

Chart #2 – Token launch schedule.

Chart #3 – Key metrics on launch.

Panther’s tokenomics are designed so, with a token value at launch of about $0.40 and 110M $ZKP circulating, Panther’s market cap (MC) can be at a conservative approximate of $41M. The Absolutely Diluted Worth (FDV) will thus be round $400M. The proportion between Market Cap and FDV (or just MC/FDV ratio) is essential to grasp how priceless the token might turn into ought to it rapidly accrue TVL.

Panther’s preliminary 10% MC/FDV ratio is best off the bat than some established names in DeFi. Furthermore, the 12-year vesting interval assures a easy gradual launch with a restricted affect on value, more than likely unnoticeable as demand grows exponentially. After 144 months, no extra $ZKP tokens will ever be minted, and $ZKP turns into totally deflationary, whereas TVL drives the notion of the token as priceless.

Exterior and Inner Components Driving TVL

TVL is without doubt one of the most significant metrics in DeFi. Having a Complete Worth Locked increased than a mission’s MC will be seen as a catalyst for protocol development. Given its institutional backing and traders, Panther’s $40 million ought to be simply reachable. Staking by itself ought to lock away near $13M from Day 1, assuming a 30% staking ratio. Attracting extra TVL by strong incentives and rising utilities ought to make a close to $2.5 – $6.0 token value reasonably possible.

There are a number of elements that would transfer Panther’s TVL to develop quicker than its circulating market cap. Bringing institutional darkish swimming pools on-chain, as soon as the protocol has established itself within the retail market, is an important one. Darkish Swimming pools encompass capital establishments pooling belongings to commerce with one another privately, avoiding transferring public costs with their actions. Estimates point out that these instruments signify as much as 18% of the buying and selling volumes within the US, whereas some estimates level to 40% worldwide. If these percentages translate to the entire DeFi ecosystem, Panther might turn into a zero-knowledge trade TVL black gap.

The blockchain ecosystem additionally wants an equal to money, whose whole worth (M1 provide) sits round $15 Trillion. Panther does NOT intention to create decentralized stablecoins however allows shielding present stablecoins as zAssets. In that approach, Panther will help set up a token economic system that doesn’t depend on anybody get together and that connects belongings in each blockchain.

Panther protocol is chain-agnostic and bets on a multi-chain future. Its non-public Interchain DEX will permit Panther to deal with the entire DeFi market as a substitute of simply sections of it. If simply 1% of the highest 5 chains’ TVL ends locked in Panther both on account of $ZKP charges, zAsset wrapping, staking, purchases, and many others., this singlehandedly would signify $1 Billion of TVL.

Via ZK Reveals, the ultimate piece of Panther’s grasp plan, establishments can use Panther to guard themselves on-chain whereas nonetheless disclosing their transaction historical past at will to whomever they deem needed. Reveals open the gate for extra establishments to take part within the crypto economic system. Furthermore, as blockchains start to be utilized for internet hosting the Metaverse, decentralized social apps, verifying digital identities, and many others., built-in privateness options turn into important to offset the mishappens of good transparency. Due to this fact, ZK Reveals and personal asset transfers will be important to enabling these programs to guard their customers.

Composability in DeFi Is Key

Every of the instruments talked about on this article can be utilized and leveraged by your complete ecosystem.

Different DeFi initiatives could compose with Panther-produced primitives to realize outcomes not described right here, a few of them even past what’s at present potential in DeFi and crypto. On this sense, it’s useful to consider Panther as a general-purpose software, reasonably than a privateness hammer, that can strengthen and empower your complete crypto trade.

Panther is constructing the instruments needed to maneuver as a lot capital as potential from Conventional to Decentralized Finance… however, some could argue, that is just the start.

About Panther Protocol

Panther is an end-to-end privateness protocol connecting blockchains to revive privateness in Web3 and DeFi whereas offering monetary establishments a transparent path to compliantly take part in digital asset markets.

Panther supplies DeFi customers with totally collateralized privacy-enhancing digital belongings, leveraging crypto-economic incentives and zkSNARKs expertise. Customers can mint zero-knowledge zAssets by depositing digital belongings from any blockchain into Panther vaults. zAssets circulation throughout blockchains through a privacy-first interchain DEX and a non-public metastrate. Panther envisions that zAssets will turn into an ever-expanding asset class for customers who need their transactions and methods the way in which they need to at all times have been: non-public.

Keep related: Telegram | Web site

Disclaimer

The data and knowledge contained on this doc is offered for data solely and shouldn’t be taken as funding, authorized, monetary or different skilled recommendation. Any opinions expressed within the doc are the creator’s alone, and don’t essentially signify opinions of Panther Protocol or any authorized entity related to that mission. Nothing on this doc is, or ought to be thought of to be, a monetary promotion or different providing or invitation to subscribe for or buy any asset described or referred to on this doc. Data contained on this doc is just meant to be present as of its first date of publication and won’t essentially be up to date. Any data obtained from third-party or exterior sources is taken from sources moderately believed by the creator to be correct, however with out offering any assurances as to its accuracy.

This can be a sponsored submit. Discover ways to attain our viewers right here. Learn disclaimer under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, straight or not directly, for any injury or loss brought on or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or providers talked about on this article.