Stablecoins have turn out to be outstanding fee rails on the earth of cryptocurrencies commanding $177 billion in fiat worth as we speak. The highest ten stablecoins by market capitalization symbolize the biggest share of the worth within the fiat-pegged coin economic system and plenty of of those tokens grew exponentially final 12 months. Terra’s UST stablecoin grew probably the most final 12 months, leaping 5,431% in 2021.

A Deep Dive Into Stablecoin Progress Through the Course of 2021

Stablecoins as we speak symbolize 9.77% of the $1.8 trillion crypto-economy as we speak which is $177 billion in USD worth. Whereas many digital belongings surged in progress final 12 months, stablecoins additionally noticed their market valuations swell as issuance grew month after month.

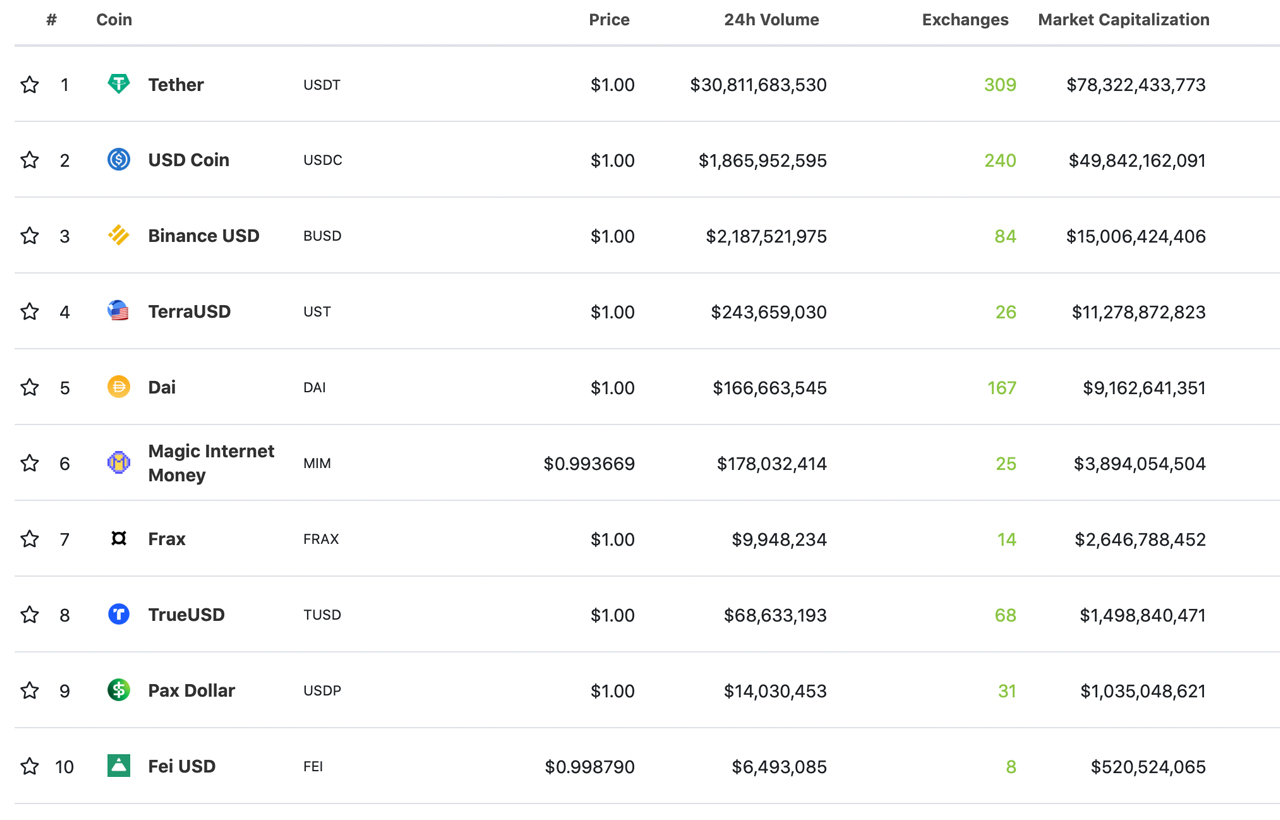

Tether (USDT) is the highest stablecoin, by way of market capitalization with $78.3 billion. USDT alone represents 4.32% of the whole crypto economic system’s $1.8 trillion and amid the $177 billion stablecoin economic system, USDT towers over the pack by 44.24%.

On January 2, 2021, tether (USDT) had a market cap of round $21.2 billion and by January 2, 2022, this grew by 269.81% to $78.4 billion. Usd coin (USDC) as soon as had a market cap of $4.1 billion on January 1, 2021, and roughly 12 months later it grew 936.58% to $42.5 billion.

The third-largest stablecoin binance usd (BUSD) had a market valuation of round $1.07 billion on the primary of the 12 months in 2021, and on the primary day of 2022, it was $14.4 billion seeing a 1,245.79% improve.

Terra’s UST stablecoin grew by 5,431.22% in 12 months from $182.6 million on January 1, 2021, to $10.1 billion on the identical day in 2022. Makerdao’s DAI grew by 641.66% from $1.2 billion on January 1, 2021, to $8.9 billion by January 1, 2022.

Magic web cash (MIM) was not round on January 1, 2021, however 128 days in the past or 4 months in the past, MIM had a market cap of round $879 million. MIM grew by 422.18% in 4 months to $4.59 billion by January 1, 2022.

The stablecoin frax (FRAX) had a $71 million market cap on January 1, 2021, and on the identical day in 2022, it was $1.8 billion. FRAX grew by a whopping 2,435.21% in 12 months’ time. The eighth-largest stablecoin trueusd (TUSD) grew by 322.54% between January 1, 2021, to January 1 of this 12 months.

TUSD’s market cap final 12 months was $284 million and on January 2, 2022, it was $1.2 billion. Pax greenback (USDP) had a valuation of round $346 million on January 1, 2021, and 12 months later it was $1 billion rising 189.02%.

Lastly, the tenth-largest stablecoin fei usd (FEI) doesn’t have a market cap for January 1, 2021, however 301 days in the past or 9 months in the past, it was $2.3 billion on April 4, 2021. FEI’s market cap truly shrunk through the 12 month interval by 66.08% to $780 million.

What do you concentrate on the issuance will increase stablecoins noticed between January 1, 2021 up till the identical day this 12 months? Tell us what you concentrate on this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, straight or not directly, for any injury or loss brought about or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or companies talked about on this article.