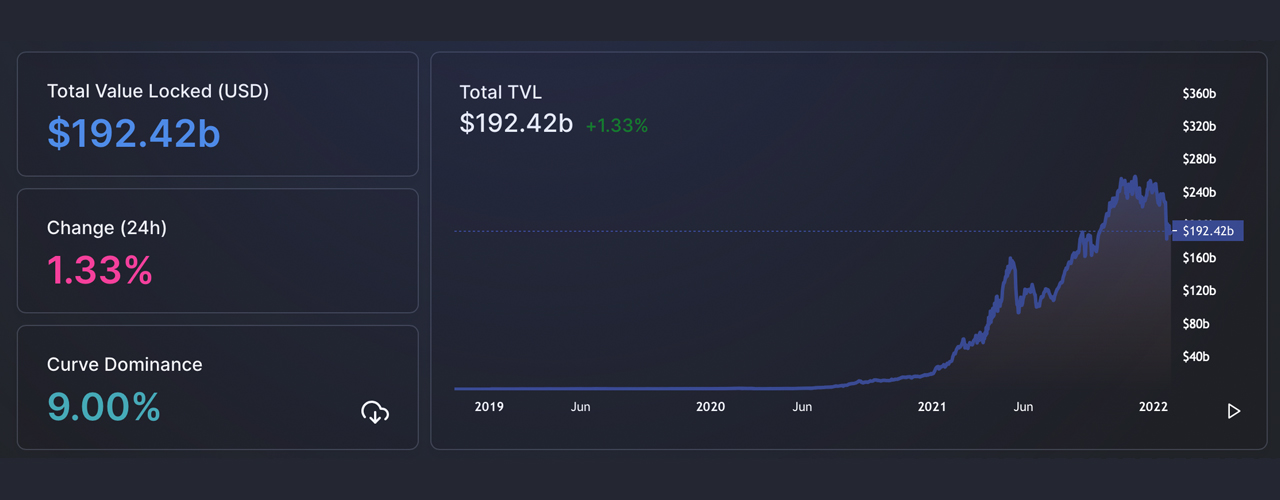

On Sunday, January 30, 2022, the highest good contract protocol tokens by market capitalization is $592 billion or 32.66% of the $1.8 trillion crypto financial system. In the meantime, the total-value locked (TVL) in decentralized finance (defi) protocols is $192.42 billion up 5.28% since January 23.

Defi TVL Climbs Extra Than 5%, Ethereum Defi Dominance Nonetheless 60%, Cross-Chain Bridge TVL Jumps 13.5%

On the finish of the week, crypto asset costs have rebounded from the market carnage that happened seven days in the past. Over the past week, the highest two main crypto belongings bitcoin (BTC) and ethereum (ETH) have gained 7% to 9% in worth towards the U.S. greenback.

Per week in the past at the moment, the TVL in defi dropped beneath the $200 billion mark and hit a low of $182.76 billion on January 23. Since then, the TVL has elevated by 5.28% to $192.42 billion, based on Sunday’s defillama.com metrics.

Curve Finance, which is accessible on eight completely different blockchain networks instructions a dominance of 9% amid the $192 billion TVL with $17.31 billion locked. Curve’s TVL, nevertheless, shed 11.21% in worth through the course of the week.

The second-largest defi protocol is Makerdao with $15.81 billion locked and the third-largest is Convex Finance with a $12.03 billion TVL. When it comes to TVL by blockchains, Ethereum at present instructions $117 billion of the $192 billion TVL in defi at the moment.

The $117 billion locked amongst 509 Ethereum defi protocols equates to 60.80% of all the defi TVL on January 30, 2022. Moreover, Terra’s blockchain has round 17 defi protocols and is the second-largest blockchain, when it comes to TVL in defi at the moment.

Terra has $13.17 billion locked and the UST staking protocol Anchor instructions 53.38% of Terra’s TVL. Binance Sensible Chain (BSC) is holding down the third-largest TVL place with $12.08 billion locked. The BSC defi protocol and decentralized alternate (dex) Pancakeswap’s $4.26 billion captures 35.22% of the TVL within the BSC’s defi platforms.

Fantom (FTM) instructions a $9.42 billion TVL on Sunday, which is the fourth largest defi TVL. FTM’s Multichain has a dominance score of 58.24% of Fantom’s TVL with $5.49 billion. Lastly, the fifth largest defi chain at the moment is Avalanche (AVAX) with a $8.72 billion TVL, and Aave commanding 27.33% of the TVL with $2.38 billion locked.

One of many greatest seven-day gainers when it comes to defi TVL held on a blockchain was Polkadot’s (DOT) 47.89% climb. DOT at present has the tenth largest defi TVL with $1.24 billion locked.

Cross-chain bridge TVL charges jumped 13.5% over the past 30 days based on Dune Analytics statistics. On the time of writing on January 30, 2022, there’s $19.95 billion locked into cross-chain bridge platforms with Polygon commanding the highest bridge TVL.

Polygon has $5.4 billion at the moment, whereas the second-largest bridge TVL is Avalanche with $5 billion. Out of the highest good contract protocols by market capitalization, the blockchain token telos (TLOS) noticed the most important seven-day good points. The tokens poa community (POA) and terra (LUNA) noticed the largest weekly losses slipping 21.9% (LUNA) and 36.3% (POA).

What do you consider this week’s motion on this planet of decentralized finance? Tell us what you consider this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, straight or not directly, for any injury or loss triggered or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or providers talked about on this article.