Three months in the past the crypto financial system was value greater than $3 trillion and since then, digital foreign money costs have slid an amazing deal in worth, as crypto property have been bought and distributed throughout many fingers. Over the past decade, fluctuating value cycles have made it so some addresses, usually known as crypto whales, have been capable of accumulate huge portions of cash. Furthermore, a couple of crypto initiatives have additionally seen whales accumulate a majority of a token’s circulating provide through the preliminary distribution course of.

The High 8 Crypto Property by Focus of Giant Holders

The topic of whales is a well-liked one on the planet of cryptocurrencies, because the entities have all the time been a pressure to be reckoned with. Whales are giant crypto asset holders who personal extra tokens than the common individual, and they’re known as whales as a result of their big holdings can transfer markets, very similar to whales within the ocean that may shake up boats and trigger large waves.

After greater than a decade of individuals launching 1000’s of different crypto property, years of digital foreign money buying and selling, and the ever-changing value cycles, whale concentrations have modified through the years. The next is a have a look at the present focus of enormous holders and crypto whales all through the crypto financial system’s high digital property by market valuation. The focus of enormous holders checklist and its onchain knowledge derive from coincarp.com and intotheblock.com statistics.

Bitcoin (BTC) Focus of Giant Holders

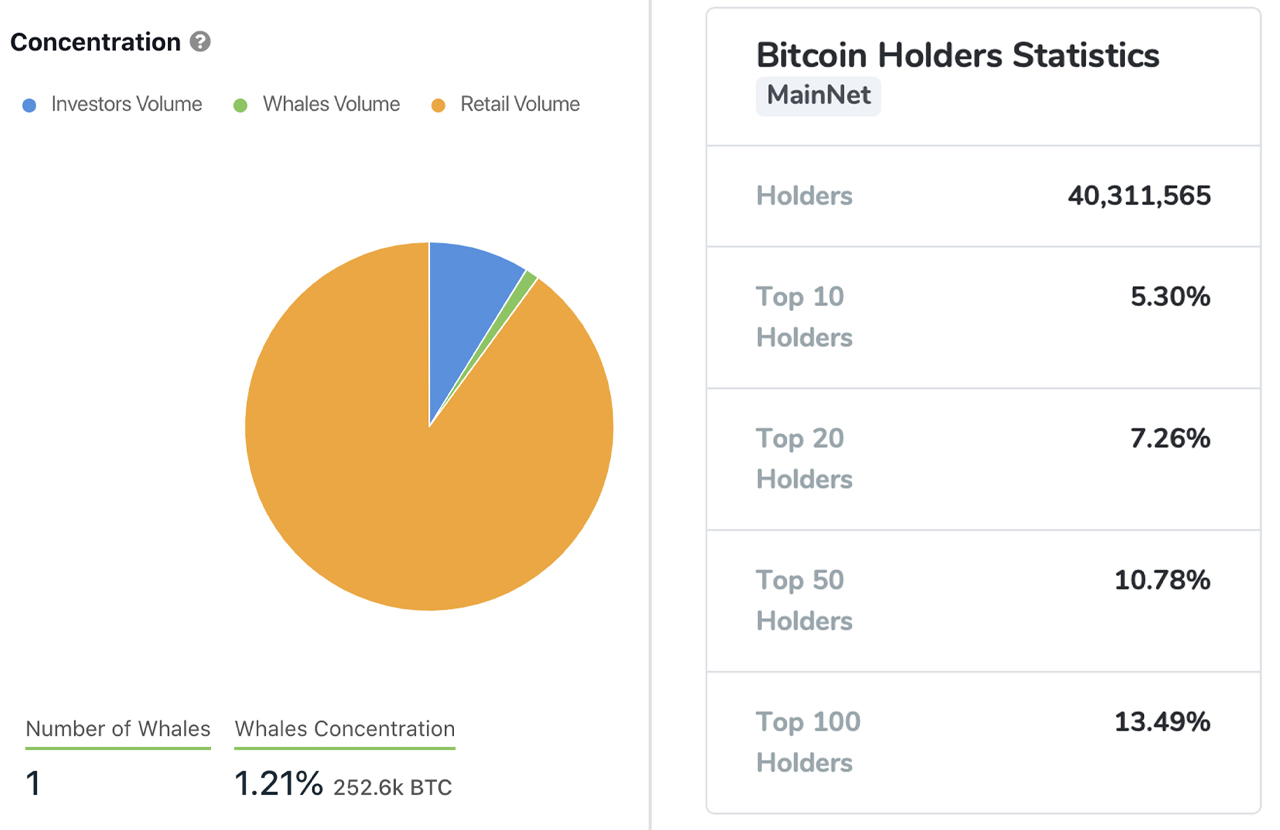

The main crypto asset bitcoin (BTC) is the oldest digital foreign money on the planet based mostly on blockchain expertise, and it’s assumed that BTC had a very reasonable distribution course of. It’s also assumed that Satoshi Nakamoto might personal round 750,000 to 1 million BTC, which sit in addresses holding unspent block rewards. This implies Satoshi’s stash is unfold out and the inventor’s focus of possession is just not simple to search out. Intotheblock.com metrics reveals BTC’s focus of enormous holders as we speak is 10%.

Intotheblock.com leverages the “complete holdings of whales (addresses that personal greater than 1% of the circulating provide) and Traders (addresses that personal between 0.1% and 1% of the circulating provide).” Coincarp.com knowledge on January 28, 2022, signifies that the highest ten bitcoin addresses maintain 5.30% of the present BTC provide in circulation. The highest 20 largest BTC holders personal 7.26% of the provision, and the highest 50 bitcoin addresses personal 10.78%. Onchain metrics additional point out that there are 40,301,661 bitcoin holders as we speak.

Ethereum (ETH) Focus of Giant Holders

Ethereum metrics are completely different as Intotheblock.com stats present focus by giant holders is 42%, which is far increased than BTC’s focus of whales. Coincarp.com knowledge reveals that there’s 185,912,265 ethereum holders and ETH’s high ten addresses maintain 23.39% of the present provide. The highest 20 ether holders possess 27.06% of the provision and the highest 50 personal 33.02%. Concerning the highest 100 pockets addresses by ether steadiness, these maintain 39.58% of the present ETH provide.

Binance Coin (BNB) Focus of Giant Holders

Binance coin’s (BNB) focus of enormous holders knowledge is just not out there on Intotheblock.com. Coincarp.com metrics, nevertheless, point out that the highest ten BNB addresses possess 88.23% of the provision. Onchain stats additional present there are 321,134 BNB holders as we speak. The highest three BNB addresses are operated by Binance’s trade platform, because the richest BNB holder is an trade pockets with 52.02% of the BNB provide. The second-richest BNB pockets operated by Binance holds 27.14%, whereas 3.55% of the provision can also be held by the third-largest tackle owned by the buying and selling platform. BNB metrics point out that greater than 82% of the BNB provide is held by Binance operated wallets.

Cardano (ADA) Focus of Giant Holders

In response to stats, there are 325,604 cardano (ADA) holders on January 28, 2022. Intotheblock.com metrics present that ADA’s focus by giant holders knowledge as we speak is 17%. Knowledge reveals that the highest 10 addresses maintain 4.36% of the ADA provide, whereas the highest 20 personal 5.86% of the provision. The primary richest ADA pockets presently possesses 1.37% of the ADA provide. 100 ADA holders maintain 16.76% of the 34,186,794,009 ADA in circulation as we speak.

Xrp (XRP) Focus of Giant Holders

Whereas XRP’s Intotheblock.com metrics are null, Coincarp.com knowledge reveals that the highest ten holders personal 78.02% of the XRP provide. The highest 5 XRP wallets are operated by exchanges, because the richest pockets operated by Binance holds 26.91% of the XRP provide. The highest 20 XRP wallets maintain 80.93% of the provision, and the highest 100 addresses presently possess 85.99% of the XRP in circulation as we speak, which is presently round 47,736,918,345 tokens.

Solana (SOL) Focus of Giant Holders

Statistics present that there’s a present provide of 314,967,774 SOL in circulation. The highest ten addresses maintain 10.11% of the SOL provide as we speak, whereas the most important holder owns 1.58% of the SOL in circulation. The highest 20 SOL wallets possess 15.77%, the highest 50 maintain 26.82%, and the highest 100 solana (SOL) wallets maintain 34.64% of all of the SOL in existence. The variety of wallets that maintain a fraction of SOL or extra as we speak is 8,383,421 holders.

Often, Concentrations of Crypto Whales Develop Bigger

Knowledge reveals that the highest eight cash by market valuation as we speak have completely different concentrations of enormous holders often called whales. Stablecoins even have a focus of enormous holders and the highest ten tether (USDT) ERC20 wallets maintain 26.79% of the present provide. The highest ten usd coin (USDC) wallets presently maintain 36.22% of the provision. 10.64% of the USDC provide is held by Maker dao whereas Binance holds 5.62% of all of the ERC20-based tethers.

Digital foreign money proponents don’t like giant concentrations of whale holders as they might dump their cash in the marketplace to make folks panic promote. It’s well-known that at occasions giant holders of any monetary asset can collude and dump hoards of property on the open market to make the value drop decrease. Whereas initially scaring the market, ultimately whales make off after a dump as a result of they merely purchase again when the panic promoting drops costs decrease. Historically, due to the focus of enormous holder ranges and illiquid markets, crypto whales develop a lot bigger after bear market cycles.

What do you concentrate on the highest eight cash and the focus of enormous holders? Tell us what you concentrate on this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, straight or not directly, for any injury or loss prompted or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or companies talked about on this article.