sponsored

CoinFLEX, a number one derivatives change and yield platform, has introduced the second iteration of their modern AMM+ (Automated Market Maker) platform—making the yield-earning product extra accessible to on a regular basis buyers.

AMM+: Leveling up the AMM mannequin on a CeFi platform

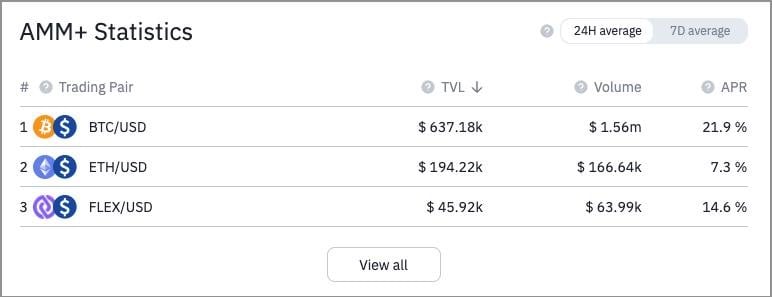

AMM+ Statistics

The revamped AMM+ web page now presents customers a statistical abstract they will simply reference to entry related info when choosing a market pair. This consists of key figures similar to common TVL (complete worth locked), quantity, and APR throughout each 24-hour and 7-day time durations.

Ideas and Steerage

AMM+ emphasizes an academic person expertise, equipping customers with the mandatory expertise and instruments to navigate round each the product and related markets. The ‘Ideas and Steerage’ toggle is turned on by default to supply customers with easy explanations for various AMM+ options.

Setting Your Value Vary

The reside worth chart presents customers the flexibility to set their worth vary whereas straight referencing reside, real-time costs from the CoinFLEX platform. For individuals who select to make use of the ‘Capital Increase’ function, an related liquidation worth may be seen on the chart within the type of a dotted purple line. The extra Capital Increase used, the nearer the liquidation worth will likely be to the bounds of the chosen worth vary.

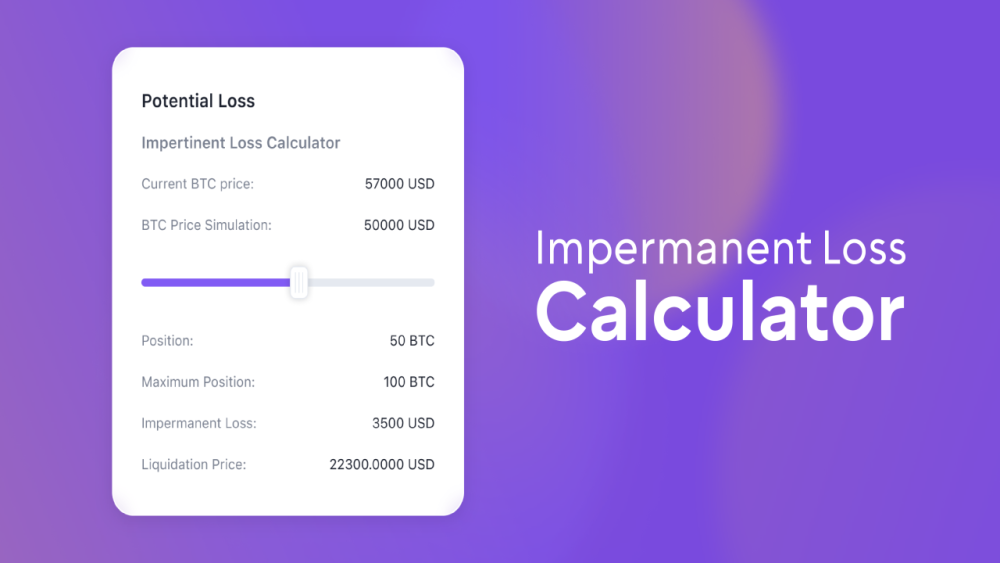

Impermanent Loss Calculator

Calculating impermanent loss (IL) has lengthy been a headache for AMM customers throughout the DeFi area. The AMM+ platform consists of an modern built-in IL calculator, in order that customers can simulate impermanent loss at particular costs—and the costs at which impermanent loss is eradicated. Offering this info upfront is essential to creating knowledgeable selections when deploying capital by means of AMM+, and highlights the corporate’s dedication to accessibility and ease-of-use.

Yield

Beneath the IL calculator, customers can see a simulated yield on their specific AMM+ place primarily based on info similar to the chosen buying and selling pair, worth vary, deposit quantity, and for these using leverage—the quantity of Capital Increase. This provides merchants an opportunity to estimate their returns earlier than deploying any capital, and incorporate this info into their decision-making.

On the Forefront of Crypto Yield 2.0

Crypto yield alternatives are rapidly evolving and increasing. Crypto Yield 2.0 is a sign of the shift from yield alternatives sourced by means of centralized intermediaries to these accessed “direct-from-market” throughout CeFi and DeFi. These alternatives have gotten extra accessible to the mainstream by means of improved platform instruments, dApps, and training. CoinFLEX stays on the forefront of this transition, constructing out the following era of Crypto Yield 2.0 alternatives.

What’s Crypto Yield 1.0?

- Staking property by means of third-party lending platforms and incomes fastened or variable curiosity.

- DeFi yield-farming and (usually unsustainable) liquidity incentivization.

- Farming-as-a-service merchandise by means of clunky CeFi integrations.

What are some points with Crypto Yield 1.0?

- Larger double- or triple-digit charges of return are related to smaller low-cap cash, whereas on AMM+ these numbers may be achieved on ‘blue-chip’ cash similar to BTC, ETH, or XRP.

- DeFi dangers similar to impermanent loss are extra simply mitigated on AMM+ as impermanent loss solely exists in a single course, i.e. for customers who select a worth course that’s “general growing” or “general lowering”.

What’s Crypto Yield 2.0 about?

- Permitting customers to supply yield straight from the crypto futures market versus centralized intermediaries, leading to larger yields for end-users.

- Accessing clear, market-based, sustainable yields.

How will AMM+ drive ahead Crypto Yield 2.0?

- Producing yield straight from futures market exercise, permitting customers to earn steady yield over the long-term with out counting on arbitrary liquidity incentives that may change at any time.

- Providing larger APRs in comparison with commonplace DEXes because of larger buying and selling volumes on futures orderbooks vs. decrease volumes on blockchain-based spot DEXes.

- Enabling customers to be extra capital-efficient with the usage of leverage.

About CoinFLEX

Based in 2019, CoinFLEX is the Dwelling of Crypto Yield and is dedicated to supply passive buyers and energetic merchants an accessible platform to earn and commerce crypto. CoinFLEX creates modern options to carry buyers and crypto markets collectively by means of intuitive yield merchandise similar to flexUSD, the world’s first interest-earning stablecoin, and AMM+, essentially the most capital-efficient automated market maker on this planet.

CoinFLEX is backed by crypto heavyweights, together with Roger Ver, Mike Komaransky, Polychain Capital, and Dragonfly Capital. In 2021, the platform achieved $9 billion in day by day buying and selling quantity.

Telegram | Twitter | Discord | LinkedIn | Fb | Youtube | Reddit

This can be a sponsored submit. Learn to attain our viewers right here. Learn disclaimer beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, straight or not directly, for any harm or loss prompted or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or companies talked about on this article.