The crypto financial system has shed monumental worth during the last three months and the main crypto asset bitcoin is down greater than 46% because it’s all-time excessive (ATH) at $69,044 per unit. The identical may be stated for a large number of digital currencies because the so-called crypto bear market has lasted 78 days to date.

78 Days Into the Present Downturn, Crypto Supporters Query How Lengthy the Bear Market Will Final

On the time of writing, a large number of crypto proponents are wondering whether or not or not the present crypto financial system downturn is a bear market. Following an exceptional 2021, bitcoin’s value fell after reaching a $69K ATH on November 10, and since BTC’s worth has been effectively under 20% from the ATH for a protracted time period, most assume it is a bear market.

If we’re to rely the times between now and BTC’s final ATH, it could be roughly 78 days. At present, bitcoin is greater than 46% down from the $69K ATH and ethereum (ETH) is down 48% decrease than its $4,878 ATH.

If we’re to imagine the crypto financial system is in a bear market following BTC’s ATH, 78 days is loads shorter than the lengthy crypto bear markets of the previous. Bitcoin’s bear run in July 2013 lasted 89 days and after the ATH in 2013, the next crypto bear market was prolonged for 406 days.

In 2017, after BTC tapped an ATH at slightly below $20K per unit, the next bear market lasted 251 days till costs began to show bullish once more. 2017 was fueled by the preliminary coin providing (ICO) increase, which largely deflated when lots of the tasks had been discovered to be vaporware.

Questioning the Crypto Trade’s Maturity, Downturn Is the Second Deepest Drawdown in This Halving Cycle

This time round, many individuals imagine the crypto trade has matured an excellent deal and decentralized finance (defi) tasks, Web3, and non-fungible token (NFT) know-how have seen a increase during the last 12 months. Whereas all three have change into billion-dollar industries, crypto supporters don’t know what number of of them will really change into strong foundations within the blockchain sphere.

There’s been vital criticism towards Web3 and greater than $60 billion has left the defi financial system since November 2021. Over the past seven days, NFT gross sales have dropped 5.73% based on immediately’s metrics.

It’s assumed the crypto trade’s maturity, its software program purposes, and the present curiosity in blockchain tech is much more strong than in 2017. In the meantime, bitcoin already had a small bear run in between its 2021 April ATH and the mid-November ATH of 97 days. The entire previous downturns have been for much longer than the present 78-day interval.

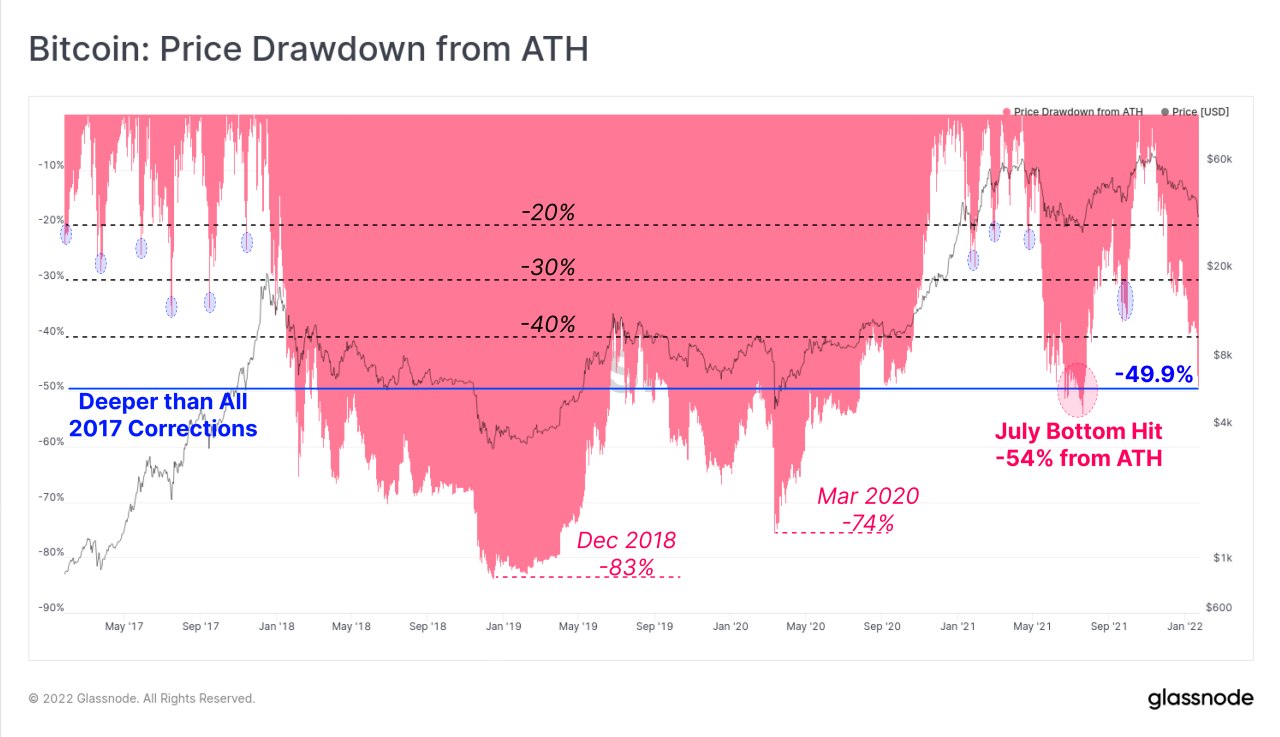

Nonetheless, market stats from Glassnode present that the present downturn is the second deepest drawdown on this halving cycle. “Corrections in 2017, and early-2021 had been a lot shallower between 20% and 40%, while July 2021 reached a drawdown of -54%,” Glassnode wrote on its Telegram channel on January 23.

What do you consider the present value cycle? Do you suppose that is an prolonged bear market situation? Tell us what you consider this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Glassnode, Tradingview, Twitter, Will Clemente

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any injury or loss prompted or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or providers talked about on this article.