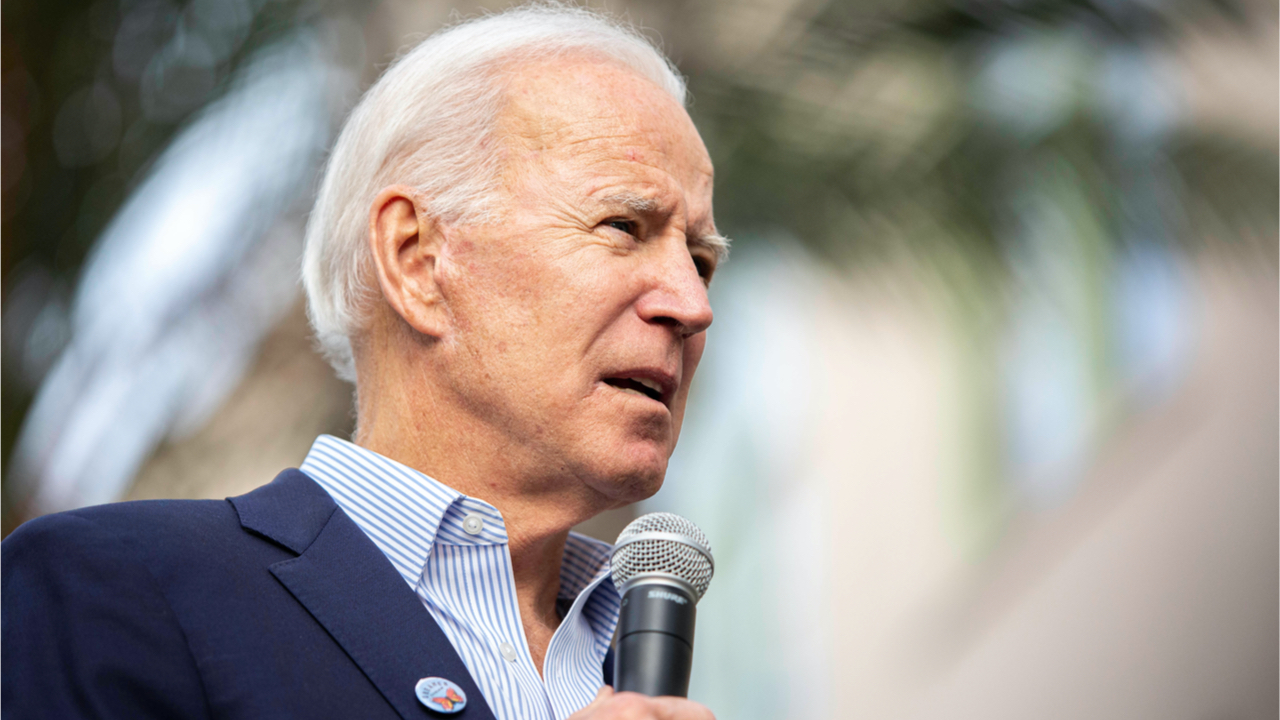

On Wednesday, U.S. president Joe Biden explained that the country’s central bank was dealing with a large share of the inflationary pressures the American economy is dealing with today. Biden welcomes the possibility of tightening monetary easing and noted that he “respects the Fed’s independence.”

US President Joe Biden Says a ‘Critical Job in Making Sure Elevated Prices Don’t Become Entrenched Rests With the Federal Reserve’

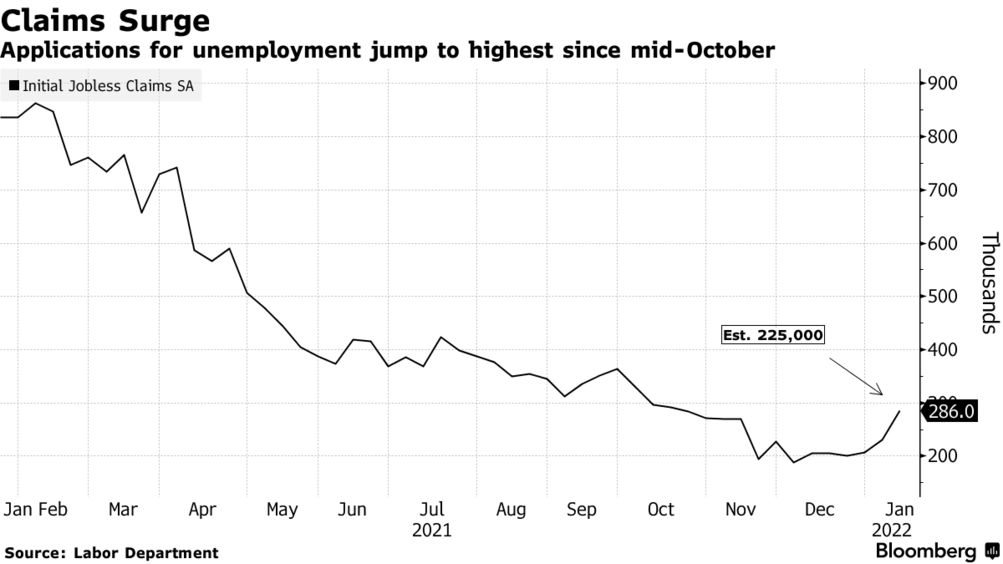

Inflationary pressures have been building in the U.S. as consumers are paying far more for goods and services in 2022, and last year’s prices continued to grow worse. American households are spending more on housing, rents, food, materials and lumber as well as automobiles. Just recently, senator Rand Paul, R-Ky., published a report that said inflation or the “hidden tax” was “only going to get worse.” Furthermore, reports published on Thursday note that U.S. jobless claims have risen significantly to a three-month high.

Although inflation increased to 7% last month, it was still higher than 2020. It also rose above 6% three consecutive months prior. While retail sales declined significantly in December 2021 due to the recession, Joe Biden the U.S. president believes most of the blame lies with the American central banking. Speaking at a news conference on Wednesday, Biden said that Americans “faced some of the biggest challenges that we’ve ever faced in this country these past few years.”

“But we’re getting through it,” Biden added. “And not only are we getting through it — we’re laying the foundation for a future where America wins the 21st century by creating jobs at a record pace, and we need to get inflation under control.” The U.S. president then declared that the coronavirus was to blame for much of the country’s economic issues.

“Covid-19 has created a lot of economic complications, including rapid price increases across the world economy. People see it at the gas pump, the groceries stores, and elsewhere,” Biden stressed. Biden noted that Americans see the problem very clearly and that a lot of pressure is placed on the U.S. Federal Reserve.

“A critical job in making sure elevated prices don’t become entrenched rests with the Federal Reserve, which has a dual mandate: employment and stable prices,” Biden noted during the press conference.

American president continues:

For nearly a year, the Federal Reserve was able to provide extraordinary support in the crisis. Given the strength of our economy and pace of recent price increases, it’s appropriate — as Fed Chairman Powell has indicated — to recalibrate the support that is now necessary. I respect the Fed’s independence.

Peter Schiff: ‘POTUS Failed to Level With the American People About Inflation,’ Americans Disagree Most of the Inflation Burden Falls on the US Central Bank

Peter Schiff (economist and goldbug) called Biden to task for being too honest about inflation in the wake of President Donald Trump’s message.

“Today, POTUS failed to level with the American people about inflation,” Schiff tweeted. “It’s a tax that pays for government spending. People want to see less inflation so that the Fed can print less. Americans should want less inflation. [Build Back Better] they’ll pay for it with higher inflation.”

Many Americans do not agree with the U.S. central banking shouldering the bulk of the blame for Americans’ loss of purchasing power. “One of my best friends owns a handful of restaurants,” the author of the Dialed in Men blog, Ryan StephensTweeted Wednesday “The last 18 months have been hell. All paper products = 55% increase over the last 18 months,” Stephens added.

Stephens reiterated that 75 cents for a piece of bacon was before the pandemic, but it’s now $187. A case of chicken was $35 pre-pandemic and today it is $90, while fry oil was $20 for a 35lb lug, today it’s $43.

What do you think about the rising inflation in the U.S. and Joe Biden’s comments about the Federal Reserve handling the issue? Please comment below to let us know your thoughts on this topic.

Image credit: Shutterstock, Pixabay, Wiki Commons, Bloomberg Intelligence,

DisclaimerThis information is provided for educational purposes only. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com doesn’t offer investment, tax or legal advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.