In 2022, which DeFi apps will make the most impact on our lives? Let’s find out!

The biggest trend in blockchain is DeFi, or decentralized finance. Many believe that it will take over traditional finance. The current financial system is based on a central platform controlled by governments and intermediaries. DeFi, however, operates on a blockchain-powered decentralized network.

DeFi was adopted by a large number of people in 2021, when DeFi investments exceeded $100 billion. Experts expect this to be an exponential increase due to DeFi financial tools like DeFi stablecoin trade, DeFi lending/Yield farming, DEX (Decentralized Exchanges), and DeFi Insurance.

Read on to learn everything you need to know about the DeFi space, popular DeFi protocols, and the top 10 Apps from DeFiIn 2022, users will be able to borrow, trade and invest in crypto assets.

Let’s dive in!

What exactly is deFi?

DeFi is a short term for Decentralized Financing. It refers to financial services that are based on blockchain technology. The DeFi concept is new, but it allows millions of people who don’t have access to traditional financial systems (for various reasons, globally, more than 1,700 million people don’t have a bank accountThis will allow them to take control of their finances and promote financial freedom, as well as unprecedented economic growth.

DeFi removes the need to have central banks or financial institutions and any other third party. Users can perform financial transactions quickly and easily through DeFi applications, without having to pay fees from banks or other financial firms.

DeFi app (DApps), which are financial transactions, use peer-to-peer (P2P) networks. These networks utilize security protocols, connectivity and software advancements. Everybody with an internet access can borrow, trade and lend digital assets.

Smart contracts are the basis of DApps. They can be used to create rare assets and execute transactions. A lot of clauses in traditional commercial contracts can be transferred to smart contracts. Smart contracts are more than finance. They can be used in video games that allow you to explore and trade in the Metaverse.

Ethereum is the basis for most DApps. Today, the Ethereum Ecosystem is the foundation for 214 out of 238 DeFi project around the globe. Solana (LUNA), Polkadot and Algorand are all cryptos that offer smart contracts.

DeFi: Why it is important in crypto

Traditional FinanceMany transactions involve lengthy processing times, surveillance, and many service fees. Regulators from fintech companies and government agencies often create problems with traditional or central finance.

You might be wondering how to get a traditional loan. You’d have to request it from your financial institution or another middleman. If you’re authorized, you’ll have to pay tax and processing fees to use the lender’s facilities.

These restrictions are removed for DeFi users, since blockchain technology makes it impossible to control the DeFi platform. Smart contracts are used by DeFi lending platforms to remove the need to have intermediaries such as banks. manage lending.

A DeFi application is essential as:

- This eliminates fees that financial companies charge for using their services.

- You can save cash by using a virtual wallet to store it instead of placing it in bank accounts.

- Everyone can connect to the Internet without permission.

- You can make transactions more quickly.

Differential Features between DApps and DeFi Coins

These terms may confuse new users to DeFi’s system: DeFi Coins and DApps.

Decentralized apps, also known as DApps, are similar software programs to the traditional but work with Smart Contracts platforms. Open-source apps are free from central government oversight and administration. Everybody can use DApps because they are distributed on a network that uses blockchain P2P technology.

DApps allow you to use different apps such as finance, gaming and banking. Virtual money can be earned by content creators using DApps. This is similar to YouTube, Twitter, and other social media sites.

What is Defi Coins?

DeFi coins, also known as DeFi tokens, are digital currencies which can be bought, sold and exchanged using DApps.

Open-source DeFi coins can be created on censorship resistant adaptable platforms. Some tokens have a fixed value, such as the US dollar. Andere DeFi coins are subject to fluctuations due to market forces, such as stock market movements. They can also rebase in response markets variations.

Generally, you don’t have to provide private information to access DeFi coins on DApps. You can buy and sell DeFi coins anonymously using smart contracts in DApps.

The Top 10 DeFi Apps for 2022

Let’s look into the best DApps that have stood the test of time and have a large user base and other advantages. TVL (total value locked) is the first factor most ranking considers. This can lead to confusion as there are many DeFi projects that quickly raise large amounts of money only for their users to abandon the platform in favor of another.

In digital currency, TVL refers to the total value of assets locked within these DApps – the higher the value locked up in a DApp, the better. The state of yield farming environments can be estimated by knowing the value total within a DApp.

TVL should not be the sole feature you consider when choosing a DeFi app. You also need to look at the sustainability of the app and its longevity.

Below are some DeFi applications that have stood the test.

Here are the Top DeFi Apps

AAVE

Performance Score: 9/10

The total value locked up: $11 billion

The pros

- There is a huge lending pool for digital assets.

- Additional features available for both lenders and borrowers when using digital assets.

- Some digital currencies have stable interest rates

- With KYC registration, users can apply for flash loans.

Cons

- It is not easy to use.

- Lenders and borrowers who use the platform receive low incentives

- Hackers can manipulate the flash loan option.

Aave operates on an open source framework, which gives both lenders and borrowers full control over crypto assets. Aave was originally designed to allow digital assets and cryptocurrency loans to be borrowed and loaned. However, it has become a household brand among cryptocurrency enthusiasts and blockchain professionals thanks to its high market capitalization, large liquidity pools, stable interest rates, huge lending pools for various crypto assets, collateralized loans, etc.

General Information

· Stani Kulechov is the founder of Aave.

· The DApp was created in 2017.

· It was formerly named ETHLend.

· Aave runs on the Ethereum blockchain.

· Aave Twitter community consists of 408,000 followers.

The Key Features

· Collateralized infinite loans with zero borrow interest rates.

· Flash loans or non-collateralized loans with a fixed interest rate of 0.09%.

· Access loans in different virtual currencies.

· Flexible interest rate for borrowers.

Why we recommend: Experienced users will love Aave’s unique features and functionality. It’s an excellent choice for individuals interested in crypto-based borrowing and lending due to its rapid and straightforward lending process.

MAKER

Performance Score: 9.0/10

Absolute Value: $17 Billion

The pros

- Maker currently supports more than 400 apps and exchanges.

- Maker’s token DAI is stable since it’s pegged to the value of the US Dollar.

- It has an open, transparent structure.

- You can earn interest or DAI Savings Rate (DSR) by locking your assets in Maker’s DAI.

- You will find stability, security, flexibility and safety.

Cons

- It’s prone to malicious hack attacks against smart-contract infrastructure.

- Black Swan Events are events that can lead to significant losses.

MakerDAO, an open-source project that uses the Ethereum blockchain, is called “Open Source”. You can find the full article at The collateralized lending protocol has had 14,954 users to date and is the fifth largest app in the DeFi ecosystem. It’s a decentralized autonomous organization (DAO), powered by its native token, MKR, and the stablecoin DAI. Maker enables users to DAI Generator by leveraging collateral assets approved by “Maker Governance.” You can lend or borrow money in DAI stablecoin if you have a Metamask or ETH wallet.

General Information

· Rune Christensen is the founder of Maker.

· The development of MakerDAO started in 2015, but it was available for use in 2018.

· Maker is built on the Ethereum blockchain.

· Maker DApp provides lending/borrowing services and stability in trading.

The Key Features

· MakerDAO offers two cryptocurrencies: DAI and MKR.

· The stablecoin known as DAI is pegged to the Dollar, while the MKR token is used to pay interest to users.

· Maker is mainly used for lending of the stablecoin, DAI. The Maker Vault is used to store supported ETH. This generates a loan that’s represented by DAI and can be subsequently compounded interest.

What we recommend: MakerDAO’s tokens, DAI and MKR, function together to offer investors significant rewards and revenue. MakerDAO offers token holders the ability to collateralize a range of digital asset holdings in return for stablecoin loans paid in DAI and managed through a system called “Collateralized Debt Positions” (CDPs).

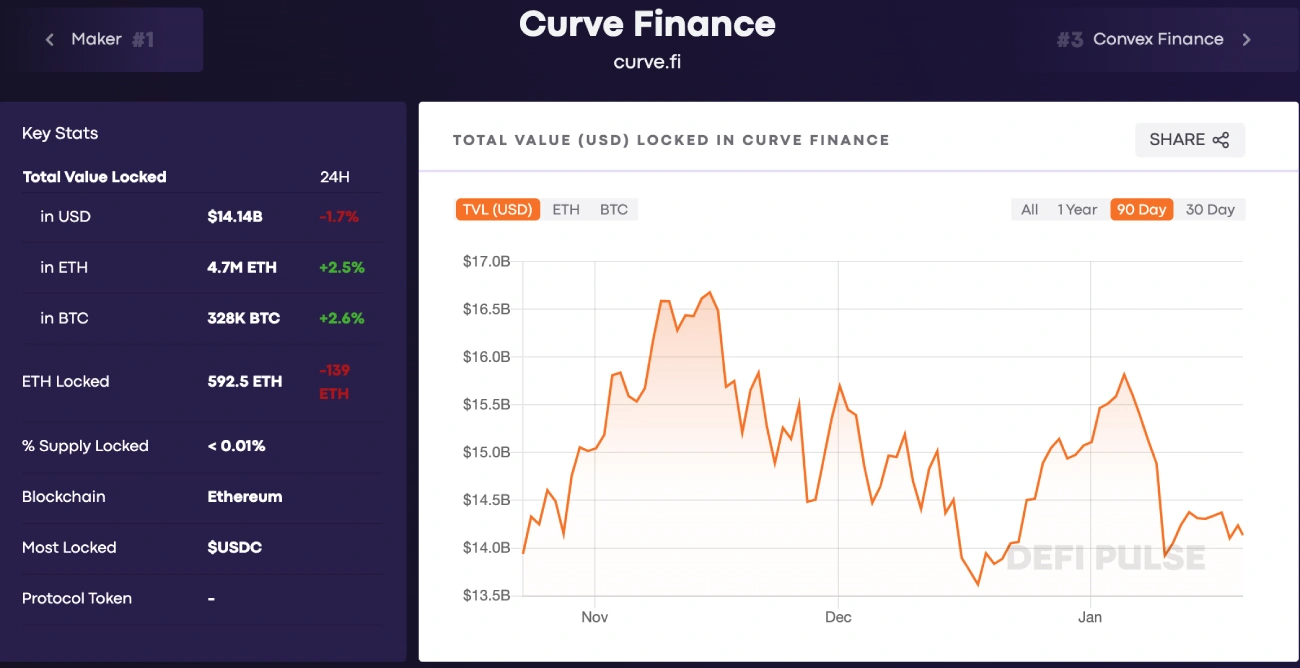

Curve Finance

Performance Score: 9.0/10

Total value: 14 billion

The pros

- Very low transaction fees

- By allowing new bonding curves, Curve can help to prevent price variations in crypto pairs.

- You are less likely to lose your money permanently. Curve’s liquidity brokers offer stablecoin pairings that reduce impermanent loss to a minimum.

Cons

- Most investors avoid Curve’s token due to its sophistication.

- Separate DeFi protocol risks. Curve Finance can integrate with many DeFi protocols. This makes the system susceptible to any issues that may arise from another DeFi protocol.

- There is a high degree of fluctuation in liquidity return returns. High annual percentage yields (APY) in liquidity pools can sometimes decrease over time to lower APY.

Curve Finance is an Ethereum open-source platform that allows you to swap or trade Ethereum-based assets. Curve Finance is also able to provide liquidity to markets through a market-making algorithm. This algorithm automatically buys or sells assets and profite from bid/ask price spreads. Curve Finance facilitates high-quality stablecoin transactions with low risk for market makers.

General Information

· Michael Egorov is the founder of Curve Finance.

· The Curve Finance DAO’s ERC-20 token, CRV, is a governance token.

· Curve Finance has 251,000 followers on Twitter.

· Curve is both a Decentralized Exchange and DeFi lending platform.

The Key Features

· Vote-escrowed CRV (veCRV) is a term for CRV that has been secured into the Curve protocol for a set period.

· Owners of veCRV often earn profit from transaction fees.

· If you deposit the coin with the smallest ownership in a liquidity pool, a deposit incentive may be provided.

Why we recommend: Curve Finance offers low volatility loans that are comparable to those offered by other DEXs. Curve Finance rewards those who provide liquidity for the exchange. Liquidity pools don’t match a buyer with a seller to complete an exchange, resulting in a more efficient transaction.

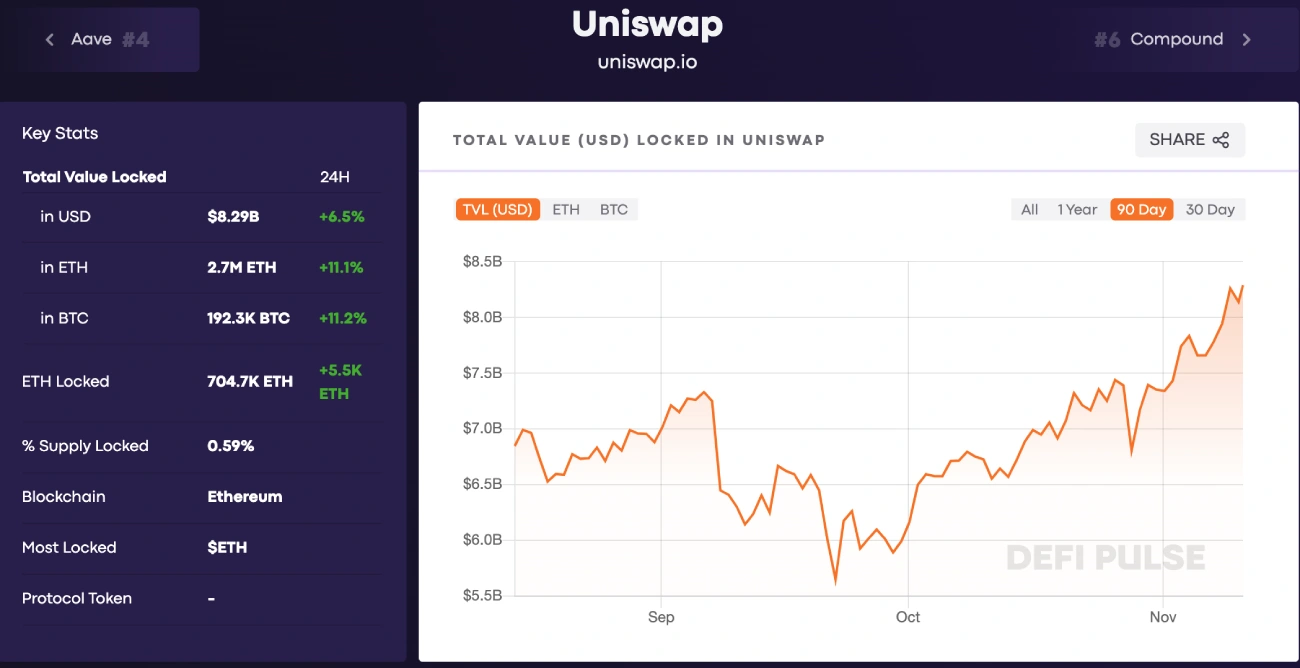

UniSwap

Performance Score: 8.5/10

8.3 billion in total value

The pros

- You can swap many ERC-20 tokens.

- It’s simple and easy to use.

- Transparency and open source code.

- Earn rewards for staking digital currency.

- You only need a crypto wallet to start.

- KYC registration or other personal information are not required for the creation of an account.

Cons

- You can’t use fiat currency to make transactions on Uniswap.

- Fees for Ethereum. Uniswap works on Ethereum. As of May 20,21, Ethereum is hit with high transaction (gas) fees.

- Uniswap is a popular investment option for investors who experience temporary losses.

Uniswap operates on Ethereum Blockchain and is a decentralized crypto-exchange. DApp allows users total control of their funds. It is completely decentralized and self-regulated. The platform is not controlled by any one business. Uniswap has an independent liquidity system. This is a new method of trading that does away with the requirement for certified intermediaries, but prioritizes security and scalability.

General Information

· Hayden Adams is the founder of Uniswap.

· Uniswap serves as a decentralized exchange platform (DEX).

· Uniswap was launched in 2018.

· The Twitter community of Uniswap includes 718,000 followers.

The Key Features

· UNI, Uniswaps’ original coin, is a governance token, so owners can participate in decisions on how the platform is run.

· Customers may make money by supplying liquidity using Uniswap’s Pool.

What We RecommendUniswap offers a variety of features and services. You can trade through the DEX in order to exchange tokens. You can also earn interest on your crypto holdings through Uniswap’s liquidity pools.

Compound

Performance Score: 8.0/10

8.3 billion in total value

The pros

- Higher interest rates are available than those offered by traditional financial institutions.

- You don’t need AML, KYC, or Credit Score to use the platform.

- To reward customers, the Compound (COMP tokens) can be used.

- The asset pool can be used multiple times without restriction.

- It’s a Decentralized Autonomous Organization that is governed by Community.

Cons

- There are a limited amount of cryptocurrency that you can borrow and lend.

- Technical errors can be caused by a highly volatile, algorithm-based smart contracts system.

- Yield farming can pose a risk because users may trade cryptocurrency for a greater amount than they actually have.

The Ethereum-based financial market Compound uses an algorithmic, cryptographic approach. Protocol that permitsUsers can borrow cryptocurrency assets as collateral and earn interest. Anyone may contribute securities to Compound’s liquidity reserve and start earning interest right away. Market dynamics affect automatic rate adjustments.

General Information

· Robert Leshner is the founder of the Compound protocol.

· Compound was launched in 2018.

· The DApp provides a stablecoin and a platform for lending/borrowing digital assets.

· The number of followers in Compound’s Twitter community is more than 213,000.

The Key Features

· The Compound smart contract allocates 10% of interest payments as reserves, with the remaining funds going to providers.

· cTokens are representations of the financial commodity that generate interest and act as security for supplied asset amounts.

· Based on the asset class value, customers can borrow between 50% and 75% of the price of their cTokens.

What We Recommend Compound was a key player in the modernization of the financial system by using smart contract technology. This is one of the easiest, most secure and open DeFi technologies. It is possible that the number supported crypto-assets will increase over time.

Convex Finance

Performance Score: 8.0/10

Total value: $12 Billion

The pros

- It’s easy to stake your crypto assets straight from the Convex Finance website.

- It is easy to use the web interface.

Cons

- CVX cannot be purchased directly using the US Dollar, or any other fiat currency.

Convex uses Curve to create a decentralized application. It allows liquidity providers as well as CRV stakers better returns. Convex finance uses the Ethereum blockchain, so to engage with the DeFi platform, you’ll need Ethereum wallets like Metamask. You can also use the CoinStats wallet, which lets you manage all your DeFi and crypto from one place – a single wallet to buy, sell, swap, track, and earn on your crypto.

General Information

· Ricardo Rosales is the founder of Convex Finance.

· Convex’s DeFi protocol uses Ethereum blockchain technology.

Convex’s Twitter community has more than 30,000 followers.

The Key Features

· Convex Finance rewards curve liquidity suppliers.

· Convex Finance’s original framework coin is CVX.

· CVX can be used to receive a portion of Curve LP’s CRV profits through Convex Finance.

· Convex has a transaction charge of 16 percent of CRV income, and convex customers are solely responsible for these costs.

· The overall availability of CVX coins is 100 million.

Why we recommend: Since Convex is entirely symbiotic to Curve and magnifies Curve’s effectiveness, Convex will achieve by orders of magnitude if Curve continues to succeed. Convex allows everyone to pool their resources so that the platform can acquire more CRV. Then, it converts it into veCRV.

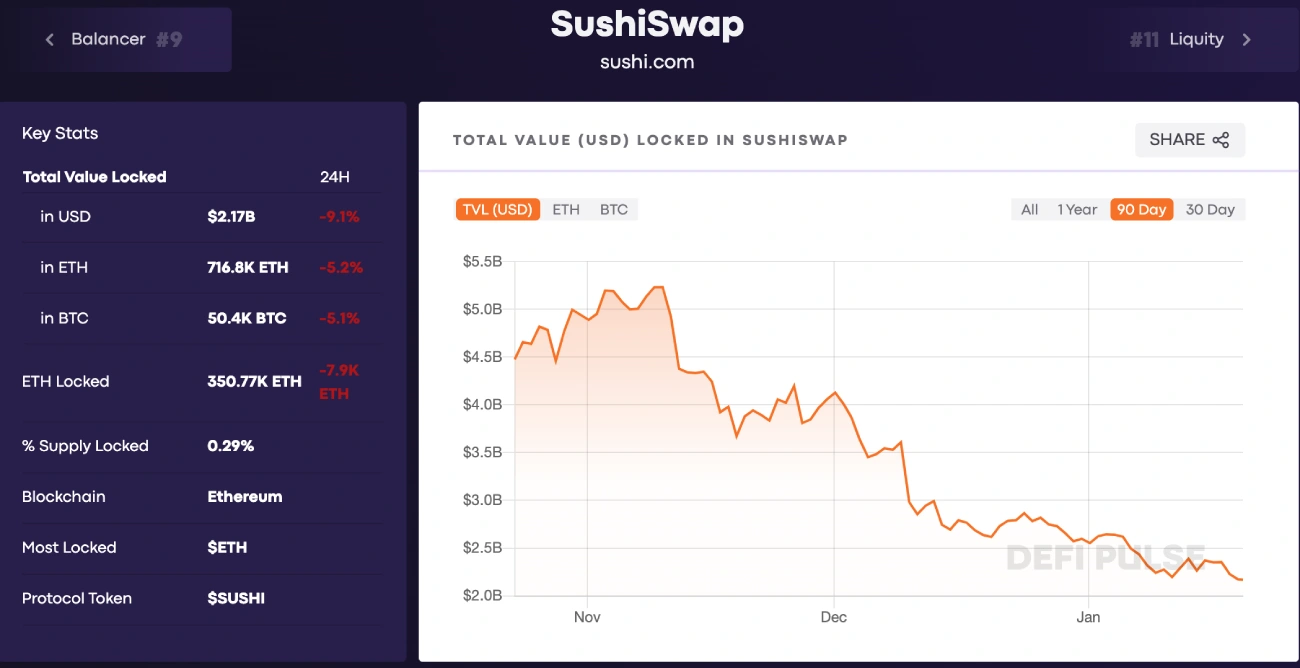

SushiSwap

Performance Score: 7.5/10

The total value locked up: $2 billion

The pros

- There are over 100 ERC20 trading pairs.

- SUSHI-based project users can trade, stake or farm.

- Simple to navigate, and easy to use.

Cons

- Uniswap charges lower fees than Uniswap.

- The high gas costs (a problem all Ethereum AMMs have to deal with)

- The danger of irreparable loss

- There are many internal issues.

SushiSwap uses global liquidity pools in order to establish unique markets for each pair of assets. It also employs an automated liquidity protocol and trading model. SushiSwap Tokens (SUSHI), which govern the exchange, rewards liquidity providers and regulates its operation. SushiSwap employs Automated Market Makers(AMM), which facilitates trades and uses smart contracts to create and manage liquidity pool. The most significant difference between it and Uniswap is its ability to generate yield farms on SushiSwap.

General Information

· Chef Nomi and 0xMaki are founders of Sushiswap. These names were pseudonyms for the unknown inventors.

· Sushiswap was introduced in August 2020.

The Key Features

· Users may effortlessly trade within the range of 100 ERC-20 tokens on SushiSwap.

· SushiSwap charges 0.3% in trading fees.

· You can use the SushiSwap’s Menu to find former yield farming pools.

· Traders can stake SUSHI tokens at SushiSwap’s Sushi Bar to gain more SUSHI tokens. Holders of SUSHI can participate in community governance and stake their tokens to receive a portion of SushiSwap’s transaction fees.

Why we recommend:SushiSwap can be used to grow and receive a high rate of interest, as well as grant and loan assets. While the code is a copy from Uniswap, the SushiSwap team continues to add new features and compatibility with multiple blockchains that Uniswap doesn’t offer.

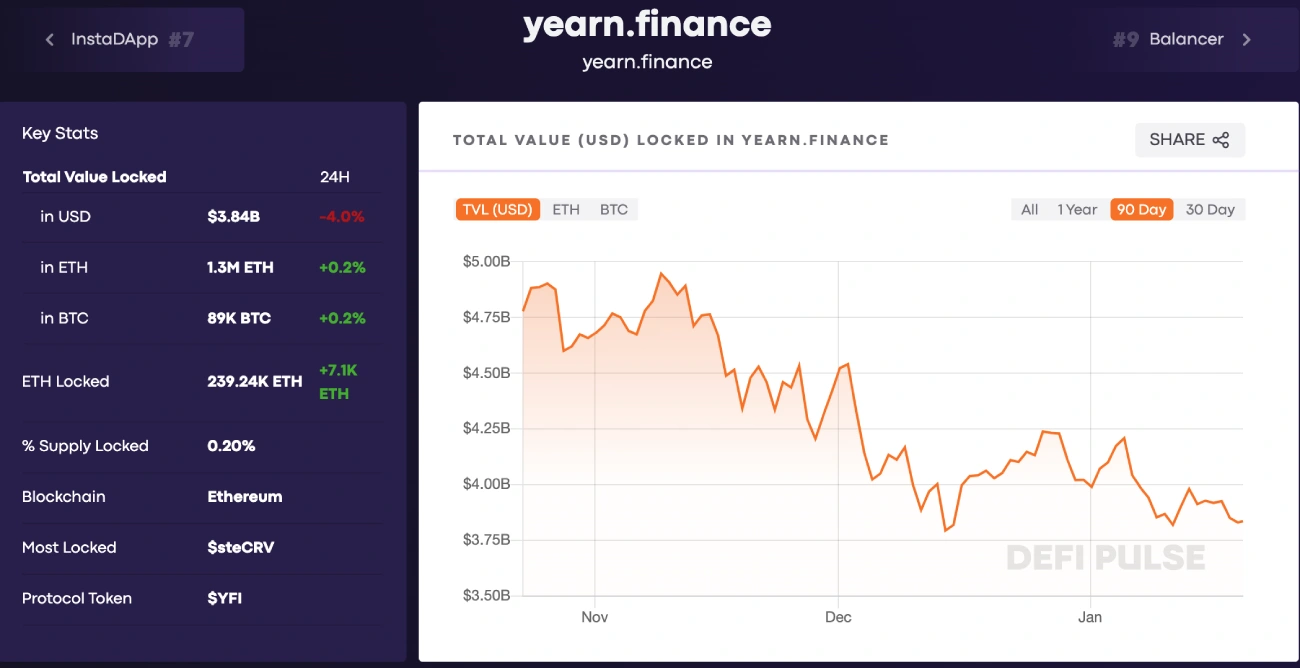

Yearn.Finance

Performance Score: 7.5/10

The total value locked up: $3.9 billion

The pros

- The best ROIs are available to users.

- This is the best DeFi platform available.

- Interfaces are available for clients based upon their location.

Cons

- Many have questioned the protocol’s credibility due to its inadequate documentation.

Yearn. Anyone interested in DeFi finance can use finance as an aggregator. It’s a lending and yield farming protocol that employs automation to help investors get the most out of their yield farming investments. Yearn.finance’s Zap is one of the most user-friendly services on the market, and users can “zap” funds in and out of the curve pools via Zap, avoiding transaction fees.

General Information

· Andre Cronje is the founder of Yearn. finance.

· Yearn. finance’s underlying coin, YFI, is the basis for its protocol. YFI token owners control the ecosystem and submit proposals to govern it.

· Yearn.finance Twitter community has 174,000 followers.

The Key Features

· Users have access to features like liquidate. finance, trade.finance iborrow.finance and the yswap.exchange.

· The vault’s (crypto-based software wallet) service is subject to a 2% annual maintenance cost.

· DAI, USDC, USDT, and sUSD are currently supported by Yearn. finance.

What We Recommend Yearn. Yearn. Finance has one of the highest yielding annual percentages, compared to other DeFi protocols. You can access the platform’s most sophisticated security features. It is self-governed by YFI holders. Yearn. Finance also provides streamlined and easy ways to dispose of funds.

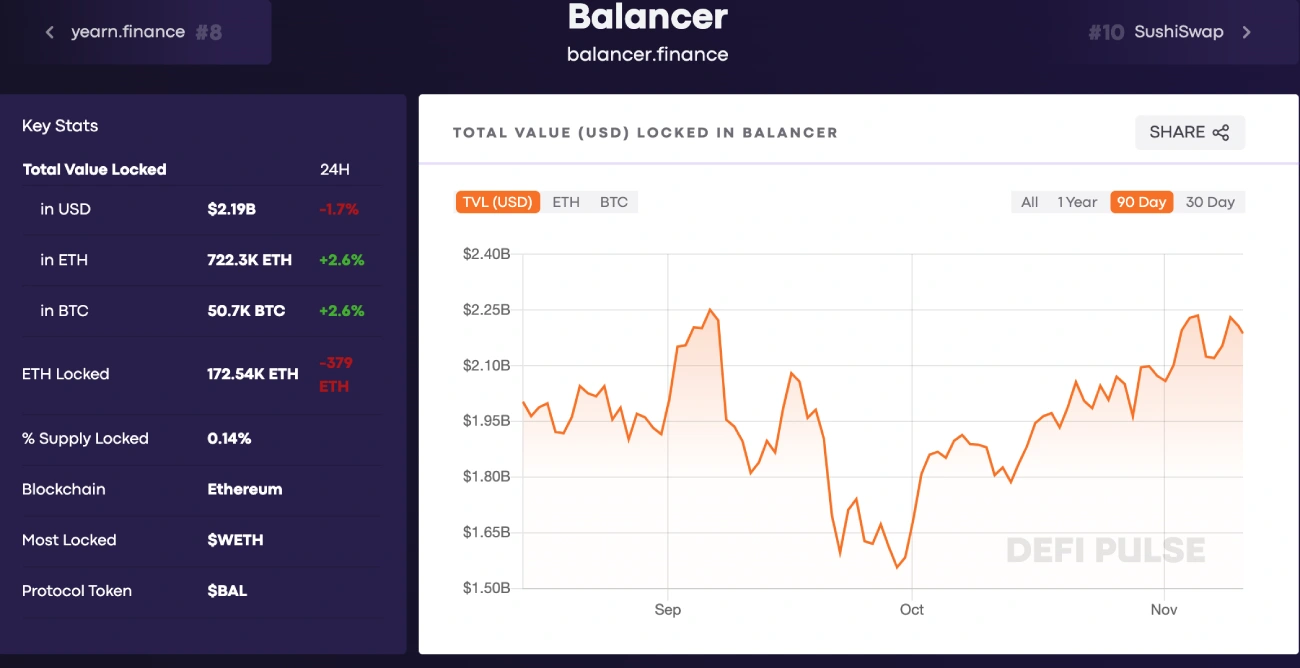

The Balancer

Performance Score: 7.0/10

The total value locked up: $2 billion

The pros

- Novel multi-asset pools.

- Swap Functionality allows arbitrage users to generate from refreshing pool.

- Lower gas prices

- All-Materials for Manufacturing

Cons

- The danger of irreparable loss

- The theft of $500,000 of tokens was the result of a large hack in 2020.

Balancer already has made significant strides to distinguish itself from other competitors. It’s a decentralized exchange (DEX) and automated market maker (AMM). The platform enables users to trade any combination of ERC-20 tokens, earn BAL (Balancer’s native governance token), and profit from arbitrages.

General Information

· Fernando Martinelli is the founder of Balancer.

· It was formally introduced in September 2019.

· BAL is Balancer’s native cryptocurrency token.

· Balancer has 119,000 followers on Twitter.

The Key Features

Five key products are offered by Balancer to make trading easier.

- The Vault;

- Balancer Pools;

- Smart Order Router;

- Merkle Orchard;

- Balancer Gnosis Protocol.

At Balancer, there are two kinds of swimming pools: private and public.

Why we recommend: Balancer stands out among other platforms because it allows users to create their own liquidity pools, which can contain more than 2 crypto assets. You can also create multi-token pool, which allows you to have up eight different tokens.

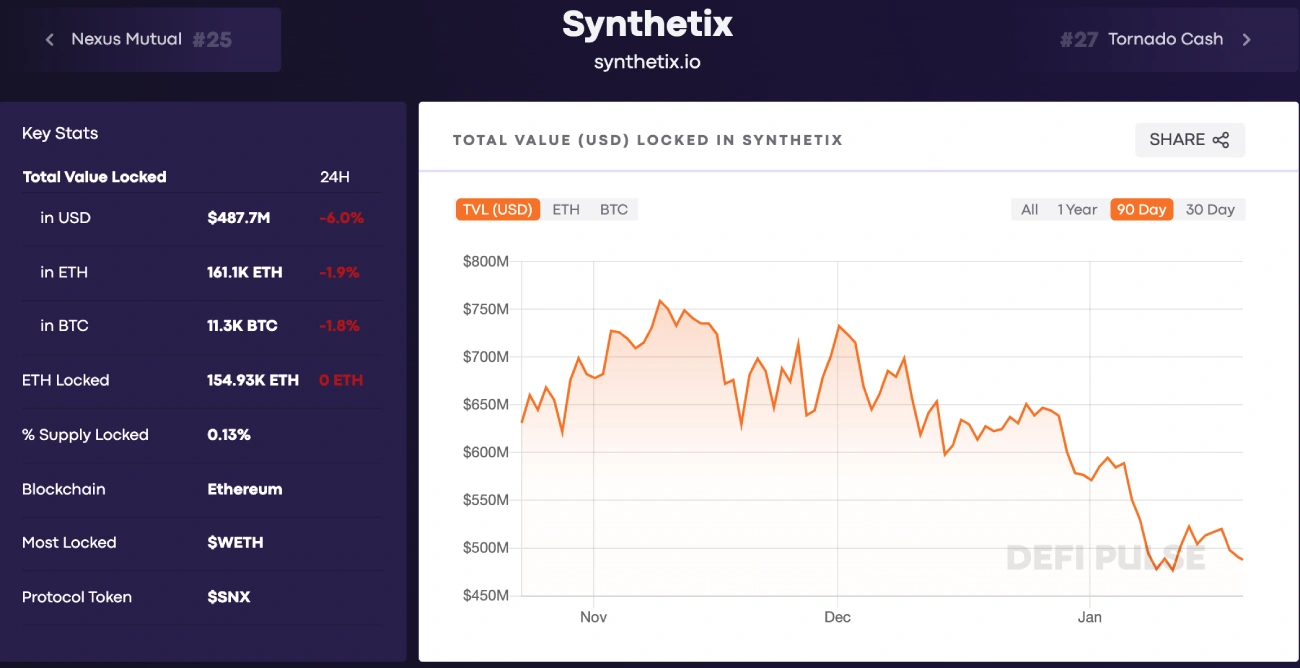

Synthetix

Performance Score: 7.0/10

The total value locked up: $523 Million

The pros

- Decentralized price volatility detection system using smart contracts.

- When trading on this DeFi platform, you don’t need to own assets physically.

- You have access to many digital assets.

Cons

- It is still in its development phase and the platform cannot be guaranteed to grow.

- For SNX to be activated, customers might need to use additional Synths.

- Often experiences centralization troubles.

Synthetix allows the creation of artificial assets on Ethereum. The exchange expands the crypto ecosystem’s exposure to non-blockchain assets, resulting in a more mature financial sector. Synthetic assets include synthetic inverse cryptos, synthetic cryptocurrency and synthetic gold.

General Information

· Kain Warwick is the founder of Synthetix.

· The SNX token is an Ethereum-based ERC-20 token.

· Synthetix’s Twitter community has 184,000 followers.

The Key Features

· Synthetix is a blockchain-based platform that gives users access to a wide range of highly liquid synthetic assets (synths).

· These assets offer returns on underlying investments without requiring the user to have direct possession.

· Synthetix is a synthetic asset platform and decentralized exchange (DEX).

What We Recommend Synthetix seeks to diversify cryptocurrency landscape through the introduction of non-blockchain assets. Users have access to an active financial market.

Conclusion

DeFi, a revolutionary innovation in blockchain technology that revolutionizes global finance, is the key to its success. This is the right time to start exploring ways you can capitalize on DeFi. What are the best ways to use DeFi apps?

Although borrowing and lending are two of the most frequent DeFi use cases, other more complicated options are available, like becoming a liquidity provider on a decentralized Exchange.Depositing crypto assets on DeFi platforms like Aave and Compound can help you earn yield. These decentralized lending platforms also offer an annual percentage yield.

Participate in liquidity mining to be paid for liquidity capital (decentralized exchange)

DEXs allow you to trade. DEXs are able to facilitate P2P transactions between users, allowing them to trade small altcoins that were not listed on central exchanges.

It’s been incredible to watch DeFi projects explode in popularity. DeFi, which is a fascinating sector to watch with the launch of new financial services every week decentralized from DeFi, is something I’m always interested in.

FAQ

Which DeFi Platforms Are There?

This post will cover the top DeFi platforms available in crypto today. These scores and the list are based upon total amount of each platform’s assets and other key metrics.

DeFi: How much money can I make?

DeFi has seen a huge increase in value, and many people are now claiming that they have been able to make enormous profits. Through Ethereum-based, decentralized lending platforms, users can earn passive income.

As mentioned previously, yield farming protocols offer the possibility of even greater profits. These mechanisms can be complicated or ambiguous, which could lead to increased risks.

Is Defi investing safe?

DeFi is still in its infancy, and there are many speculations, experiments, and so investing in DeFi will not cause a disruption to your investment portfolio.

Which Defi apps are available in Ethereum

According to DeFi Prime, there are 214 DApps.