Bitcoin is now above the $51k mark. On-chain data shows that more than 20k BTC were exited from exchanges prior to this price movement.

Bitcoin netflows say that around 20k Bitcoins were withdrawn from all exchanges yesterday

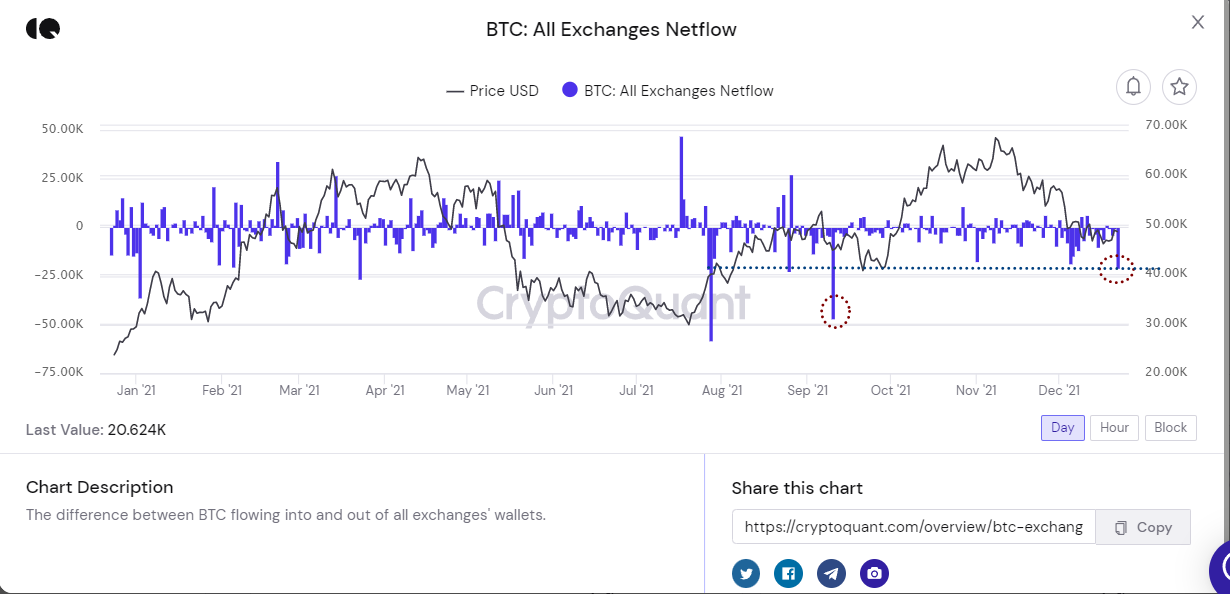

CryptoQuant posted that netflows were 20k BTC leaving exchanges yesterday. This is the biggest spike since September.

The “all exchanges netflow” is an on-chain indicator that measures the net amount of Bitcoin going into or out of wallets of all exchanges. The metric’s value is calculated by simply taking the difference between the inflows and the outflows.

Positive values indicate that there are more coins entering the exchanges than outflows. Investors typically send their crypto to the exchanges in order to either withdraw to fiat currency or purchase altcoins. If such netflows continue, it could lead to a bearish outcome for BTC’s price.

Negative netflows are when there is more Bitcoin being sent out than it entering the exchanges. The indicator’s prolonged downward rises can prove to be bullish as it may indicate that holders are in an accumulation state.

Related Reading| Growth Of Bitcoin ETFs & Other Instruments Doesn’t Support Supply Shock Narrative

Below is a chart showing how the BTC netflows have changed over the past 12 months.

The indicator appears to have shown negative values in recent times | Source: CryptoQuant

You can see that yesterday’s Bitcoin netflow spiked by more than 20K BTC.

The netflow’s value has reached its lowest point since September. Shortly following this spike, BTC’s price showed strong momentum up, and the coin broke past $51k once again,

Quant Explains How Large Bitcoin Leverage Ratio Can Help Turnaround Price| Quant Explains How Large Bitcoin Leverage Ratio Can Help Turnaround Price

Interestingly, the December period has had the highest amount of BTC being removed from exchanges as compared with the rest.

This could indicate that whales may be accumulating coins and are withdrawing large amounts to their personal wallets. This trend could prove to be very bullish in the long-term for Bitcoin’s price.

BTC price

At the time of writing, Bitcoin’s price floats around $51k, up 8% in the last seven days. The crypto’s value has fallen 11% over the last month.

Below you will find a chart that illustrates the trends in Bitcoin’s prices over the last five business days.

Source: BTCUSD on TradingView| Source: BTCUSD on TradingView

The long period of consolidation that Bitcoin has been in seems over. It now surpasses the $51k mark.

Unsplash.com's featured image. Charts by TradingView.com. CryptoQuant.com chart.