Bancor, a protocol that allows automated and decentralized trading on Ethereum and other blockchains, is called Bancor. Bancor is an innovative platform that allows you to trade currencies or tokens with others. Network participants can also add funds to liquidity pool in return for incentives. Bancor is an automated market maker and allows for peer-to–contract trades in a single transaction based on smart contracts.

Read on to learn everything you need to know about the Bancor Network, Bancor tokens, and How to Buy Bancor Network Token/BNT

Let’s dive in!

Bancor Network Token History (BNT)

Guy Benartzi, Galia, and Guy Benartzi founded the Bancor Project. The Bancor Foundation is responsible for overseeing the Bancor Network, which is located in Zug, Switzerland.

In token sales in 2017, $153 Million in Ethereum tokens were raised by the project. The tokens were sold in half to investors and the remaining to the team to be used for operating and grant budget purposes.

Bancor V2, which was the second edition of the protocol in 2020, was released. The protocol was updated with single-sided exposure, impermanent loss insurance, and single-sided coverage.

Bancor dramatically increased its liquidity pool on January 1, 2020 by airdropping its entire Ethereum Reserve (which totaled 10% at that time) in the form ETHBNT Bancor Tokens. The Bancor network went from having just $4 million in liquidity on January 1, 2020 to more than $17 million by mid-June 2020.

Name Bancor was inspired by the French “Banque or”The idea of a supra-national currency was proposed in the late 20th century.

Bancor was known in Kenya for its unique June 2018 venture. This project was designed to enable community currencies that are based on blockchain technology. This new currency operated within the framework of the POA platform. Through the use of a variety of US-based notary publics to verify transactions, the POA earns for its users. Bancor utilized the POA to lower transaction costs for cases that were involving community currency.

Every participant in the network is responsible for recording all the community-currency transactions. After the records have been compiled, they are forwarded to main POA network. The result is lower transfer fees.

Bancor holds almost $2B in cryptocurrency trades to date.

What is Bancor Network Token?

Bancor has created Bancor Network Token, a virtual currency that acts as a reserve currency. This protocol allows for the automatic control of prices and trade volumes through an exchange mechanism.

BNT is the default reserve for smart tokens on the Bancor Network. This token is used for multiple purposes: as an incentive token, admission token, intermediary currency and governance token.

Bancor Network Token can be used as an Ethereum token. Bancor coin mining cannot be done as BNT originally had a limit on the number of coins that could be distributed at the ICO. BNT tokens offer liquidity and enable the automating of Ethereum-based, decentralized networks.

Smart contracts allow you to pool liquidity and facilitate trades between peer-to-contract parties that are within one transaction.

Bancor Network Tokens can be staked in automated markets for interest and liquidity. Users can also vote for the Bancor DAO, which is the operating protocol.

Bancor Network’s uniqueness is its ability to connect with other networks such as Ethereum and EOS. Bancor customers can connect to these networks in order to increase liquidity and execute trades from within Bancor.

How does the Bancor Network Token, (BNT), work?

Bancor token and Bancor Protocol bring liquidity to the cryptocurrency market. Every token has the ability to get immediate liquidity through Bancor Protocol. This is vital for decentralized applications.

The Bancor platform provides a much-needed service of increasing liquidity for any token and of creating a platform where any token can be exchanged without the need for a counterparty.

Bancor makes Smart Token by using smart contracts. Smart Token is used in Bancor’s ERC-20 system to convert ERC-20 tokens. Smart contracts keep a reserve ERC20 tokens. A particular ERC20 coin can be drawn on this reserve. It can be also converted to another token.

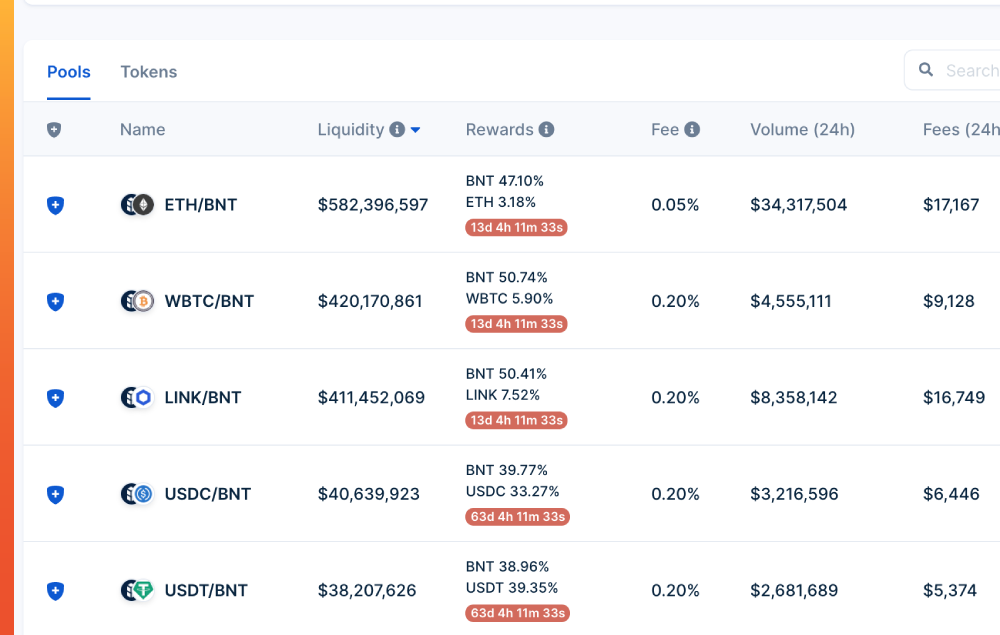

Bancor Network works via AMM. This means that every trade executed through the platform converts cryptocurrency into BNT. Liquidity providers that deposit funds into the pool can receive a portion of trading fees from traders.

Cross-chain operations allow for the conversion of cryptocurrency while users retain control over their private keys. Bancor can connect to users on other platforms like Ethereum or EOS and provide multi-platform liquidity solutions.

BNT can be used to exchange tokens or cryptocurrencies. This is in support of the AMM system. Bancor lets users add one token to a liquidity fund instead of two.

Another token is ETHBNT. It was introduced in 2020. It represents BNT shares and ETH in Bancor/Ethereum swimming pools.

How to buy Bancor Network Token

This step-by-step guide will show you how to buy Bitcoin from the most popular cryptocurrency exchanges.

First, create an account online. You don’t have to use Bancor’s exchange platform to purchase BNT. You can instead choose the cryptocurrency exchange that suits you best. Bancor support is available on many cryptocurrency exchanges such as Coinbase and Binance. Bancor can be purchased directly at Binance using cash.

To register for a crypto exchange, most require you to provide personal data such as your name, address, telephone number, proof ID, social security numbers, and email address. Bancor only requires a connection with an Ethereum wallet. A standard KYC process will be performed.

Step 2 – Get a Wallet. A cryptocurrency wallet allows you to store valuable crypto tokens in a secure virtual area. While software wallets, such as Metamask or Coinbase Wallet are great options for investors, it is a good idea to consider acquiring a hard drive wallet. Professionals highly recommend Ledger wallets like the Ledger Nano S and X for long-term safe storage. You can send your BNT at any moment to an outside address.

Step 3: Fund your account. Step 3: Fund your account. Once verified, you can deposit fiat currencies using the payment method that best suits you – Bank transfer, credit or debit card, and wire transfer are all widely accepted. Alternative funding options such as Skrill or Apple Pay are accepted by some exchanges. It is possible to deposit supported currencies, including Bitcoin directly into an exchange account. Then, you can trade Bitcoin for BNT.

Step 4: Buy Bancor Network Tokens. All you need to do is exchange your funds for BNT. The buying process is as easy as entering the amount you want to purchase and clicking “buy” on most exchanges.

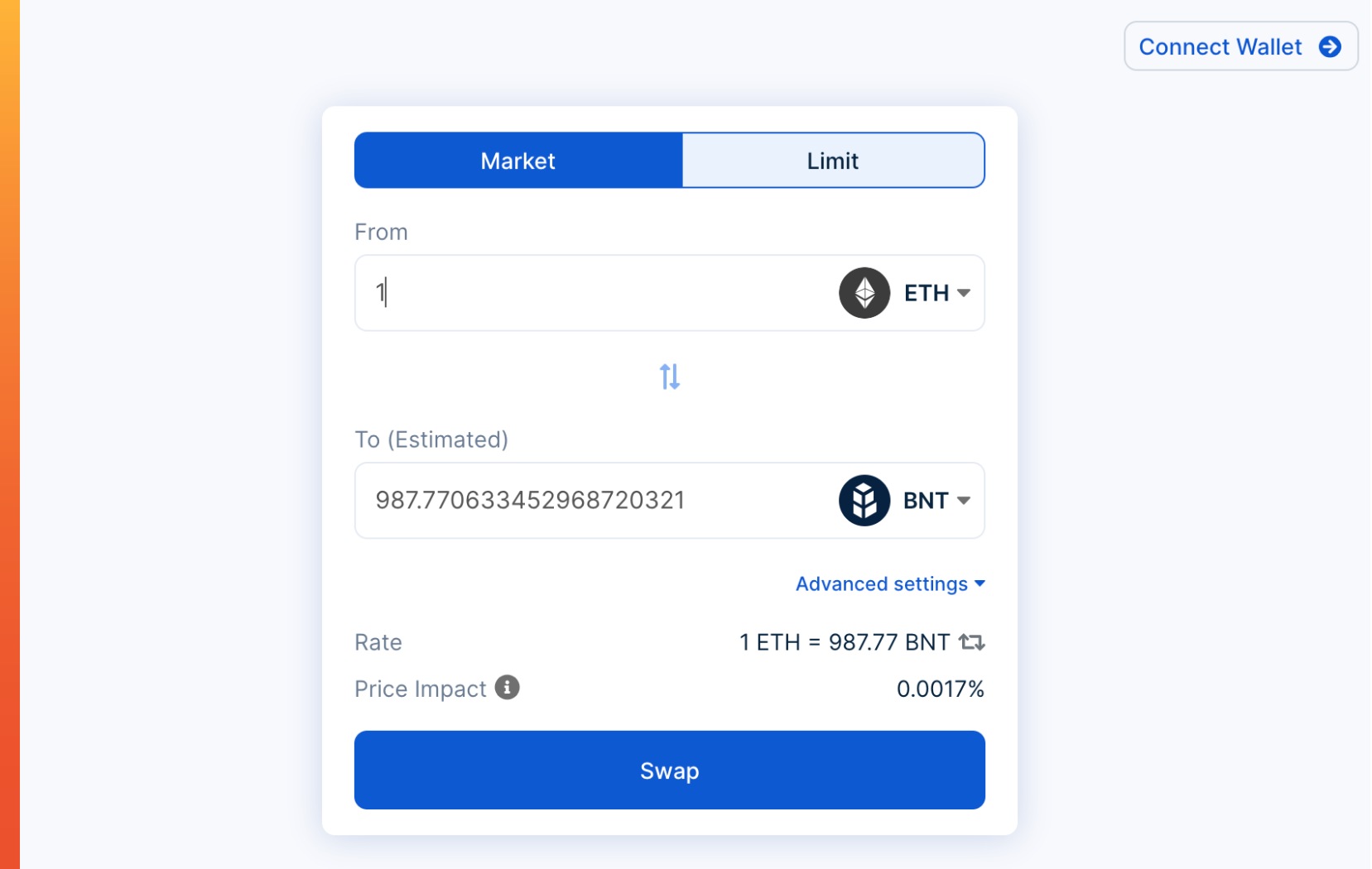

There are two options: a limit and market. When you place a limit order, you set the price you want to buy BNT at, and if you’re going to place a market order, you can instantly buy BNT at its market price.

You can sell Bancor BNT by simply reversing the above-mentioned buying procedure. The Bancor application has all of the necessary tools to help you sell BNT. It is possible to convert your BNT into USD coins such as USDT. Look for a “Sell” button in your account wallet and sell BNT for Dollars, then initiate a transfer to your bank account.

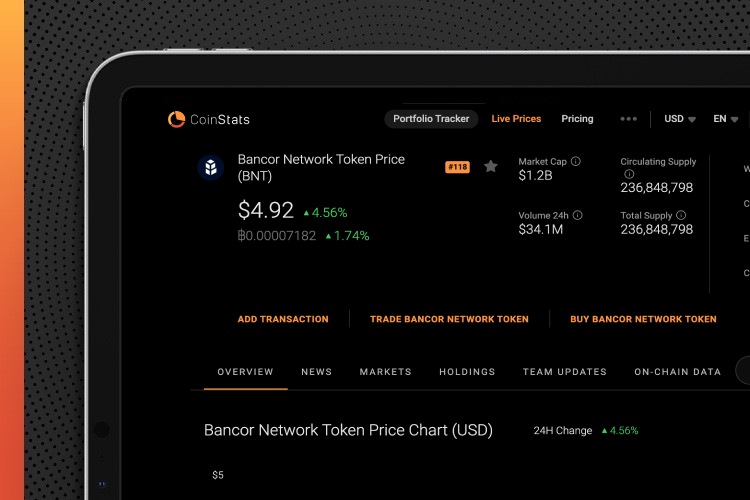

How to Purchase Bancor Network Tokens(BNT) from CoinStats

CoinStats has been voted one of the top crypto platforms. You can check the current market prices and get detailed information about several of most popular and fast-growing cryptocurrency. CoinStats allows you to see and compare the BNT price against Bitcoin and can even purchase Bitcoin at its current price.

CoinStats provides investors with valuable data on crypto news, investment advice and cryptocurrency portfolio tracking.

You can buy Bancor Network token BNT via CoinState by creating an account. The process is simple and straight forward. When you have created your account, head to the search section. Type BNT. You can trade and exchange tokens from this section.

For investors, guides and educational blog posts like BNT price and how-to-buy guides such as how to purchase Coinstats cosmos, and more, are highly recommended.

Bancor Network Tokens: Why should you buy them?

Below are some key benefits to BNT.

1) Network effects: Bancor stakes Demand directly rises BNT.

2) The Staking Reward: Bancor Protocol could activate BNT Staking rewards, subject to a vote by the community. Staking rewards will be offered to users who place tokens into Bancor pools.

Governance BNT will soon be used to vote for key attributes in the Bancor Protocol after the BancorDAO is launched.

4) CrossChain Conversions Bancor’s BNT pool allows it to efficiently trade tokens across multiple blockchains. BNT creates and destroys its own blockchain-based tokens to make these trades.

Conclusion

Bancor offers a better solution than cryptocurrency exchanges. Bancor allows you to trade across multiple cryptocurrencies without the need for another person. This is possible quickly and for a much lower price than other solutions.

Users can also use the non-custodial, secure wallet provided by the team to connect seamlessly to EOS or Ethereum. They can trade with more than 500 tokens on any device. This latest update of the platform is designed to make it easy to use. A seamless exchange application can be built using Bancor Protocol by developers.

The volatility of cryptocurrencies can pose significant risk to investors. You should consider your situation and seek your own advice before you trust this information. You should also carry out your own research, including the legal status and relevant regulatory requirements, and consult the relevant regulators’ websites before making any decision.

All information and content contained herein are subject to change without notice. The information provided is for informational purposes only. This does not include any investment advice, advice on trading, or other advice.